When you buy a stock that is undervalued, you are essentially investing in the company at a discount. This is because the stock is trading at a price lower than its perceived intrinsic value.

In this guide, we take an in-depth look at the 10 most undervalued stocks to consider buying today and how you can invest in a matter of minutes without paying any commission.

Best Undervalued Stocks to Buy in 2022

The 10 most undervalued stocks to buy right now can be found in the list below:

- Coinbase – Overall Most Undervalued Stock to Buy Right Now

- Philip Morris – Undervalued Staple Stock to Hold During All Economic Cycles

- Diamondback Energy – Volatile Oil Stock With a Huge Upside Potential

- Meta Platforms – Buy This Undervalued Stock at a Discounted Price

- Innovative Industrial – Invest in One of The Most Undervalued Marijuana Stocks

- Southwest Airlines – Top Undervalued Airline Stock With a Reasonably Solid Balance Sheet

- SoFi Technologies – Buy This Leading FinTech Stock at an Attractive Entry Price

- Grab – Hugely Undervalued Growth Stock to Hold Long-Term

- Disney – Undervalued Stock With 40%+ Medium-Term Upside

- Bank of America – Undervalued Banking Stock With a Low P/E Ratio

We explain why the above stocks are deemed to be trading at a price below their perceived intrinsic value in the following sections.

A Closer Look at the Best Undervalued Stocks to Invest in

There are many reasons why a stock might be deemed to be undervalued. Although subjective, in many cases a stock will trade at an undervalued share price because of an overaction from the broader markets.

This might be something as simple as a company falling short of its forecasted revenues in its most recent earnings report.

Or, a stock might be undervalued because the firm is still operating in a new and unproven industry – or it simply hasn’t had enough time to dominate its respective sector.

Either way, in the sections below, we take a closer look at the 10 best undervalued stocks right now.

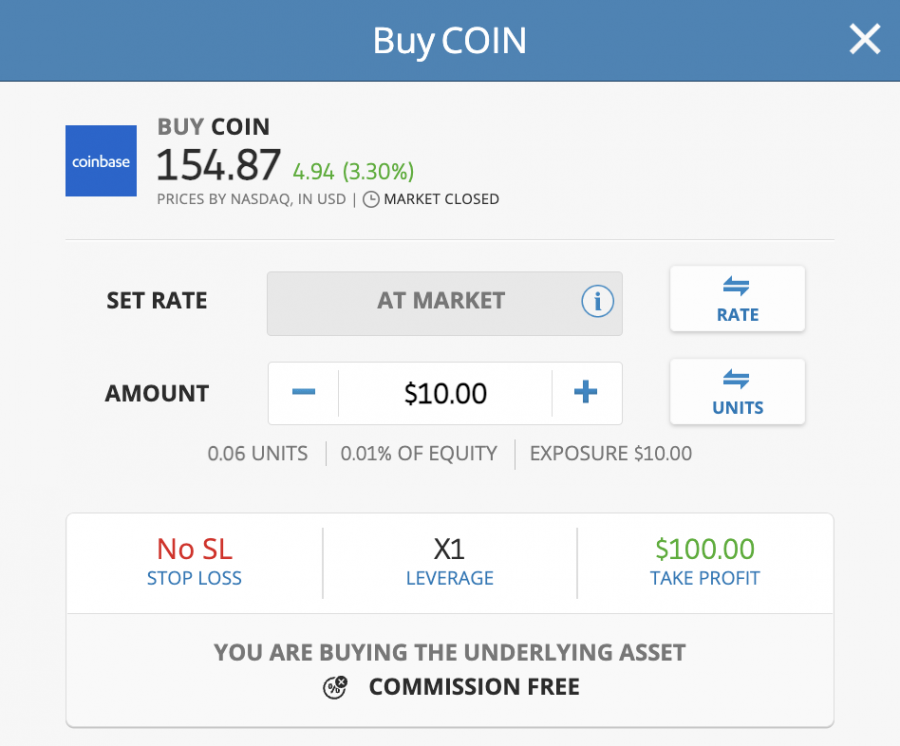

1. Coinbase – Overall Most Undervalued Stock to Buy Right Now

If you’re in the market for the most undervalued stock of 2022 – look no further than Coinbase. Crucially, if you are a firm believer that cryptocurrencies, blockchain, NFTs, and the metaverse will play a huge role in the future of society, then Coinbase is arguably the best publicly-traded company to benefit from this ever-growing industry.

In a nutshell, Coinbase is a US-based crypto exchange that serves tens of millions of customers from around the world. The platform was first founded in 2012 and it was listed on the NASDAQ exchange in April 2021. Coinbase – which opted for a direct listing, attracted a significant amount of interest from growth stock investors in the lead up to its much-anticipated IPO.

However, while the shares opened for trading at $342, Coinbase stock has since moved in the wrong direction. In fact, as of writing, the shares are trading at just over $150. This means that since its IPO, Coinbase stock has more than halved in value. With that being said, we would argue that this stock market decline is unjustified.

After all, Coinbase – after Binance, is the world’s second-largest crypto exchange. The firm makes money irrespective of how the wider crypto markets are performing, because, just like conventional stockbrokers, Coinbase generates revenue from commission fees. As such, Coinbase can be profitable regardless of whether the crypto industry is bullish or bearish.

When you consider that Coinbase is a regulated entity that has a great reputation for safety and trust, this popular crypto exchange can continue to build on its significant customer base. In addition to its traditional exchange and brokerage services, Coinbase is also launching an NFT marketplace, crypto-backed debit card, and more.

In terms of valuation, it is somewhat unprecedented that Coinbase is still trading with a P/E ratio of just over 10 times. Moreover, the firm is carrying a market capitalization of under $35 billion as of writing. And as such, this could be the most undervalued stock to buy for your portfolio today.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

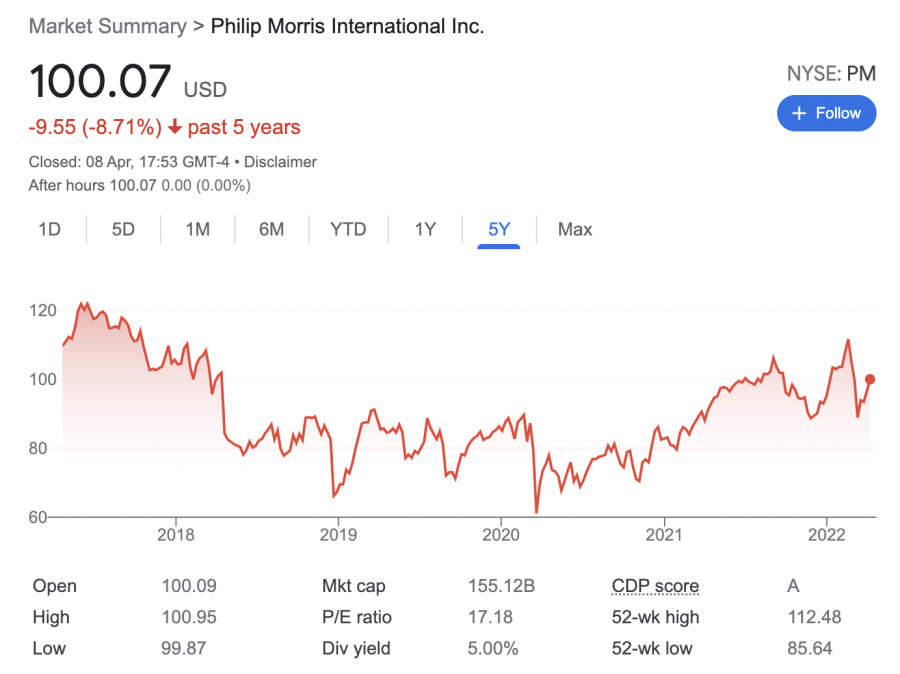

2. Philip Morris – Undervalued Staple Stock to Hold During All Economic Cycles

Although the number of active smokers continues to decline globally, tobacco stocks still represent a solid sector to invest in. And at the forefront of this is Phillip Morris, the world’s largest tobacco firm after the state-owned China Tobacco. Philip Morris is behind some of the most recognized tobacco brands in this market – including Marlboro and L&M.

Crucially, stable stocks like Philip Morris can be held in your portfolio long-term, irrespective of how the broader economy is performing. After all, tobacco is a product demanded by consumers during all economic cycles. Moreover, to counter falling demand on a per capita basis, Philip Morris does what all leading tobacco firms do – it simply increases its prices.

Moreover, Philip Morris operates a high cash transient business model and as such – it is also one of the best undervalued dividend stocks to own. As of writing, this stands at an attractive running yield of 5%. However, we must make it clear that the markets have not been overly keen on Philip Morris in recent years, with the tobacco giant’s share price underperforming.

For example, the shares are up just 11% over the prior year. In comparison, its main competitor British American Tobacco has seen its stock price increase by over 17% during the same period. Moreover, over the prior five years, Philip Morris stocks are down 7%. As such, Philip Morris could be heavily undervalued.

Another important metric to note about Philip Morris is that the firm dominates the emerging markets with its Marlboro brand. Unlike western regions such as the US and Europe, countries in the emerging markets do not regulate smoking in the same way. Furthermore, management at Philip Morris is also dedicating increased resources to IQOS (Heat Not Burn) products.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

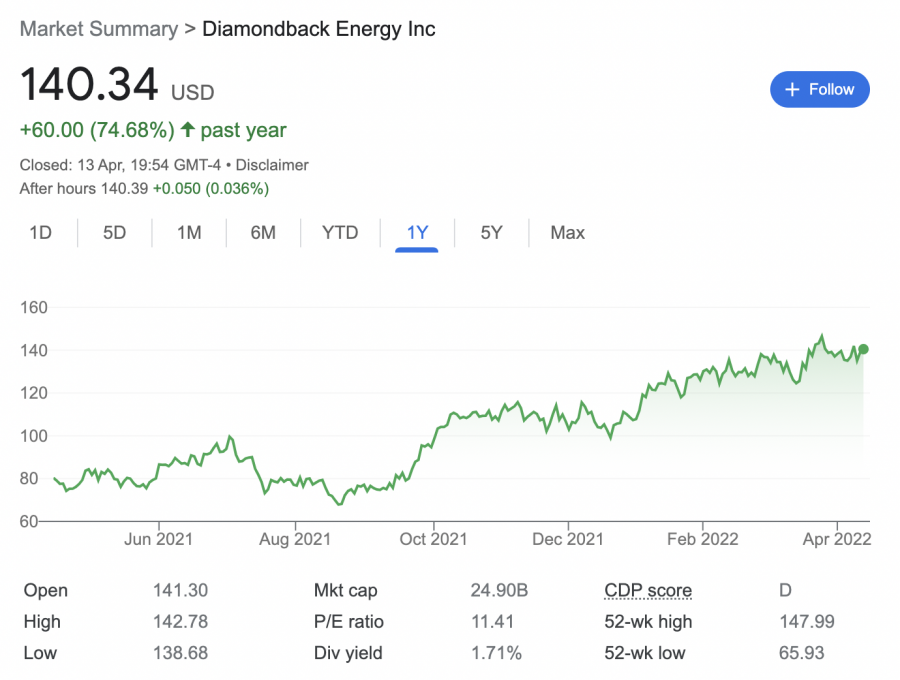

3. Diamondback Energy – Volatile Oil Stock With a Huge Upside Potential

In comparison to other companies in this sector, Diamondback Energy is a relatively small oil and gas stock – at least in terms of its market capitalization. As of writing, the firm is still trading with a valuation of under $30 billion. And as such, Diamondback Energy is arguably one of the most undervalued oil stocks to add to your portfolio today.

In terms of performance, Diamondback Energy has benefited tremendously from record-high oil prices. Over the prior 12 months alone the stocks are up 74%. both ExxonMobil and Shell are up 51% over the same period. Moreover, although Diamondback Energy is much smaller than many of its industry counterparts, it still pays an attractive dividend yield.

As of writing, a running yield of over 1.7% is on offer. Another reason why Diamondback Energy could be one of the best undervalued stocks to buy now is that its most recent earnings report smashed through market projections. Year on year, Diamondback Energy’s quarterly revenues grew by 162% while net income was up 235%.

The firm also increased its cash and equivalents by more than 500%. On the other hand, Diamondback Energy is an independent oil producer that is more sensitive to changing oil prices than many of its peers. As such, the firm should be viewed as a cyclical stock – meaning that you should consider holding it only when oil prices are high.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

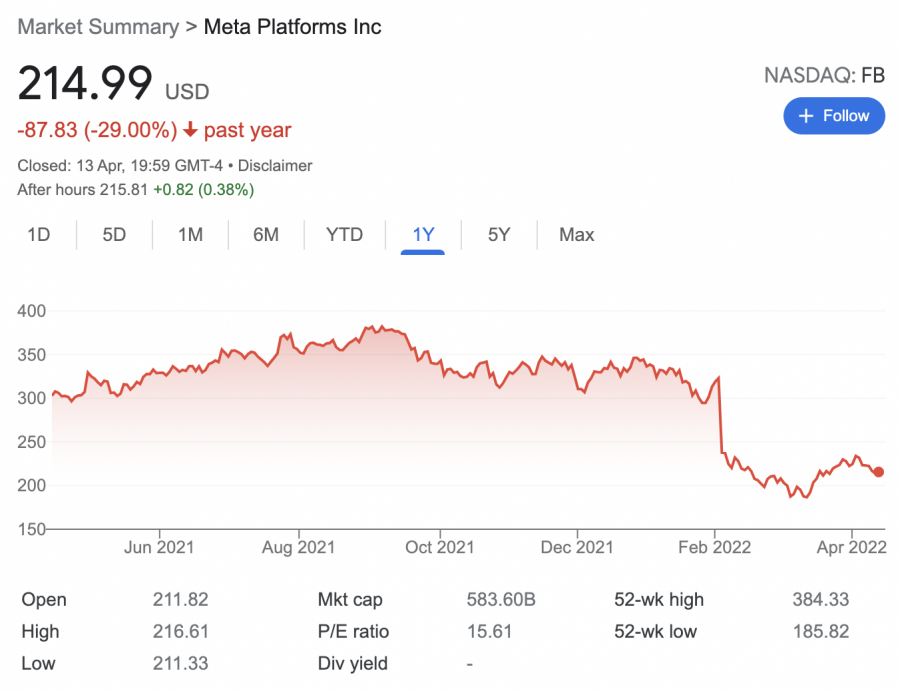

4. Meta Platforms – Buy This Undervalued Stock at a Discounted Price

Meta Platforms – formally known as Facebook, is the world’s largest social media conglomerate. In addition to Facebook, Meta Platforms is also behind Instagram, Messenger, WhatsApp, Oculus, and dozens of other subsidiaries. And as a result, Meta Platforms are used by billions of consumers from around the world.

However, Meta Platforms – which rebranded to highlight its intentions to target the metaverse in the coming years, has had a rough time on the stock markets recently. Over the prior year, for instance, the shares are down 30%. Over a 5-year period, Meta Platforms stock is up just 50%. In comparison, fellow social media platform Twitter is up over 200% during the same period.

With that said, the share value decline of Meta Platforms is a classic example of an overreaction from the broader markets. Crucially, in its most recent earnings report, the firm noted that for the first time since going public – the number of monthly active users on its Facebook platform declined.

When this was announced, over $230 billion was wiped from Meta Platform’s market capitalization in a single day of trading. Based on prices as of writing, we would argue that Meta Platforms is one of the most undervalued stocks today. Although the firm does not pay a dividend, Meta Platforms is trading with a cheap P/E ratio of just over 15 times.

In recent news Meta Platforms is beginning to test tools that will allow creators to create digital experiences in its metaverse Horizon Worlds.

Based on how new of an emerging asset class the metaverse is, it could be said that any metaverse related stocks are undervalued stocks currently.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

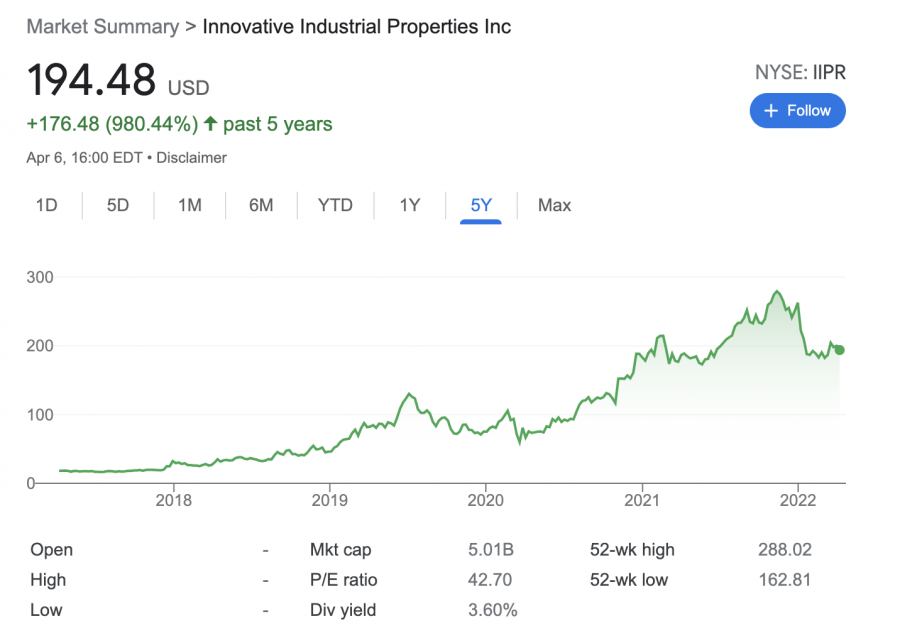

5. Innovative Industrial – Invest in One of The Most Undervalued Marijuana Stocks

It could be argued that cannabis stocks as a whole are hugely undervalued, as companies operating in this sector have struggled in recent years. With that said, if you’re in the market for the overall most undervalued marijuana stocks to buy right now – it could be worth focusing exclusively on Innovative Industrial.

In a nutshell, Innovative Industrial is a REIT that gives you access to the wider cannabis industry in a more diversified manner. This is because the firm offers core real estate facilities – such as greenhouses and storage locations for state-licensed operators in the legal cannabis industry. Over the past five years of trading, Innovative Industrial has grown in value by nearly 1,000%.

Over a 12-month period, the shares have remained flat. Nonetheless, with a market capitalization of just $5 billion, Innovative Industrial is potentially undervalued – at least in the long run. After all, as more and more states in the US decide to legalize recreational cannabis sales, this will only benefit established market players like Innovative Industrial.

What we also like about Innovative Industrial is that as a REIT, the firm is required to distribute dividends every month. And, as of writing, a very attractive running dividend yield of over 3.8% is being offered. Finally, Even with a P/E ratio of over 40 times, this is still somewhat modest when you consider how well Innovative Industrial stocks have performed in recent years.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

6. Southwest Airlines – Top Undervalued Airline Stock With a Reasonably Solid Balance Sheet

Since the pandemic came to fruition, companies operating in the aviation industry have been hit extremely hard. Not only have airline stocks had to contend with ongoing travel restrictions and hugely reduced passenger numbers, but now record-high oil prices. And therefore, it will come as no surprise that many airline stocks are still trading below pre-pandemic levels.

Although this industry is fraught with risk, we would argue that the likes of Southwest Airlines are undervalued and thus – could represent a bargain buy for your portfolio today. While there are many aviation stocks trading on the cheap, Southwest Airlines stands out for us, not least because of its reasonable solid balance sheet.

This is perhaps the most important metric to consider in an industry that continues to burn through free cash flow. Not only in terms of survival during times of increased travel restrictions, but to ensure that it continues to increase its domestic and international route expansion program.

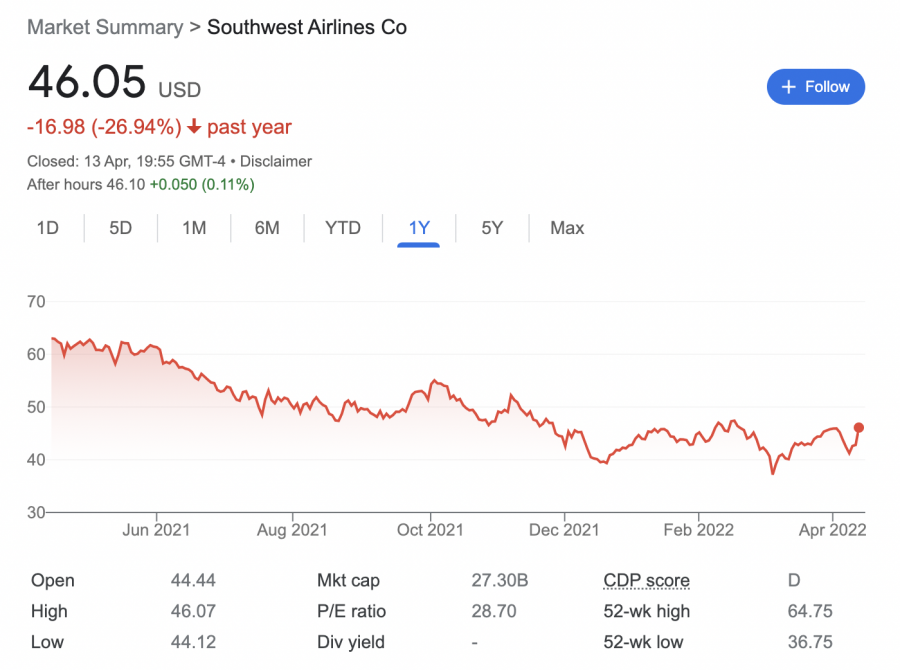

When it comes to its stock price action, Southwest Airlines surpassed its pre-covid valuation in April 2021. However, the stocks have since slumped. As such, over the prior 12 months, Southwest Airlines stock is down over 25%. This does, however, present an excellent opportunity to invest in this undervalued stock at an attractive discount.

7. SoFi Technologies – Buy This Leading FinTech Stock at an Attractive Entry Price

SoFi Technologies is behind the popular SoFi website and mobile app – which consolidates a full suite of financial and investment services via a single hub. In addition to stocks, ETFs, and robo-advisory services, SoFi also offers checking accounts, loans, student finance, and much more.

Crucially, at current prices, SoFi Technologies is arguably one of the most undervalued stocks in the ever-growing FinTech, which, until recently, enjoyed rapid growth. A broader market sell-off of tech-related growth stocks has resulted in up-and-coming firms like SoFi Technologies, dropping in value by a considerable amount.

