Nikolay Evsyukov/iStock via Getty Images

MariMed (OTCQX:MRMD), a vertically integrated seed-to-customer MSO in the United States (multi-state operator) has been trading relatively flat since the onset of the pandemic (0.70 cents a share at the time of writing). However, it has experienced exceptional growth in its core financial statements, having doubled revenues and EBITDA YoY. This has allowed it to keep in line with its strategic plan, a goal it is executing perfectly on to drive long-term revenue growth and profitability.

Now, the Marijuana Industry is relatively new and risky. So, it’s best to always find the highest conviction plays with the lowest downside risk for a diversified portfolio. Ironically, who would have thought a $250 million company, operating significantly better than most of its competitors would be just that.

The Business

MariMed is more experienced than any other cannabis operator in the industry. I make this claim because before it was a seed-to-consumer company it was an advisory firm. In this role, MariMed procured state-issued licenses for its clients, developed cultivation facilities, which it leased to said clients, and provided industry-leading expertise to the operations of these firms.

Recently, the company made the decision to transition from a consulting business to direct ownership of cannabis licensees in high-growth states. Core to the transition was the consolidation and acquisition of the company’s clients. This consolidation strategy allowed a more transparent view of the company’s financial situation. Furthermore, it allowed the company to deploy their human capital skills to pivot from advising to managing. So, how well did they do with the consolidation plan?

Today, the company develops, operates, manages and optimizes over 300,000 square feet of facility space for the cultivation, production and dispensing of medical and recreational cannabis. In addition, the company licenses its brands of cannabis and hemp-infused products in several domestic and overseas markets.

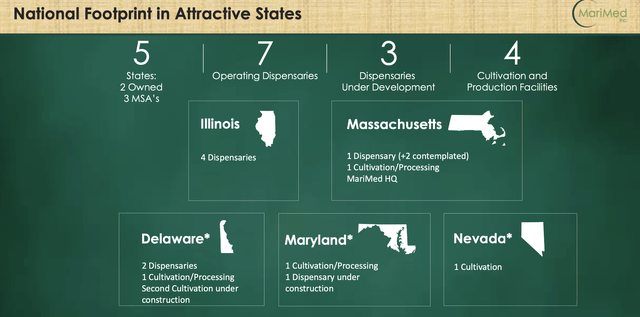

The company currently operates in 5 states, housing 7 operational dispensaries and 4 cultivation and production facilities.

MariMed National FootPrint MariMed

The Numbers

The Growth Story: Revenues

MariMed doubled revenues in 2020 and is on track to do the same thing in 2021.

2020 revenues were $51 million, growing from $16.5 million in 2019. It is important to note that the number reported for 2019 revenues is actually $45.6 million. However, $29 million came from a third party transaction unrelated to the revenue generation from its operations. Therefore, we will only consider revenue from operations ($16.5 million).

That’s an annual percentage growth rate over 200%. On the same note, expected 2021 revenues are $118 million, generating another level of mega growth for the company. These revenue spikes were caused by growth in its core revenue generators: product sales at both the retail and wholesale level. Both of these are direct sales of cannabis and cannabis infused products by the company’s retail dispensaries and wholesale operations. Retail nearly grew four-fold its previous level from 2020’s $16.9 million to $59.3 in 2021. Wholesale also grew four-fold its 2020 level of $5 million to its current level of $20 million.

| MariMed Top Line Breakdown | 2019 | 2020 | Expected 2021 |

| Revenue (millions) | 16.5 | 51 | 118 |

| Growth (%) | — | 209.1 | 131.4 |

Retail growth occurred through expansion in general sales through growth in general selling price and the repeat of customer visits. For example, the company’s retail operations in Massachusetts contributed $4.1 million of $30 million in revenue reported in Q3 2021. This was due to a ten-fold increase in the number of customer visits YoY. In its Massachusetts retail setting, customer visits increased three-fold YoY.

We all know that growth at these levels is unsustainable in the long term. The forces of competition are simply too powerful in an industry as relatively new as marijuana. However, MariMed can capitalize on its growth by improving other aspects of its business, allowing it to at least slow down the growth loss it will experience in the future.

