Yarygin/iStock via Getty Images

If you had known then, what you know now, would you have invested in cigarette and tobacco companies in the 1950s? If you answer yes, there is a similar opportunity today.

The cannabis industry is one of the fastest growing industries in the world, and it shows no signs of slowing down. With more and more U.S. states legalizing cannabis for both medical and recreational use, the demand for cannabis products is skyrocketing.

According to a report by Brightfield Group, the global legal cannabis market is expected to grow from $10.9 billion in 2018 to $66.3 billion by 2025. The U.S. is leading the way with a forecast of roughly 50 million users by 2025 and $25 billion in revenues. California is the leader in cannabis use and is expected to exceed $7 billion by 2025. (Listen to this podcast regarding California’s market and a few of its players: California’s Cannabis Market – A Deep Dive (Transcript).)

And as the demand for cannabis grows, so does the need for investment opportunities. That’s where cannabis ETFs come in. A cannabis ETF is a type of exchange-traded fund that invests in companies involved in the cannabis industry. This can include growers, processors, product brands, retailers, and more.

Cannabis ETFs offer investors a way to tap into the rapid growth of the cannabis industry without having to pick individual stocks. And with the cannabis industry expected to continue to grow at an extraordinary rate, investing in a cannabis ETF can grow your portfolio like a weed.

I am investing in the AdvisorShares Pure Cannabis ETF (NYSEARCA:YOLO) which has plummeted in share price the past year. However, as legalization of cannabis use moves forward and the companies can gain normal access the financial system, growth is set to take off. I believe its share price will follow. Buy this ETF, because, YOLO!

The Trough Of Disillusionment

The past year has been tough for the cannabis industry. A combination of over-hype, unrealistic expectations, and a lack of understanding of the challenges faced by the industry has led to a sharp sell-off in cannabis stocks. This has left many investors feeling frustrated and even despondent about their investment prospects in the sector.

But it’s important to remember that every new industry goes through growing pains. It’s natural for there to be bumps in the road as the industry matures. And while the past year has been difficult, it’s also important to remember that the long-term prospects for the cannabis industry remain extremely bright.