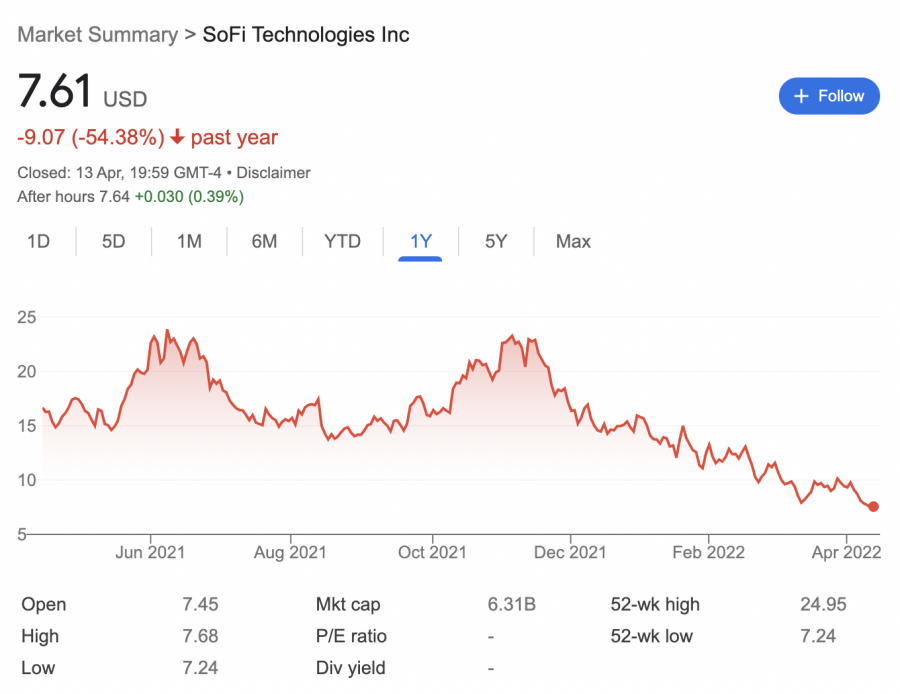

In fact, in the prior 12 months alone, SoFi Technologies stock is down more than 50%. This means that the firm is now trading at a lower price than its 2020 IPO, which opened at roughly $10 per share. With this in mind, if you’re looking to add some undervalued tech stocks to your portfolio, SoFi Technologies is well worth considering.

In terms of the fundamentals, 2021 was a great year for the firm – with SoFi Technologies attracting an additional 87% in customer numbers. This takes the firm’s customer base to 3.5 million, which, in the grander scheme of things, is still minute. Therefore, there is plenty of upside potential with this undervalued stock.

This is especially the case when you consider that as of writing, SoFi Technologies is trading with a market capitalization of under $7 billion. And, perhaps most importantly, it was recently announced that SoFi has had its banking charter application approved by US regulators. This will enable the firm to expand its portfolio of banking and lending services by a considerable amount.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

8. Grab – Hugely Undervalued Growth Stock to Hold Long-Term

Consumers in the US might not be overly familiar with the Grab app – not least because the firm largely operates in South East Asia. The Singapore-based super app provider is particularly dominant in Thailand, Vietnam, Indonesia, Malaysia, and the Philippines.

In addition to ride-hailing services, Grab offers everything from food delivery and groceries to micro-loans. Due to the exponential rate at which the firm continues to grow in the emerging economies, Grab was one of the most anticipated IPOs of 2020. However, things haven’t quite gone to plan since its NASDAQ listing.

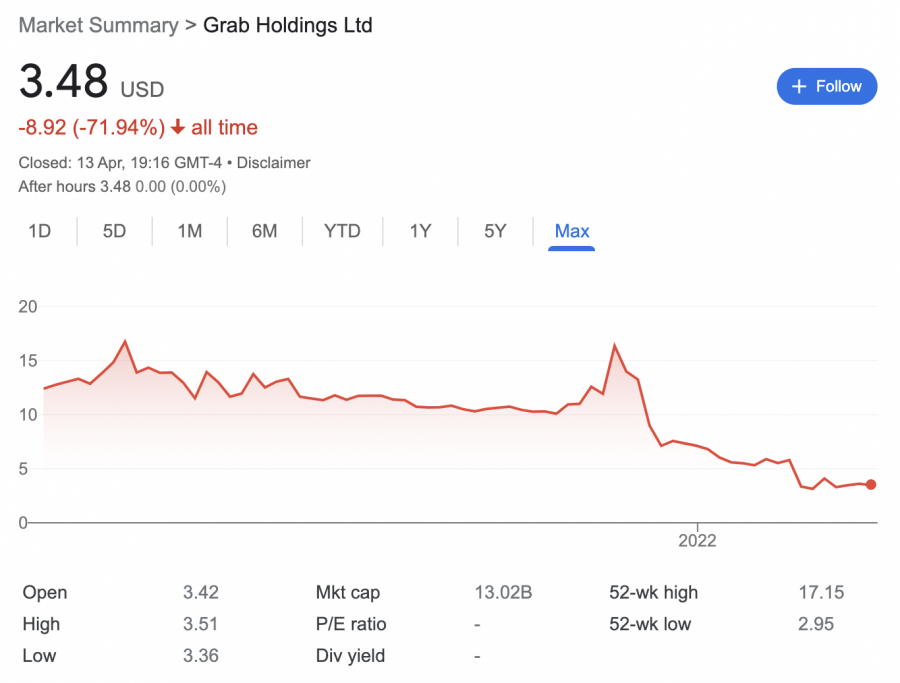

Based on prices as of writing, Grab is trading at a price over 70% lower than its IPO. One of the main reasons for this rapid sell-off is due to Grab’s overly aggressive business model – in which it allocates significant resources to customer incentives. In other words, in order to attract new customers, Grab offers highly attractive discounts.

This has since increased to an annual spend of over $1 billion. However, it should be noted that Grab is still very much a growth stock and thus – expenditure of this nature is not overly uncommon. Moreover, although the firm is still very much a loss-making company, this is to be expected. Ultimately, at current prices, Grab stocks are simply too cheap to turn down.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

9. Disney – Undervalued Stock With 40%+ Medium-Term Upside

Make no mistake about it – Disney is a high-grade stock that can be relied on for long-term value seekers irrespective of how the economy is performing. Sure, on the one hand, many of Disney’s core services – such as its theme parks, cruise ships, and movie sets, were heavily disrupted in the midst of the pandemic.

