kmatija/E+ via Getty Images

Innovative Industrial Properties (NYSE:IIPR) has once again become the center of Wall Street drama. This is not an unusual place for the marijuana facilities REIT. Indeed, in my first coverage of the company back in 2019, I wrote: “Don’t Bet Against This Pot REIT” in response to people that were shorting the company at that time.

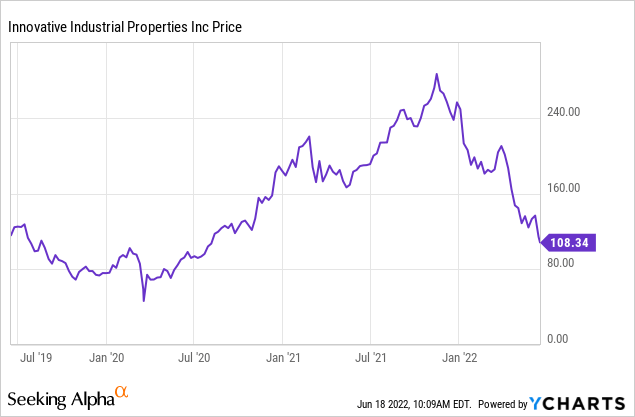

IIPR stock was at $120 then, and is at $109 now, so it might seem like the firm has had a sleepy go of it since then. But, the flat stock price hides a great deal of volatility along the way:

Indeed, IIPR stock made it up to a high of $288 last fall after a scorching run. Now, however, the stock has plunged more than 60% from its 52-week highs.

To set the stage, in 2019, I warned not to short IIPR stock when it was a controversial company. It’s once again controversial following a scathing short seller report from Blue Orca Capital. So where do things stand for Innovative Industrial today? Let’s dig in.

Innovative Industrial’s Bull Case

The bull case for Innovative Industrial is simple but compelling: It’s growing like a weed.

The company has developed a clever niche of providing capital to marijuana businesses that would otherwise not be able to access capital given that marijuana remains illegal on a federal level. Innovative Industrial can access capital at okay rates through the stock market and effectively lend it out (via property leases) to marijuana cultivators at nosebleed levels collecting a massive premium. As cash flow rolls in, IIPR can rapidly redeploy funds into further cultivation facilities, creating a growth machine.

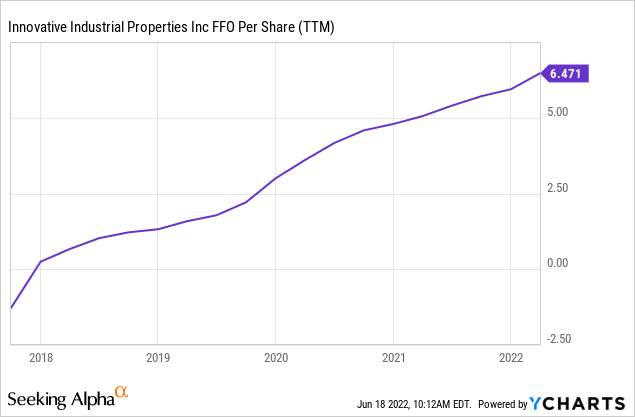

The company’s unique business model and success there-in is reflected in the numbers. Here is its funds from operations per share evolution over the years:

Even with the effects of the pandemic, Innovative Industrial didn’t have even a single down quarter over the past five years. And the growth rate has been simply tremendous. