lucadp/iStock via Getty Images

Mind Medicine Inc (NASDAQ:MNMD) is a high-risk stock, that has hardly any prospects, that investors should stay away from. Its poor fundamentals and little progress in drug development make it a stock to steer clear off, in order to limit exposure to the risk of long-term price depreciation.

Company Overview

Mind Medicine Inc is a New York-based biotech company that specializes in the psychedelic domain of medicine as a therapeutic mode of treatment, addressing mental illness and various forms of addiction. The company strategy revolves around ensuring the development and eventual marketing of treatments targeted toward this increasingly growing niche in the pharmaceutical markets.

The existing Mind Medicine Inc pipeline consists of several initial-phase treatments that are aimed at challenging the mainstream, conventional approach to mental illness and addiction treatment. These innovative treatments consist of various psychedelic substances such as DMT, MDMA, LSD, Psilocybin, as well as 18-MC. Although none of these candidates are currently undergoing serious clinical trials beyond second phase studies, the company claims these next-gen treatments will be game-changers.

Founded in 2019, and listed on NASDAQ in April 2021, Mind Medicine Inc is a relatively small company. It employs a total of 22 individuals within its organization and has a market capitalization of less than $400 million as of April 2022.

Market Overview

Within the broader healthcare market, the niche catering to psychedelic drug users holds a high degree of growth potential. Market research from last year indicates surging demand that will value the market at almost $11 billion worldwide by 2027. Factoring in growing acceptance for mental health treatments such as those addressing depression, analysts indicate a CAGR of 16.3% across the seven years leading to 2027.

Despite this promising growth potential, the market stands far from saturated, with only a handful of capable players shown to have made an entry into this market, owing to the high risks that are associated with the pharmaceutical development of drugs in general. This risk factor is significantly enhanced in an emerging drug market such as psychedelics and hallucinogens, where industrial acceptability remains low. Moreover, gaining regulatory approval for treatment candidates by psychedelic biotech companies remains difficult, which further results in a low number of market participants, especially in comparison to other bio-therapeutic domains.

Three core factors denote enhancing opportunities for the psychedelic market going forward. The first factor is the mainstreaming of public opinion regarding addiction and mental health. There is an increasing trend observed in the developed regions of the world, where treatments are being sought for a wide range of mental disorders. The continuation of this trajectory points to surging demand which will lead to a sizeable market in the near future, pointing towards broader opportunities for stocks such as MNMD. Secondly, there has been a general easing of regulation and policy in regards to mental health treatment, which is indicative of a broader social shift where mental healthcare is treated as mainstream as other specialist domains in medicine. And finally, there is a clear gap in the drug markets towards increasingly prevalent mental health problems such as ADHD, bipolar disorder, addiction, and its like.

While all of the factors raised above point to the growing opportunity that is inherent to markets offering innovative solutions to mental health conditions, the psychedelic health industry in particular still has a long way to move forward. Those that are keen on betting long on the psychedelic industry claim it will surpass from the fringe to the mainstream, just as had been the case with marijuana stocks. Skeptics, however, maintain that psychedelic stocks such as MNMD are wrought with a high degree of risk, with investors being better off investing in alternative growth industries. The link between mental health acceptability and the growth of the psychedelic industry remains unclear as of yet.

MNMD News and Price Movements

Mind Medicine Inc is a company that is relatively new in the corporate domain and holds barely a year of being publicly traded on NASDAQ. The price trends observed throughout this brief period could shed light on how the stock has fared, since its initial public offering.

Finviz

Taking a broad look at the 9-month performance from June 2021, a strong bearish trend can be observed, with investors losing nearly 77% of their capital investments to price depreciation. Having not generated revenues, and costs rising annually, the MNMD graph is largely consistent with the company’s significant cash burn rate.

Throughout this period, announcements relating to the company have proven significant in influencing MNMD price, resulting in brief rises that are shortly followed by subsequent falls. A near 51% jump in price had been seen from late January 2022 to mid-February This was following a crucial approval by the Utah Senate, regarding a study on psychedelic substances, which had already passed a majority in the house.

