anankkml/iStock via Getty Images

Background

As the close of trading on January 21, 2022, the Dow Jones Industrial Average stood just 7.3% below its all-time high and the S&P 500 was only 8.7% below its all-time high. On the same day, 1,070 stocks hit new 52 week lows. Of these 427 were down 80% or more and 655 were down 70% or more.

With 8 hours of free time over the weekend I took a look at the stocks hitting new lows to see who they were and if any were worth buying. I also looked at what it all means for the stock market and economy.

Below is a list of all 427 stocks that hit new 52-week lows and were off by 80% from their 52-week highs as of the close of the market on January 21, 2022.

Barcharts.com

Description of the stocks off 70% or more

I noticed several things about these stocks which are listed below.

1. A chart pattern – The charts on most of them had a pattern to them. They jumped in the last quarter of 2020 and first two months of 2021 and peaked in February, 2021. They then started a slow decline into the summer. That decline accelerated in the fall of 2021 and accelerated even more in January 2022.

2. Microcaps – Most of these stocks are microcaps, that is have a market value of under $300 million.

3. Losing money – Most are money losing and represent the most speculative stocks in the market.

4. Less visible – None of these stocks are Dow Jones Industrial Average members and relatively few are part of the S&P 500.

5. Most are either tech or medical sector companies.

6. Most are Nasdaq listed.

7. Biotechs – The largest contingent by far are microcap biotechs.

8. IPOs & SPACs – Many were recent IPOs or SPAC mergers, but not the premerger SPACs. They went south after their mergers.

9. Green stocks – Another large group is the green stocks in areas such as renewable energy and electric vehicles. This group surged after the election of Joseph Biden as president and has declined since.

10. Marijuana & Chinese – Sprinkled in is a healthy portion of marijuana stocks, an earlier bubble that had popped and Chinese stocks.

The recent declines have been primarily in the information technology and healthcare sectors. However, the chart below shows those two sectors to be no worse than three other sectors so far this year. What gives? Well, the larger profitable healthcare and information technology stocks have done much better. They masked the carnage in the smaller and unprofitable ones.

The Daily Shot

This carnage is clearly the result of excess risk taking by individual investors and hedge funds. The two charts below show returns over the past 6 months in stocks more heavily held by individual investors and hedge funds compared to the market as a whole. The market has held up while hedge fund and individual investors stocks are melting down.

The Daily Shot

The Daily Shot

Why it happened

On January 27, 2021, I wrote an article titled “How The Current Stock Market Manias Took Off: The Perfect Storm” . In this article I noted the following reasons for an elevation of risk taking. For more detail on each, please see the article.

- Massive stimulus by the Fed

- Robinhood’s gamification of trading

- Free trading

- Idle workers at home

- Redeployment of profits into new bubble stocks

- FOMO

- Animal spirits

- Short covering

- Earnings estimates increases

On February 19, 2021, I wrote another article titled “Massive Stimulus Led Directly To Stock Market Bubbles; The Economy Doesn’t Need More”. The bullet points from that article were as follows

- The government has used unprecedented stimulus to mitigate the pandemic’s impact on the economy.

- The result has been a booming stock market with numerous subsectors in bubble territory.

- This article will connect the dots to show how that happened.

- The newer stimulus has added fuel to the fire also caused by the Fed’s low interest rates, $0 commissions, Robinhood, more at home, FOMO, and short covering.

- Additional stimulus now risks expanding asset bubbles, accelerating inflation, and blowing up our national debt.

So essentially what happened was the $1.9 trillion stimulus package approved in March 2021, added fuel to what already was quite a fire. It elevated risk taking, not to mention sparked inflation.

Investor Action Points

I briefly looked deeper at over 300 of the stocks down at least 75% and couldn’t find one I was interested in buying. My conclusion is most are still way overvalued by any historical metric. I have been around long enough to have heard, it’s different this time, many times. Things always change some, but not to this degree. I recommend against buying the dip in the types of stocks mentioned earlier, with the possible exception of some biotechs.