The Growth Story: Other Core Components

Revenue growth is not beneficial unless it translates into positive or growing EBITDA and net margins for the company. Let’s see how these other core components have performed.

EBITDA

EBITDA performed well for MariMed. In addition to reporting strong and competitive EBITDA margins, it has a high EBITDA-to-operating cash conversion rate. This is especially important for its strategic plan (to be discussed).

2020 adjusted EBITDA was $18 million on $51 million in revenues. That’s gives an EBITDA margin of 35.2%. According to Seeking Alpha’s Quant analytics, the sector median is an embarrassingly low 5.96%. Better, yet 2021 adjusted EBITDA is expected to be in the range of $42 million on $118 million in revenues. This gives an EBITDA margin of around 39%.

| MariMed EBITDA Margin | 2020 | Expected 2021 |

| Revenues | 51 | 118 |

| Adjusted EBITDA (millions) | 18 | 42 |

| Adjusted EBITDA margin (%) | 35.2 | 42 |

This is a direct result of MariMed’s consolidated plan of vertical integration (VI). VI has allowed MariMed to scale production while stabilizing or reducing costs. This results in improved and efficient Economies of Scale; a feat rarely seen by new or growing companies.

Cash and Cash Equivalents, Working Capital, Profitability And Health

Cash and cash equivalents increased by $22.6 million at the end of September 2021 to $25.6 million, a drastic jump from $3 million at the end of 2020. This will allow the company to execute its goal of acquiring additional client businesses’ and expand its footprint in additional states.

Working capital increased to approximately $27.3 million at the end of September 2021 from a working capital deficit of $2.2 million in 2020. Working capital is a key indicator of efficiency. Thus, the growth seen here is great evidence to support the increase in EBITDA and Net Income.

The company’s Net Income margin is 16.12% according to the Quant data provided by Seeking Alpha, the result of $14 million Net Income provided up to Q3 2021. The sector median is -1.51%. Not many marijuana companies are profitable. It is especially impressive to see this level of profitability for a small and growing company. This speaks for management’s expertise in executing a vertical integration strategy effectively in order to scale and compete with the big players in the industry.

The company is in a very strong position with regard to its debt. As of Q3 2021, the company had total current assets of $49.7 million and total current liabilities of $22.2 million. Its long-term debt stands at $45.21 million.

Strategic Plan: 4 Goals

Other than the consolidation plan, the company has 4 goals it wishes to achieve to drive long-term growth and profitability. So let’s focus on if these goals are achievable and exactly what value they will add to MariMed’s plans for growth and profitability.

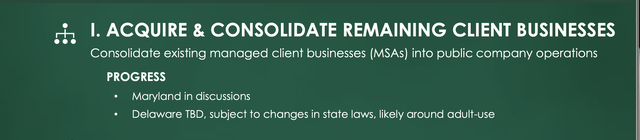

1) Acquire And Consolidate Remaining Client Businesses

Acquisitions of the licensed businesses in Massachusetts and Illinois have been completely approved, while the remaining licensees in Maryland, Nevada and Rhode Island are at various stages of completion. To their guidance, Maryland is currently in discussion and Delaware is to be determined.

Achievability

Let’s break it down. We know the company operates in 5 states. The company has already completed Massachusetts and Illinois. That’s 2 down. However, the focus in the near term for the company is both Maryland and Delaware.

The only guidance we have received about Maryland is that it is currently in discussion. Now, we know the company has a 180,000 square foot former cultivation and processing facility that’s leased to a licensed cannabis client under a triple net lease that commenced in 2018 and expires in 2037. In addition, it has leased a 4,000 square foot retail space which is transformed into a dispensary under a similar triple net lease. We know the company is targeting clients which it leased out. Therefore it’s very likely that MariMed is in discussions to acquire this client to reclaim full control over its second biggest facility.

