MasterKeySystem/iStock via Getty Images

Last month, the House passed a bill that would legalize marijuana across the country. This would also entail the decriminalization of marijuana, eliminating all criminal penalties for producers or people in possession of the substance. In other words, progress in the industry is imminent. However, in this article, I will also outline the numerous problems that the management team of Aurora Cannabis Inc. (NASDAQ:ACB) has yet to solve.

Overview

Aurora’s strategy is described in their “Q2 Management Discussion” as follows:

Aurora’s strategy is to leverage our diversified and scaled platform, our leadership in global medical markets, and our cultivation, science and genetics expertise and capabilities to drive profitability in our core Canadian and international operations in order to build sustainable, long-term shareholder value.

Although I find the latter hard to believe, due to some very worrying factors such as dilution and profitability, which I will address in a moment.

Aurora Cannabis Business Model (Aurora Cannabis IR)

Aurora Cannabis operates in an international market, despite being known to be a Canadian company. These countries include but are not limited to: the United States, Germany, France, Netherlands, Poland, Israel, United Kingdom and Australia. They are operational in both the medical market, the recreational market and the scientific market. Operating in the medical market is especially important, given the high gross profit margin in the segment (62% in Q2 2022), according to management.

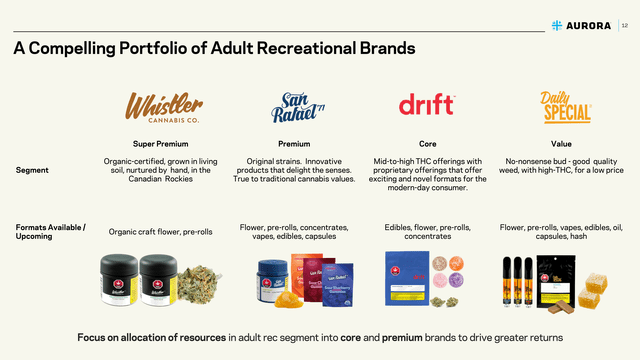

As far as products and segments go, Aurora tries to operate in all consumer segments, even though some are more profitable than others. As with many other companies, their Super-Premium segment drives the highest margins. Currently, Aurora drives a 25% gross margin on its value segment and 55% on its super-premium segment. Although, as previously mentioned, their medical segment remains the most profitable in terms of gross margin.

Aurora’s Portfolio (Aurora IR)

Financials & Results

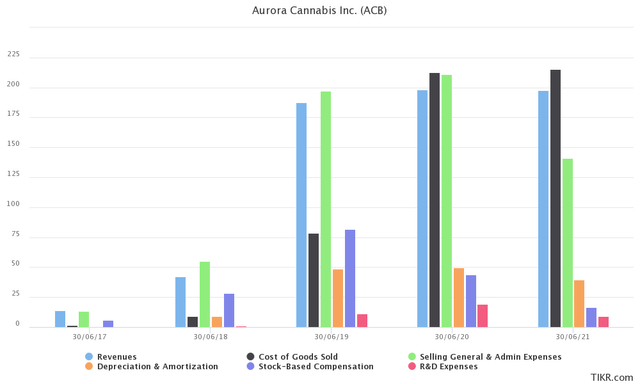

As seen in the chart below, Aurora Cannabis grew revenue to US$197.82M, from US$197.82, which shows significantly no revenue growth, although management did state in the Q4 2021 earnings call that they expected revenue growth for 2022.

Net income actually increased to -US$302.4M for the full year 2021, compared to -US$560.7M for the full year 2020. Most of this loss is attributable to an immense amount of operating expenses, which totaled -US$206.09M for the full year 2021. As you may already guess, this raises quite a few questions about where profitability can be seen, since the cost of goods and operating expenses together represent more than double the amount of revenue generated.

TIKR Terminal

One can argue that Aurora has a lot of fixed costs, and that it is simply a matter of scaling up with few variable costs. But profitability is still far from questionable, even after 8 years of existence. I must also admit that out of the thousands of 10-Ks and financial statements I have read over the past few years, their method of reporting and accounting is one of the most confusing I have ever seen.

That’s because their 10-K’s were presented in Canadian dollars, which had to be converted to U.S. dollars to get a detailed view of the company’s finances. On top of that, management loves to use their non-GAAP “adjusted numbers” when it comes to accounting, instead of giving us investors a clear overview in USD GAAP financials.

Fully discounted are costs that most would consider necessary to keep the business afloat, such as share-based compensation, loss from investments, interest costs and so on. Especially as a company operating in a low-margin industry. Their non-GAAP statistics give the company a far too rosy picture that is far from reality.