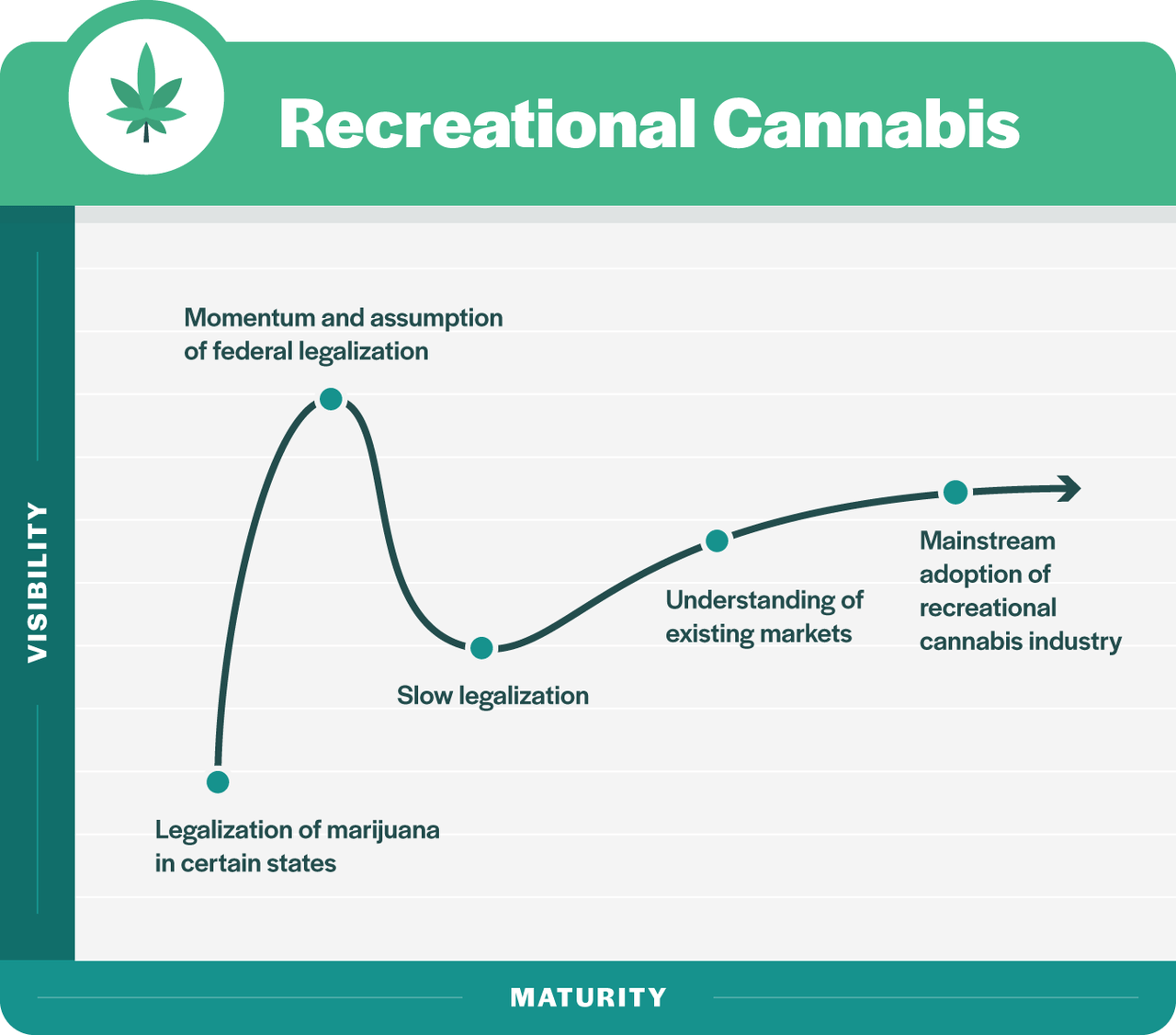

Here, MoneyCrashers overlays Gartner’s “hype cycle” with cannabis.

Trough of Disillusionment (MoneyCrashers)

Share price is currently in Gartner’s “trough of disillusionment” due to slow legalization of both cannabis use and access to the financial system.

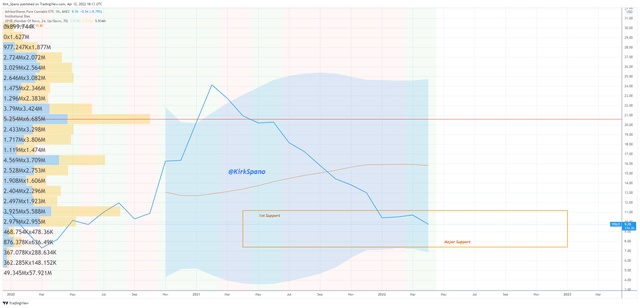

Cannabis Crash (Kirk Spano)

While we cannot perfectly pick bottoms in any investment, the left hand part of the chart above gives us a clue. The volume study on the left of the chart above suggests that selling is almost exhausted for YOLO.

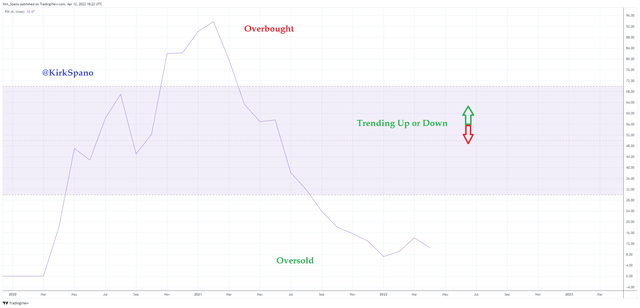

We can also see below that the RSI using the longer weekly time frame (most RSI you see is based on shorter term trading and uses the daily time frame) is very oversold. It is rare that this holds long and price usually rises soon after meeting such an oversold condition.

YOLO RSI Oversold (Kirk Spano)

Certainly uncertainty over the broader stock market due to Federal Reserve tightening is a concern, but YOLO has already been beaten up and has limited downside, especially long-term as legal adoption continues and financial normalization occurs supporting growth rates as expected.

What The Market Is Missing With Cannabis Stocks

As with any investment opportunity, it’s not what the market knows that gives you a compelling opportunity, it’s what the market is missing or ignoring. In the case of the cannabis industry, stock market investors are missing the rapid pace at which the remaining cannabis companies are and are becoming profitable.

What’s even more compelling is that the profitability is developing despite many states not yet legalizing marijuana, nor there being any passed federal legislation on allowing cannabis companies full access to the financial system.