In Delaware, we know the company only has plans to acquire its clients, but no discussions have been set yet. The good news is that Delaware lawmakers just approved a Marijuana legalization bill in a committee vote on January 26th, 2022. Thus, it’s becoming increasingly more likely discussions will be on the way in the state.

Value Added

Acquiring and consolidating its remaining client businesses’ will allow the company to vertically integrate its production without expensing heavy outlays. Remember, acquiring these companies brings all the existing assets to MariMed. Therefore, there is no need to build new stores or production facilities. This is because MariMed will gain the ability to create synergies between itself and its clients, producing more efficiently than if the two were separated.

Strategic Plan (Goal 1) MariMed

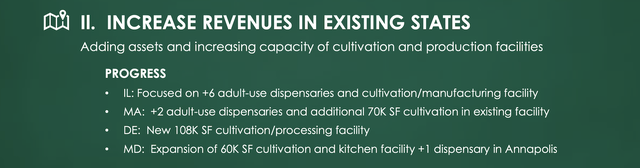

2) Increase Revenues In Existing States

This goal correlates directly to the growth story by adding assets and increasing capacity of cultivation and production facilities.

In Illinois: management is focused on opening more than 6 adult-use dispensaries and expanding to build a cultivation facility. Management is quickly executing on this. MariMed recently acquired Green Growth Group, a cannabis licensee in Illinois. This transaction will enable MariMed to add cultivation, manufacturing, and distribution to its existing retail cannabis operations in the state.

In Massachusetts: management is focused on 2 new adult use dispensaries and expanding its cultivation facility by an additional 70k square feet

In Delaware: management is focused on a new 108k square foot facility for cultivation

In Maryland: management is expanding its 60K square foot cultivation and kitchen facility and opening 1 new dispensary in Annapolis. This new dispensary was recently announced through a press article on the 5th of January. MariMed acquired Kind Therapeutics, a company MariMed advised, executing on its goal of both increasing revenues in existing states and acquiring its remaining clients.

Achievability

This goal is extremely beneficial on the surface, but will require heavy capital outflows to execute.

However, we know MariMed just increased their cash balance by $25 million. That should be enough to complete some of the above goals. However, they are in a position where they can afford to take on some debt, if needed. Leveraging itself will allow it to complete its goal of increasing revenues. Unfortunately, they can’t go through a federal or chartered bank because the law prohibits cannabis companies from taking loans. Though, they can seek financing from private equity firms or venture capitalists. MariMed can also go the route of raising additional equity, but diluting is never a good option unless the company has its back against the wall.

In addition, its existing assets are earning higher than their costs (just look at their EBITDA margin or net income) and leveraging is a good strategy because the company can likely pay off the loan quickly.

Value Added

MariMed knows its core revenue drivers are both its retail and wholesale sales. Therefore, it is attempting to drive growth in these channels by expanding its retail exposure and wholesale potential to maximize its long-term growth. The probability of these goals being achieved are very likely based on our previous discussion. Therefore, it’s only logical that in a market that is growing tremendously quickly, increasing both retail and wholesale channels will drive revenue growth rather quickly. In addition, because of its operational efficiencies, its margins will benefit also.

For example, the company’s CFO, Jon Levine, has said vertically integrating in Illinois will improve gross margins at the retail stores and provide the company wholesale revenue from the sale of their branded products to other dispensaries.

MariMed Strategic Plan (Goal 2) MariMed

3) Expand Footprint In Additional States

Management will be securing new licenses with marijuana companies in untouched states. To date, management is in discussion with a number of profitable operators with strong balance sheets.

Achievability

The achievability of this goal is very likely. The company’s scaling strategy is based on absorbing the relationships it has with its clients. Therefore, I believe MariMed has the knowledge base to expand this strategy with non-clients that still reflect the profitability and efficiency that it possesses. Though, I do see this as a longer term goal because the company must first acquire its remaining clientele, maximizing its reach in its existing states before it branches out.

Furthermore, the market for Marijuana is growing tremendously. California is the fastest growing state, hosting sales of $1.8 billion in 2018 and $4.4 billion in 2020. That’s 144.4% growth over two years. Thus, I don’t see them ignoring markets on the West Coast, or, even the East Coast where the market is also starting to pick up.