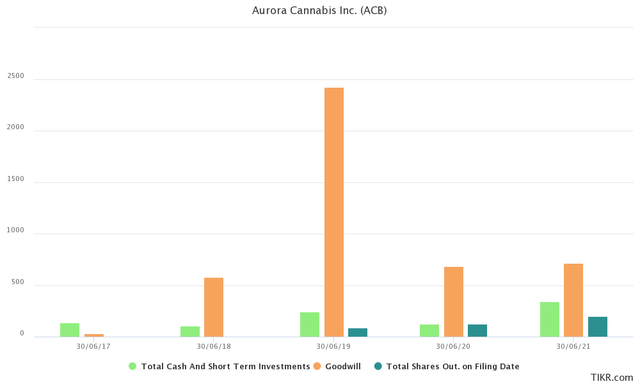

Aurora Cannabis is even currently being sued multiple times for this type of practice between 2019 and 20, according to SEC statements. On top of that, there are several red flags, including a laundry list of risks mentioned in the annual filings, the harvesting of more than 2.4B in “Goodwill” at one point, and the immense dilution of shareholders, which I will explain a bit more here.

TIKR Terminal

While investors have already suffered greatly over the past 12 months, with the market wiping out over 63% of Aurora’s share price, they have suffered even worse due to the dilution that has occurred at the company, and is still ongoing. In June 2014, the company had about 6.7M shares outstanding, which as of the last filing date has increased to 214.8M total shares outstanding. That is a dilution in excess of 3105%.

At the same time, it does not seem that all this dilution over the past 8 years has improved the financial situation, as the company is still bleeding at a rate of over US$59M per quarter, if we look at its net income in the fourth quarter. This is especially dangerous given that the company has only US$264.2M in cash and cash equivalents on its balance sheet, according to its most recent quarterly report.

Moreover, according to the latest 10-K, there could be much more dilution ahead:

The 2021 Shelf Prospectus and the 2021 Registration Statement allow the Company to make offerings of up to US$1.0 billion in common shares, warrants, options, subscription receipts, debt securities or any combination thereof during the 25-month period that the 2021 Shelf Prospectus remains effective. As of December 31, 2021, all US$1.0 billion remained available for use.

So, Where is the Profitability?

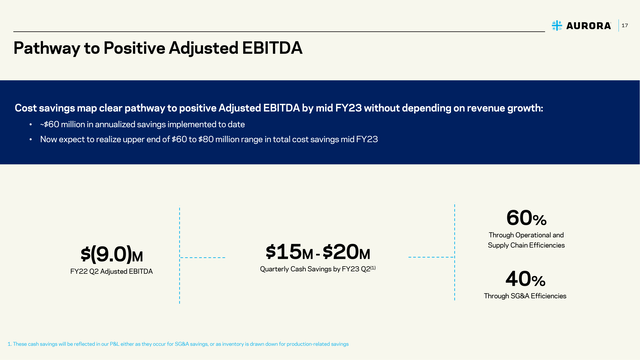

Again, as mentioned earlier, Aurora’s management team likes to use “Adjusted EBITDA” which is far from the actual reality. As a result of the falling stock price/loss of investor confidence, management was prompted to try to reduce expenses.

They claim to achieve this by making both their operational and supply processes more efficient, as well as their selling and general administrative costs more efficient, thus reducing the cost of goods and operating expenses. Whether this strategy will end up working is yet to be seen, and highly questionable knowing the management’s track record of previous unsuccessful strategies.

Aurora IR

Management has not presented a clearly quantifiable long-term plan, outlining how it will actually achieve a certain amount of GAAP Free Cash Flow, to satisfy investors who take on this enormous risk of high cash burn and dilution by taking a position in the company. They just seem to be “winging it”, trying out multiple strategies that have not played out till this day.

One of the few good things I can say about the company is that for its current market capitalization, Aurora still has a pretty strong balance sheet. They have about US$978M in total assets, if you exclude goodwill and other intangibles. That would equate to a P/B ratio of 0.70, representing a market capitalization of US$685M.

Conclusion

Given the poor track record of the management team, multiple class action lawsuits in which management reportedly misled investors, poor performance/dilution, and very questionable profitability and margins, I conclude that it may be better to move your money elsewhere. The market is full of wonderful opportunities, and blue chip tech stocks like Google (GOOG) (GOOGL), Meta (FB), Amazon (AMZN) and more trading at a nice discount, with lower beta, reliable management, and strong profitable business models that generate tons of FCF as they continue to grow.

At times during my research, I even wondered how management can still run this as a publicly traded company on the Nasdaq, given their countless lawsuits, financial mismanagement, and vague/misleading statements about the true profitability of the company despite burning trough hundreds of millions in cash yearly. With that in mind, the only price target I can foresee at the moment is a slow and imminent bankruptcy.

I am convinced that it is only a matter of time before the company runs out of cash, after current shareholders are already more than 96% diluted due to the company’s mismanagement since inception. However, the company may still have upside potential as its enterprise value (EV), which currently stands at US$716.85M, is above its market capitalization of US$685.13M. This would imply a share price of $3.34, not taking into account any losses that could be added next week after earnings.

Unless you are speculating on the best case scenario: hostile/ activist takeover followed by asset liquidation, the management team being ousted, Reddit extolling it as a meme stock or an actual change in strategy. For those reasons, I wouldn’t go short on the stock, either. Aurora Cannabis has been subject in the past to momentum swings, as can be evidenced by Seeking Alpha’s Quant Rating.

Be the first to comment