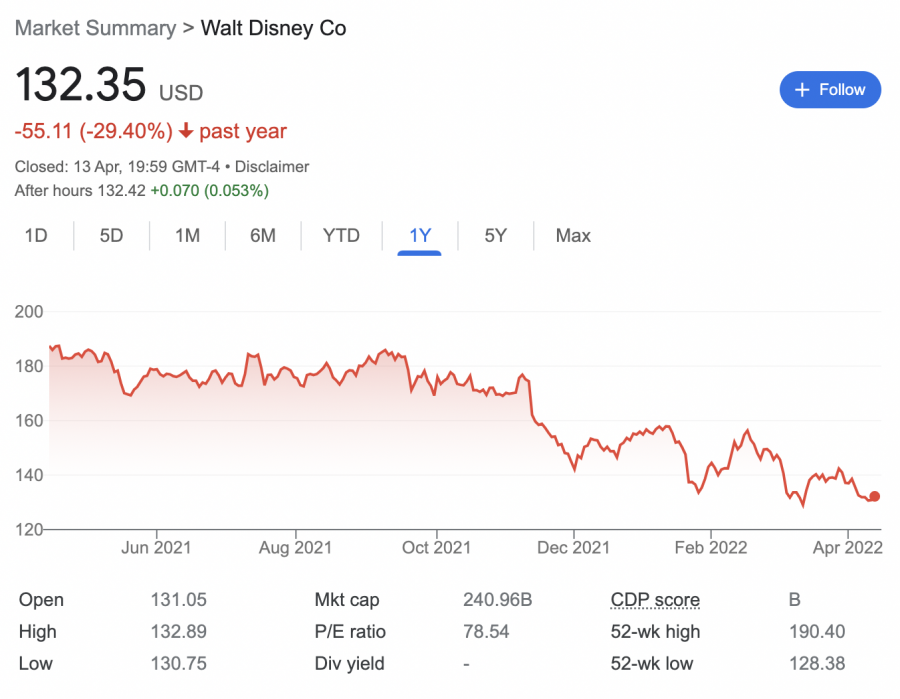

However, the firm’s relatively new streaming service – Disney +, continues to perform well. Moreover, now that global economies are finally returning to some sort of normality, Disney stocks appear to be an unmissable bargain at current prices. Although the stocks hit all-time highs of over $190 in early 2021, the shares have since entered a market correction.

As of writing, this blue-chip stock can be purchased for less than $135 per share. And as such, if and when Disney returns to its prior high, this offers a medium-term upside of over 40%. Moreover, although Disney suspended its previously consistent dividend program in 2020 as per the impact of the pandemic, this is sure to return in the very near future.

After all, its decision to temporarily suspend dividends has no correlation to its balance sheet – which is solid.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

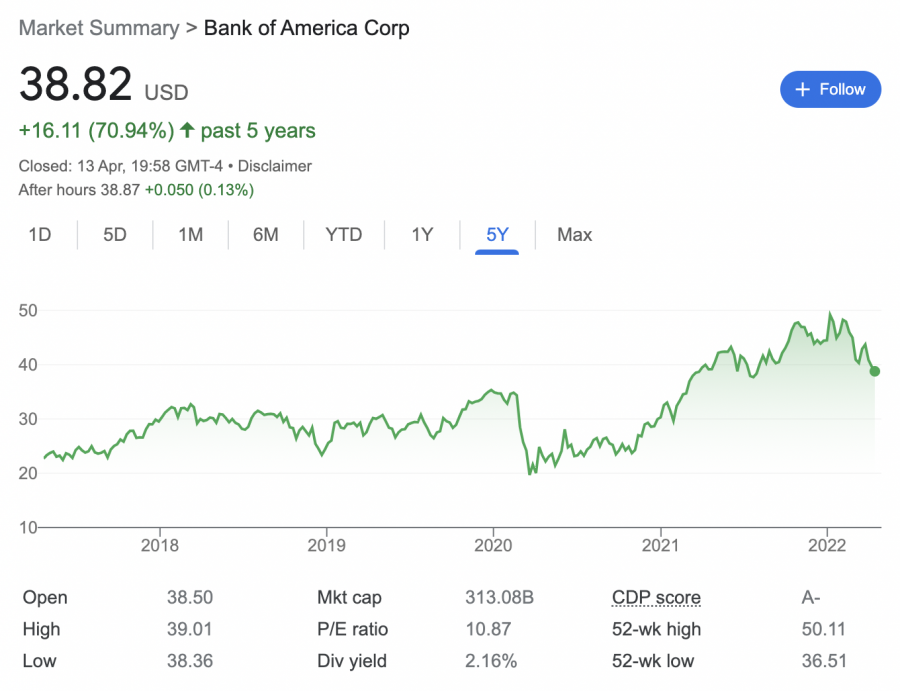

10. Bank of America – Undervalued Banking Stock With a Low P/E Ratio

The final option to consider from our list of the most undervalued stocks for 2022 is the Bank of America. This US financial powerhouse is one of the best-performing banking stocks in recent years, with 5-year gains of over 70%. This constitutes much higher growth than most of its sector peers.

There are many reasons why the Bank of America stands out from a value perspective. First and foremost, as of writing, the firm is carrying a P/E ratio of just under 11 times. For us, this represents a bargain buy. Moreover, we like that management at the Bank of America continue to focus on leaner operations – with the firm now super-efficient in many of its core divisions.

This has ultimately resulted in healthier operating margins. Another thing to note about this undervalued stock is that the firm is offering an attractive running dividend yield of over 2.1% as of writing. In terms of short-to-medium term targets, investors should look for the $50 high that the Bank of America hit in early 2022.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

What are Undervalued Stocks?

