Charnchai/iStock via Getty Images

Our article today focuses on a small growth company with excellent future expectations: we are talking about GrowGeneration (NASDAQ:GRWG). The US company is one of the leading distributors of nutrients, growing media, advanced indoor lighting, environmental control systems and accessories for hydroponic growing and gardens. Among the main customers we can find mainly companies linked to the cannabis industry, but also companies producing high quality fruits and vegetables.

The company operates through three different sales channels:

- Retail: GrowGeneration as a retailer sells third-party products in its 62 proprietary hydroponic centres in the US.

- E-commerce: In 2020 due to the pandemic, the company opened its online sales channel. In 2021, revenue volumes from this channel flew 241% to $36.2 million.

- Proprietary brand: In this business unit GrowGeneration produces and markets its own products, consequently increasing the verticality of its corporate structure. The company has also recently bought vertical farms where it produces fresh organic fruits and vegetables.

We find the management strategy interesting, aiming to increase its retail sales channels in the short term in order to continue to grow revenues and gain market share. Subsequently, in the long term, the company is focussing on expanding the distribution and sales of its proprietary products; this last step is expected to lead to an increase in margins, which are currently very low.

In addition, there has been an increase in the purchase of the company’s shares by institutional investors, especially Renaissance Technologies, the hedge fund with a 40% average annual return, which has seen a sharp increase in the number of shares, could this be a good sign?

First of all let’s analyse the main market where the company’s revenues come from.

Marijuana Market

As mentioned above, GrowGeneration’s revenues are highly correlated to the marijuana market, which has been characterised in the last two years by an overproduction problem that has caused the financial collapse of many listed companies. This bubble has been caused by the excessive expectations of growth of the market and the huge investments made by venture capitalists, factors therefore related to short-term rather than long-term negative trends.

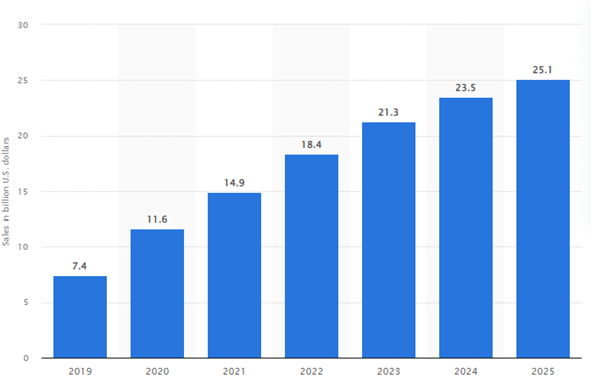

In support of our thesis, marijuana market growth expectations are very positive with a value of $14.9 billion in 2021 which is expected to rise to $25.1 billion in 2025 (Legal recreational cannabis sales U.S. 2019-2025 | Statista)

Sales of legal recreational cannabis in the United States from 2019 to 2025 (Statista)

We therefore think that after a stormy period this business can regain momentum also favoured by the increase of federal states where recreational use of marijuana is legal (19 at the moment). For these reasons, GrowGeneration despite performing poorly in the second half of 2021, ending the last quarter with a loss of $4 million and an operating loss of $7 million, will continue to grow in the long run aided by the boost of investments related to the marijuana market.

FY and Outlook

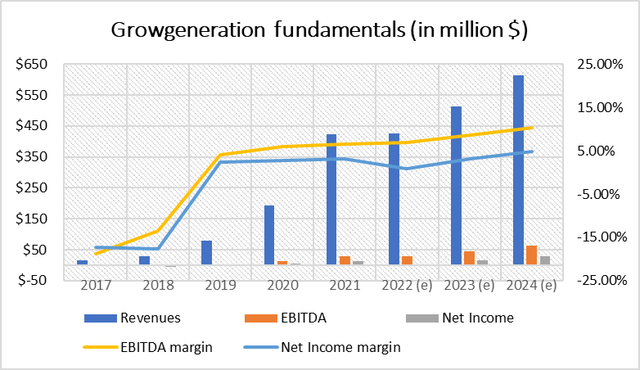

In contrast to the marijuana market, which is characterised by high volatility in economic results, GrowGeneration in the last four years has exponentially increased its revenues and managed to increase margins. Between 2017 and 2021, revenues increased from $14.4 million to $422.5 million, hand in hand with EBITDA margins and profit margins moving from -18.75% and -17.36% to 6.53% and 3.03%, respectively.