However, this optimism remained short-lived, with the stock maintaining its bearish fall through to April 2022. I believe this was due to the dwindling perception regarding MNMD, which was deemed incapable of meeting the broader opportunities presented.

In early April 2022, remarks by Nora Volkow, director of the National Institute on Drug Abuse (NIDA) spelled out the wide-ranging challenges that are faced by the industry as a whole. She added that there is a need for a greater degree of cooperation between the industry and regulatory bodies such as the FDA. Ever since the announcement, MNMD has fallen by over 15%, until the 20th of April, with no clear indication as to when a reversal may come about.

Risks Inherent to MNMD

Mind Medicine, being a company with a limited operating history, spanning no longer than three years, is wrought with several risks, that raise question marks about its business sustainability.

The most immediate concern that validates skepticism towards MNMD is that it currently has a zero-earnings potential. This is due to the stock neither having any launched products marketed nor any large-scale clinical studies underway. As a result, demand for MNMD in the market is based solely on optimistic anticipation with little substance to anchor it to.

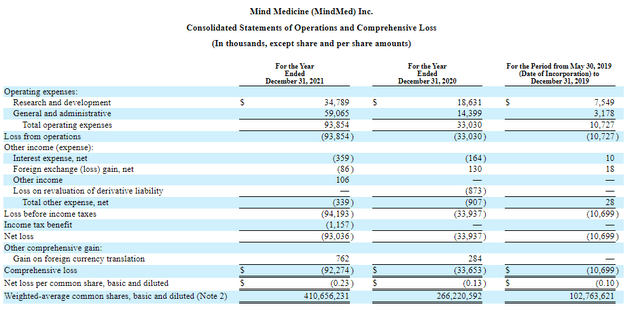

Since the company’s inception, Mind Medicine has consistently incurred losses at a worsening trend, which the company states are likely to continue for the foreseeable future. This is reflected in the Mind Medicine Inc’s consolidated statement of operations and comprehensive loss, reported on March 28, 2022:

MindMed

As can be observed, there is an increase in loss from operations across the years, with the portion of administrative costs climbing against research and development costs. On average, net loss for each year grows by almost three times, which points to the substantial burn rate it holds, without clear prospects of when breakeven will be anticipated. This is extremely uncertain, given that the company is presently in its life-cycle stage where it has never generated revenue or profit in any form.

Given the high costs of pharmaceutical drug development, both in terms of time and resources consumed, the company shows a significant need to raise additional amounts of capital. This is understandably a challenge for Mind Medicine, given its low market capitalization, and the lack of any positive cashflows generated priorly. This presents challenges both in terms of raising debt and equity finance. Even without the existence of profits in its historical statements, the firm further lacks any successful product candidates that are likely to see a successful launch.

Finally, it is important to note that Mind Medicine’s set of problems faced are compounded by the nature of the products it aims at delivering. Sensitivity to public perception is extremely high for the company, and negative press about psychedelics could severely influence the financial potential of such products if they are launched at all.

With such challenges, the company can rightfully be considered to be a high-risk investment. Given its risk profile coupled with its deteriorating financial performance, investors would do well to steer clear of this gamble, showing no signs of promise.

Conclusion and Remarks

I have established above that the psychedelic drug sector in the broader healthcare market is one that, despite the substantial opportunities relating to mental health treatment, is characterized by significant risk. Given the opportunity market participants associated with the psychedelic market in general, certain investors may consider holding MNMD for a long period, anticipating a future turnaround. However, I believe such a move will only result in disappointment, with a significant opportunity cost. MNMD in particular is a stock to be avoided, given its high-risk profile, and poor financial performance.

MNMD is a stock that has consistently generated losses and has not yet initiated any serious clinical studies that investors can latch on to. Its pipeline does consist of a few early phase trials with a low likelihood of success and a range of regulatory obstacles that make the stock a tough gamble. Even in the case of an industrial turnaround, which many anticipate, MNMD as an individual company shows no promise, and investors would be better off opting for a comparable psychedelic stock that shows better prospects.

Be the first to comment