The term undervalued stock refers to a public company that is trading at a share price that is perceived to be less than its true value. In other words, the term is subjective, not least because investors determine and view company valuations in different ways.

Nonetheless, if you identify a top-rated stock that is undervalued, then you are entering the market at a discount. A great analogy here is if you were offered a $100 bill for $50, you would no doubt take the 50% discount on offer. This concept is no different in the case of underpriced stocks, not least because you have the opportunity to invest at a more attractive cost price.

In many ways, stocks are undervalued because of an overreaction from the markets. For example, we briefly mentioned earlier that when Meta Platforms announced in its most recent earnings report that the number of monthly active users on Facebook had declined in the quarter for the first time, the firm lost over 25% of its share value in just one day of trading.

This resulted in a decline of over $230 billion from its market valuation. However, many would argue that the fact that Facebook slightly underperformed for the quarter does not warrant such a significant stock decline. As a result, this is a perfect example of how to find undervalued stocks on the back of an unnecessary market reaction after the release of an earnings report.

How to Choose Undervalued Stocks?

Finding the best undervalued stocks for 2022 is not an easy task. After all, whether or not a company is under or overvalued is a subjective thought process.

Nonetheless, there are several key methods that you can consider when searching for undervalued companies – which we unravel in the sections below.

P/E Ratio

One of the first things that value investors look for when searching for underpriced stocks is the price-to-earnings – or P/E, ratio. This is a relatively straightforward accounting method that looks at two core metrics:

- The current share price of the stock

- The most recent annual earnings of the stock

You will then need to divide the stock price into the firm’s annual earnings – which will leave you with its P/E ratio. The theory is that if the stock carries a low P/E ratio, then it could be undervalued.

However, this in itself is not enough to truly determine the value of a stock.

Nonetheless, once you know the P/E ratio of a stock, you then compare this to the firm’s industry competitors. For example, let’s say that you are researching an energy stock that carries a P/E ratio of 10 times.

You then look at the P/E ratio of the broader energy sector and discover that this averages 15 times. This means that in comparison to the wider market, the stock you are looking at could be undervalued.

Earnings Report

If you have the time to actively research the markets and are able to place trades quickly, one of the easiest ways to make money from top undervalued stocks is to focus on quarterly earnings reports.

This is something that all public stocks must publish every three months and the report outlines how the company has performed in the prior quarter. This covers everything from revenues and net profit to operating margins and free cash flow levels.

- Before the earnings report is announced to the public, you should look at what Wall Street projections look like.

- In addition to this, make some notes on how the firm performed in the previous quarter.

- Ultimately, what you are looking for here is a high-grade stock that slightly underperforms – either against market projections or its previous earnings report.

If this happens, then there is every chance that the stock will witness a brief market sell-off. Meaning – that the stock price of the firm in question will go down due to its under-par results.

And therefore, this enables you to buy the stocks at an undervalued cost price. With that said, this strategy only works when you are investing in high-grade companies that you are confident will recover from their brief market dip.

Broader Market Correction

The broader stock markets will typically move in sync across both bullish and bearish cycles.

For instance, in early 2020, the entire stock market took a major hammering as a result of COVID being declared a pandemic by the World Health Organization. However, for many stocks, this market correction was short-lived.

- For example, in March 2020, Tesla stock went from roughly $850 down to $600 in the space of a few weeks – representing a decline of 30%.

- However, by November of the same year, Tesla stock had surpassed a share price of over $1,200.

- This means that had you bought Tesla stock after it went through its brief market correction, you would have doubled the value of your investment just six months later.

As such, when the broader markets go through a collective correction, this offers a great opportunity to buy undervalued stocks for your portfolio.

Are Undervalued Stocks a Good Investment?

Stocks that you identify as undervalued can be a great addition to your investment portfolio.

Some of the main benefits of targeting undervalued companies are discussed below:

Buy Stocks at a Discount

Perhaps the most obvious benefit of investing in undervalued stocks is that you are doing so at a discounted price.

For instance, if your chosen stock is trading at $80 per share but you believe that its true value stands at $100 – you are entering the market at a discount of 20%. If and when the stock recovers back to $100 – this would translate into an upside of 25%.

Avoid Buying at Peak Prices

When high momentum stocks increase in value at a rapid pace – they will never do so in a truly straight line. By this, we mean that investors will eventually look to cash out their shares at some point to lock in profits.

And, when this happens, the stock will go through a brief market correction before its upward trend resumes.

This is the best point in which you can buy undervalued stocks, insofar that you can wait for the shares to dip. In doing so, you can avoid buying your chosen stocks at peak prices.

Easier Upside Targets

When you buy a stock that is undervalued, your upside targets – at least in the short-to-medium, are a lot easier to identify. This is because your initial target will be for the stock to return to its perceived intrinsic value – as per your subjective findings.

Where to Buy Undervalued Stocks

Once you know which equities you wish to add to your portfolio, you can then process to buy your chosen undervalued stocks at an online broker.

The overall best place to complete your investments is eToro.com – and we explain why in the section below.

eToro – Best Place to Buy Undervalued Stocks at 0% Commission

All of the 10 companies from our list of the most undervalued stocks discussed today are available to purchase on the eToro platform in a safe and low-cost manner. First and foremost, the 3,000+ stocks listed on eToro can be bought and sold without paying any trading commission.

All of the 10 companies from our list of the most undervalued stocks discussed today are available to purchase on the eToro platform in a safe and low-cost manner. First and foremost, the 3,000+ stocks listed on eToro can be bought and sold without paying any trading commission.

Moreover, spreads are very competitive and US-based clients can deposit and withdraw funds without incurring any transaction fees. This is not only the case with ACH and bank wires, but debit/credit cards and e-wallets like Paypal too. The minimum deposit is just $10 for US clients, so you can invest in undervalued stocks on a budget.