Value Added

I believe additional footprint expansion will allow MariMed to be exposed to growth in new markets, further driving revenue growth. In addition, once scaled properly, MariMed’s high operating and net income margins will allow additional revenue to flow back into the company, further fueling its expansion strategy.

MariMed Strategic Plan (Goal 3) MariMed

4) Optimize Brand Portfolio And Drive Licensing Revenue

MariMed has a number of award-wining, high quality brands like Thrive and Nature’s Heritage. As it acquires more operators and expands its existing ones, I expect this brand portfolio to only continue to grow. Furthermore, I expect its wholesale revenues to greatly benefit as new products are sold to the growing number of retail stores in the US.

I would even argue that MariMed’s brand portfolio, and its execution of it, is its competitive advantage. The company has more than 15 trusted brands under its portfolio, a lot of which are market leaders in their industries. Therefore, I expect their exceptional growth levels to last longer than average for this industry.

Achievability

The company’s portfolio of brands is large and growing. Therefore, I believe the brand portfolio will become optimized the further it drives its other 3 goals. Doing so will lead to more exposure by consumers, driving demand for their brands. Furthermore, this will lead directly into the second point in this goal, driving licensing revenue, in which more retailers will request their products. With this, I see this goal as likely, but not without achieving the first three strategies.

Value Added

As we have seen in the business breakdown, wholesale revenues contribute significantly less than its retail channel. Thus, it’s exciting to see that one of their goals is driving licensing revenue, which will of course, drive its wholesale revenue channels. With this, revenue growth is expected.

With the other 3 goals in place, we know operational efficiencies will improve, so like goals 2 and 3, I expect its margins to benefit as well.

MariMed Strategic Plan (Goal 4) MariMed

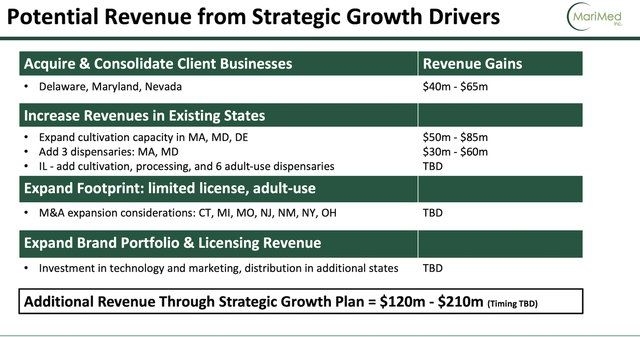

All in all, with all 4 goals, the company has revenue expectations you can see in the image below.

MariMed Revenue Projections MariMed

So we have a growing company that is firing on all cylinders and perfectly executing on its strategic plan, but the stock is barely moving. What’s going on here?

I believe it is a mix of the current macro-environment (tapering, the Fed) and sentiment on the marijuana industry (most marijuana stocks saw no growth last year). The market is missing something here. However, opinions in the market must be supported by numbers. Well, let’s look at what the market is valuing this company relative to the rest of the industry.

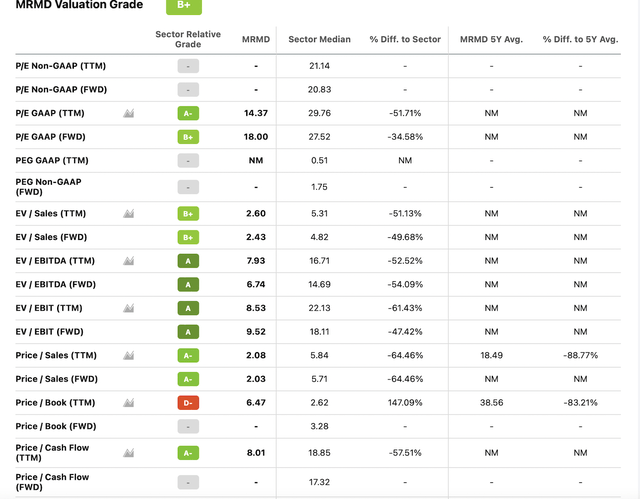

Profitable Weed, Cheap Stock

A full blown valuation will be conducted in another article. However, the stock is cheap on a relative basis. According to the Quant Analytics, MariMed is trading at a P/E GAAP on a trailing twelve month basis of 14.37, much lower than the sector median of 29.76. Its forward P/E GAAP is 18, lower than the sector median of 27.52.