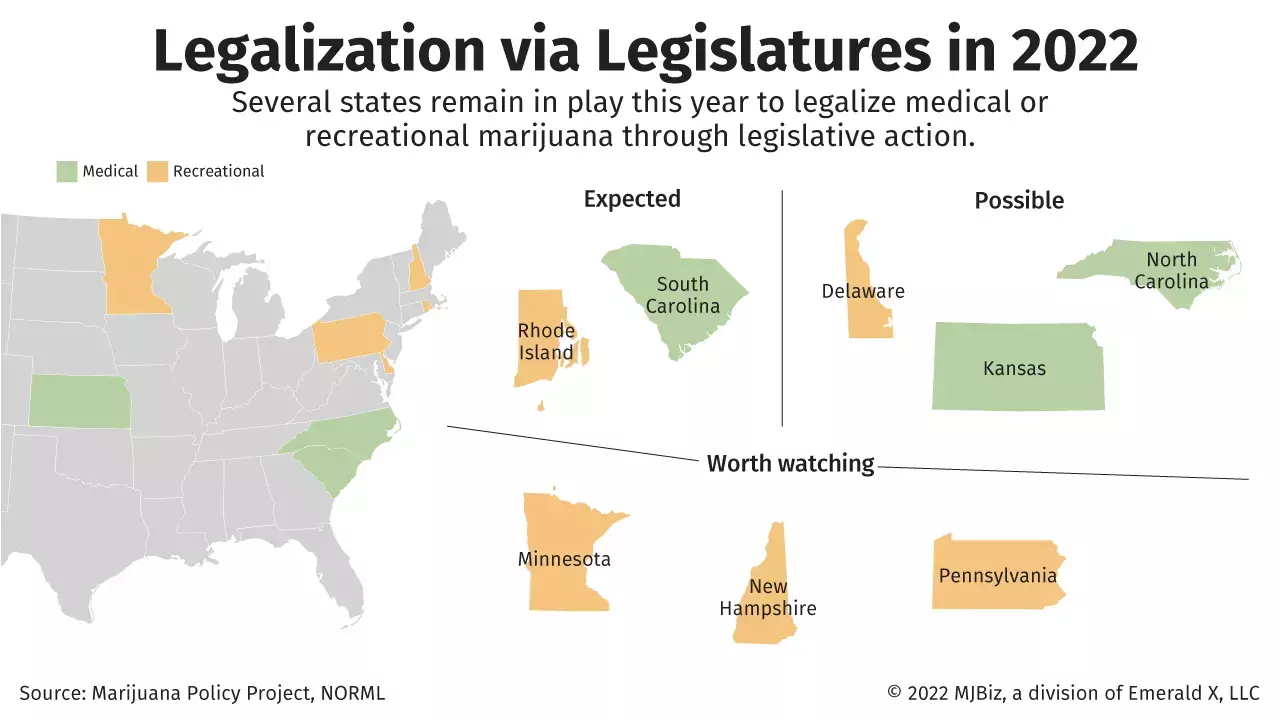

Currently, 37 states have some level of medical marijuana legalization, and 18 have full recreational use. Another 3 to 8 states appear likely to pass recreational legalization.

Marijuana Legislation (Marijuana Policy Project)

A federal marijuana bill, this time called the MORE Act, passed the House on April 1, 2022 on a narrow party line vote with only three Republicans voting in favor. It seems inevitable that decriminalization and taxation of marijuana is inevitable, but it might take a while.

On another front though, a manufacturing bill is likely to pass Congress soon that could include protections for banks that work with legal marijuana businesses in their states. There appears to be enough support to enact at least some provisions enabling marijuana businesses to use non-cash payments (credit cards) and get their deposits fully into the financial system.

Investing before all the unknowns are known is the key to getting a low price.

Breaking Down YOLO & Top 12 Holdings

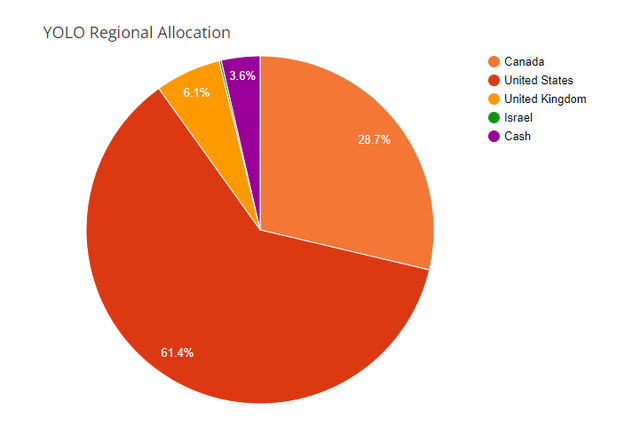

The AdvisorShares Pure Cannabis ETF is a global fund that is built similarly to the AdvisorShares Pure U.S. Cannabis ETF (MSOS) which is U.S. only and invested primarily in MSOs – multi-state operators. Both ETFs are actively managed with the key difference being country breakdown:

YOLO Country Breakdown (AdvisorShares)

Here is a breakdown of the top 10 YOLO holdings per Seeking Alpha. What you’ll see is that YOLO holds a 34% stake in MSOS. According to AdvisorShares, they are doing this for ease of investing in U.S. stocks and indicate it might change in the future depending on legalities.