When your account is set up – which takes less than five minutes from start to finish, you can then buy your chosen stocks in fractional quantities. At eToro, you can invest any amount from just $10 upwards. If you buy undervalued stocks that pay dividends, your account will be credited accordingly. This will enable you to reinvest the dividends into other stocks.

If you wish to diversify your portfolio outside of the US markets, eToro also offers access to more than a dozen foreign exchanges. Unlike other brokers in the US, you won’t pay any fees to buy international stocks. You can also invest in ETFs on a commission-free basis and even buy cryptocurrency assets from just $10 at a fee of 1% above the bid-ask price.

eToro is also renowned for offering the best copy trading platform in the online space. This tool allows you to choose an investor that alligns with your goals and copy their trades automatically. You only need to outlay $200 to utilize this passive investment feature. Pre-made smart portfolios are also offered across a great selection of strategies.

You might also choose eToro as your go-to broker for buying undervalued stocks because of its user-friendly mobile app. The app has been fully optimized for both iOS and Android smartphones and it gives you access to all of the same features as offered on the main eToro website. There are no fees to download the eToro app, either.

Safety and security will be of no concern at eToro, not least because the broker is approved in the US. It also holds licenses with the FCA (UK), ASIC (Australia), and CySEC (Cyprus). Finally, if you’re completely new to online trading, eToro offers a free virtual portfolio that tracks the real-world stock markets. This comes pre-loaded with $100k in risk-free paper money.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

How to Buy Undervalued Stocks on eToro

In the section above, we mentioned that eToro is the overall best place to buy undervalued stocks in terms of safety, fees, and small account minimums.

If you’re wondering how to invest in undervalued stocks right now – follow the simple step-by-step walkthrough outlined below.

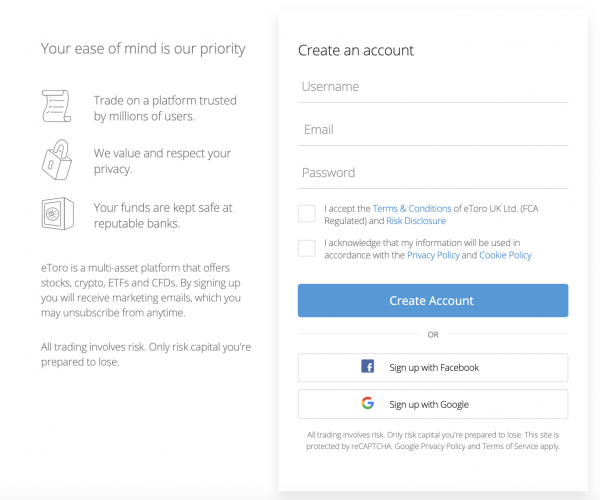

Step 1: Open an eToro Account

You will first need to register with eToro before you can invest any capital into undervalued stocks. You will need to provide some personal information to the broker, alongside your cell phone number and email address.

You also need to choose a suitable username and enter your social security number for verification purposes.

Step 2: Upload ID

To get your account verified, upload a copy of your government-issued ID and a recently-dated document that has your residential address on it.

Step 3: Deposit Funds

Choose your preferred deposit method from ACH, a domestic bank wire, a debit/credit card, or an e-wallet. Then,enter your deposit amount in the relevant box.

This can be any amount from $10 upwards. As a US client depositing funds in USD, you won’t be charged any deposit fees.

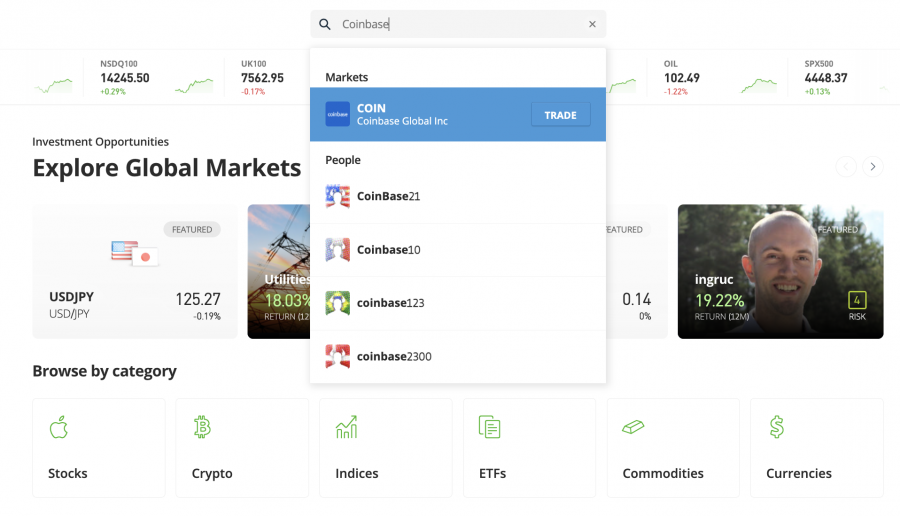

Step 4: Search for Undervalued Stock

Start typing the name of the undervalued stock that you want to invest in via the search bar.

When you see the stock appear, click on the ‘Trade’ button.

Step 5: Buy Undervalued Stock

All you need to do now is enter your desired investment size in US dollars. Once again, this can be any amount from $10.

Click on the ‘Open Trade’ button to buy your chosen undervalued stocks.

Conclusion

In buying undervalued stocks for your portfolio, you can purchase your chosen shares at a discounted price. This guide has discussed the 10 most undervalued stocks to buy right now, albeit, it’s important that you also conduct your own research.

If you’re ready to invest in some high-grade undervalued stocks today, you can easily complete the process at eToro. The minimum deposit here is just $10 and you won’t be charged a cent in commission when you buy and sell stocks.

Cryptoassets are a highly volatile unregulated investment product.

Be the first to comment