Seeking Alpha Valuation Score on MariMed Seeking Alpha

The stock is trading at 2.08x its sales (Price/Sales), significantly lower than the sector median of 5.84x.

MariMed trades at 8.01x Free cash flow (Price/FCF), lower than the sector median of 18.85x

So even without looking at a full-fledged equity valuation, the company appears cheap relative to its peers on a number of key valuation metrics. This is a direct result of the operational efficiencies MariMed has achieved in addition to the disconnect between the market and this stock (just look at its P/E).

Risks

There are two risks attributable to this company.

The Strategic Plan Does Not Pan Out

There is always the risk that the strategic plan fails. This could happen for two main reasons:

(1) Marijuana does not become federally legal, affecting goal 3. This will be discussed as its own risk

(2) The company can run into difficulty scaling and need to pause the strategic plan to re-optimize its existing assets for maximal efficiency. However, I don’t see this as likely. The company is already exhibiting Economies of Scale at such a young point in its life, proving management’s prestige in its operations.

Source: MaxMyProfit MaxMyProfit

Marijuana Does Not Become Federally Legal

Marijuana is not federally legal in the United States as yet. If the plan is revoked, the company can suffer drastically in its third goal for the strategic plan. This will severely limit long-term revenue growth and hinder their potential. However, this seems unlikely.

The Democrats control both Congress and the White House. Recently, seven new states legalized recreational marijuana and the industry is gaining new allies from mega-corporations like Amazon. Though there has not been a bill to legalize marijuana federally, it is becoming increasingly likely.

Final Thoughts: Unlimited Upside Potential With Limited Downside Risk

MariMed is one of those rare opportunities that is difficult to pass on once you dive into their story.

Unlimited Upside Potential

For one, the company is young, yet exhibits veteran-like characteristics of a firm that knows what it’s doing. It is super rare to see a company of this size show Economies of Scale and near-perfect execution of vertical integration. Furthermore, it’s damn-well profitable and healthy. MariMed can pay off all of its long-term obligations if needed, and could even pay half tomorrow, considering the significant total current assets it has on its balance sheet. OK, it’s a good company. But what’s the upside potential you speak of?

The company is exhibiting massive levels of revenue growth, attributable to its strategic plan discussed before. If this all pans out in the next few years (which is very likely considering the success it is already achieving), we could be looking at another $120-$210 million in additional revenue. Wait, that’s just with goals 1 and 2.

Goals 3 and 4 really speak to the expansion strategy, where the company will enter new markets and optimize its brand portfolio for new product licenses. We know its retail sales contribute the most amount of revenue, while its wholesale is lagging. I see no better way to exploit both channels simultaneously than doing exactly what is stated in goals 3 and 4. This is the unlimited upside potential part. There’s no stopping a company that has operated so well from maximizing its growth potential by expanding its footprint, something I’m excited to see.

Great, upside potential looks unlimited, what about those limited downside risks?

Minimum Downside Risk

Nobody knows if Marijuana is going to be federally legalized. That’s the reality. However, it’s becoming increasingly more likely. Let’s assume for a second that it doesn’t get federally legalized. Well, we could kiss goals 3 and 4 goodbye.

There’s a silver lining though. Goals 1 and 2 can still be maximized. The company operates in legalized states. Therefore, it can still acquire clients and increase revenue in these states. Remember, the $120-$210 million in additional revenue is just on goals 1 and 2. Therefore, this can still be achieved.

So, there you have it: a profitable marijuana company with unlimited upside potential and limited downside risk. It’s cheap on nearly every relative metric and is being ignored because of a turbulent market and neglected industry.

Be the first to comment