Six months ago, I couldn’t find any biotechs trading below cash value. I have now found 21 trading at 75% or less of cash with at least 6 quarters left at the current burn rate. These are ARTL, ADVM, ALGS, ALLK, ASMB, AVRO, CABA, CLBS, CRBP, ELDN, GLTO, GLYV, GRAY, MTBX, IMRA, OLMA, ONCR, ONTX, PMCB, SGTX and TCRR. Busted biotechs often have had rallies once they reach 50-75% of cash if they had active R&D projects, the farther on the better. While this downdraft may keep them falling a lot further, they are at a level of historical support.

I keep a watch list of microcap emerging tech and medical companies. All 10 of them are near or at their lows. As a value investor my opinion is this list was trading at reasonably levels. While I am not recommending any here, the point is most pre-revenue or money losing cutting edge stocks have been hit hard. There are going to be bargains. The problem is, it will be harder for these companies to raise money going forward. If they do raise money, it will be at a higher dilution than the recent past. If you invest, make sure they have enough liquidity to go a while. Back in the early 2000s, hundreds of bubble stocks (mostly internet related) ended up burning through their cash and going under. I expect we will see something similar over the next few years, so be careful.

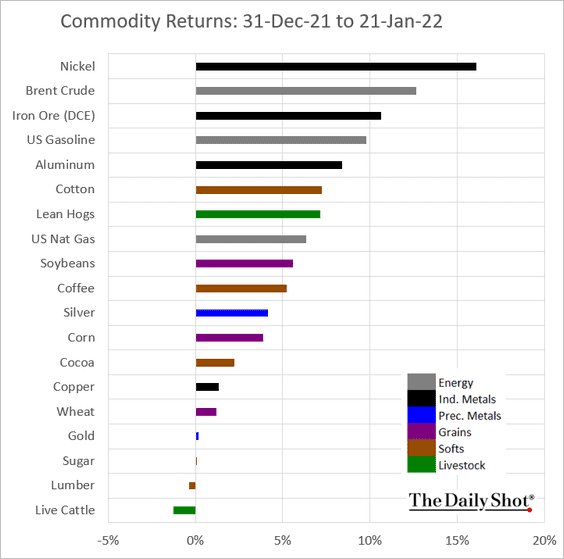

My best guess is the deflation in the bubble stocks will significantly take not down the economy. Part of the reason is they have already significantly deflated without an impact. The economy itself is still strong, in fact too strong. That’s why we have the highest inflation in 40 years right now. The jobs market is the best since World War II. The unemployment is at 3.9%, below where economists consider full employment. Employers are begging for workers. Retail sales remain strong and consumer savings at record levels. Inflation is the highest in 40 years due to strong demand. Commodities rally when the economy is strong. They are still rallying as shown below. The market itself is probably fairly valued based on historical measures such as earnings multiples when taking into account the low interest rates. The Fed plan to raise rates, but they are unlikely to return to levels seen at the top of prior cycles. Too much public debt and it would trash the dollar.

The Daily Shot

If the bursting of the bubble stocks does take down the whole market, I believe that will be a massive buying opportunity, not in the bubble stocks themselves (other than some biotechs) but in the others innocently caught in the down draft. Now is the time to keep some dry powder to buy when the smoke clears, if the whole market goes down significantly.

The age of investors bidding up growth stocks with huge losses appears to be ending. I wrote about one (LMND) a year ago when it was $122.00. On January 21, 2022 it closed at $29.21. However, like many others off 70% or more, it has huge and growing losses, and little chance of being profitable with its current business model. The market has now recognized that. This will impact the IPO and SPAC markets. IPOs going forward will be more sober and realistic and the flood of SPACs should slow considerably.

Takeaway

The big question is, will the bubble burst take down the rest of the stock market and/or the economy. I believe the economy is strong enough to withstand the bubbles bursting due to historically strong jobs market, strong retail sales, huge consumer savings and inflation. It has already withstood quite a deflation in the bubble stocks. If the economy starts to go south, the silver lining is it will stop the Fed from raising rates. The stock market is more vulnerable, but should bounce back if the economy remains good.

This is a time to have some dry powder and some hedges. There is a shakeout going on, which like others in the past often takes down worthy stocks along with the overvalued. When the smoke clears, it will be time to identify and buy those stocks.

Be the first to comment