Mare Evidence Lab

This gap between the results of GrowGeneration and the marijuana producers is thanks to the fact that the company is only a supplier of equipment and supplies to this market, it is not very sensitive to the price per gram of marijuana or to discrepancies between supply and demand. Moreover, at this moment the marijuana market, despite the lower-than-expected growth, has received a lot of capital, causing a kind of moral hazard for the management of these companies that continue to burn cash making new investments, trying to better the competitors and win this rich market. This process could definitely be good news for GrowGeneration, but the first signs of failure of the system can be seen; some Canadian and American companies in the marijuana business have declared bankruptcy for both economic reasons and scandals. This is leading to a reduction in investment in the sector and a consequent negative factor for GrowGeneration as we can see in 2022 q4 results. As soon as the market settles down, after a subdued 2022, the Company should continue its strong growth trend, reaching, according to analysts, revenues of $612 million and a profit of about $30 million. In addition, GrowGeneration margins seem to have a large potential for growth, mainly driven by economies of scale and the company’s strategy of focusing more on proprietary brands, thus increasing the value of production. Looking at cash flow, in FY21′ GrowGeneration reported its first positive operating cash flow of $5.16 million, a meagre haul for a company that over the past two years has invested approximately $144 million between business acquisitions and CAPEX. The investments were made possible mainly by capital increases for a total value of $213 million in the last two years and an increase in debt, mainly through leases. GrowGeneration however remains net cash positive for $35 million. We think is very likely that we will see further capital increases or increased use of debt in the coming years because in a 3-year period, the Company has not been able to produce solid cash flows that generate as much capital as is necessary for investments in this competitive business.

Risks

GrowGeneration is subject to multiple risks, both because of the market in which it operates and because of its size:

- The company has low-quality assets, with $105 million of inventory (approximately 25% of revenue) and $115 million of goodwill, for a total value of the two items equal to 50% of assets. Above all, the high goodwill was formed due to purchases made by GrowGeneration in recent years that cost $122 million and produced as much as $107.6 million in goodwill.

- Rising interest rates could be a big problem for the marijuana business and consequently for the Company as well. Higher rates usually also imply a higher spread paid by riskier companies such as those operating in this yet to be legalised business. The reduced borrowing that will become inevitable for these companies will also result in less investment in equipment and therefore less revenue for GrowGeneration.

- Much of the company’s revenue is derived from businesses that were illegal until a few years ago, so there is some risk associated with further regulatory changes.

- The competitiveness of the market in which GrowGeneration operates is increasing, among the main competitors we have Hydrofarm, which we previously covered (Hydrofarm Stock: Top Player With Near-Term Vulnerabilities (NASDAQ:HYFM)).

Conclusions

In light of the facts previously discussed, we think GrowGeneration could be an excellent investment opportunity to be positively impacted by the marijuana business without being directly exposed to it. We also find the possible future increase in the use of these techniques for hydroponic cultivation of fruits and vegetables very interesting and currently limited by the excessive cost of production. In addition, the company, after plummeting from the highs by about 90%, now has an attractive valuation with a 2021 price-earnings of 36x and an expected value for 2024 of 16x with the current capitalization. Even the EV/EBITDA, a more appropriate measure for a company growing at this pace, shows a 2021 value of 15.7x and an expected value for 2024 of only 6.9x. For these reasons we see the possibility of a triple-digit return by investing in this company even if, all in all, not without risk!

Be the first to comment