One of the key issues is the necessity for the U.S. fund to hold use SWAPs in place of stock shares for multi-state operating cannabis companies. Crossing state lines of course makes things a federal issue. So, until federal legislation is passed, there is a cost and hassle to the interior workings of MSOS. Ultimately, that is an issue that could be fixed with the pending legislation in Congress.

YOLO Holdings (Seeking Alpha)

Breaking down the MSOS holdings gives the following rounded holdings for YOLO of 3% or more as of 4/11/2022. Where the company named is linked, I have attached a Seeking Alpha article I found helpful in understanding the company’s model.

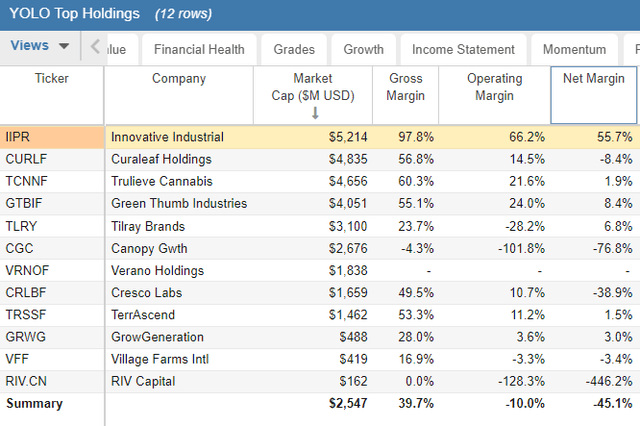

In breaking down each of these dozen companies financially, the only one that is very strong is the REIT company Innovative Industrial. All of the others generally fall around average. But, mind you, that’s without the legislation and financial access mentioned that will eventually come.

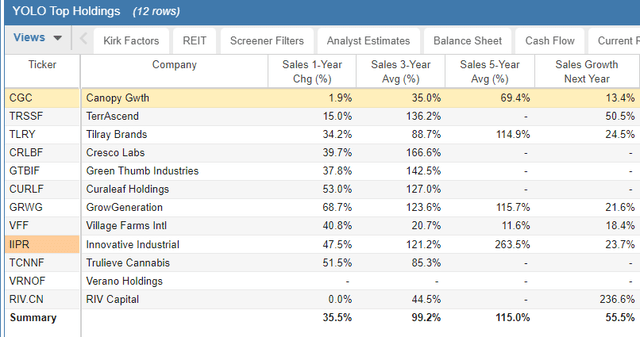

What stands out for the group is the growth rates and improving margins. See this snippet from a StockRover screen:

YOLO Top Holdings Growth (StockRover) YOLO Top Holdings Margins (StockRover)

I am focused on the gross margins. Operating and Net margins, though improving, still aren’t where we want them. But the gross margins and the idea that ongoing M&A and capex spending at almost every company indicate as those things settle, net margin will improve, dropping more to the bottom line for investors.

For those with more risk tolerance and willing to focus on the U.S., there are clear arguments for investing in MSOS which is focused on the multi-state operators. With positive legislation, those stocks could soar. On the flip side, Canadian companies are at looking multiple jurisdictions. I prefer the greater global diversification.

Closing Investment Thoughts

To be clear, there is an element of risk with cannabis in this pre-full legalization period. Legislation could go against them, though a slow pace of positive adoption is far more likely.

What I am focused on is the amazing amount of business cannabis seems to be taking from alcohol and cigarettes. At this point though, after such a sell-off, I am looking for the spot where vulture value hunters and institutions start to accumulate.

Fundamentally, I think these companies as a group are no worse than fairly valued and I believe they are undervalued by 30-50% versus earnings in the 3-5 year time frame. Do your own analysis, but remember to be forward looking. And, do your comps versus alcohol companies in my opinion.

Technically speaking, selling pressure seems like it is exhausting. See the volume weighted demand in the left side of the price chart I included above.

I believe YOLO is a buy right now and a buy more if it goes down to around $7-8 later.

In addition, if you are a put seller, there is enough premium to be a seller of puts that are slightly out of the money up to a few months out. See my Retirement Income Options pieces for details on cash-secured put selling.

Be the first to comment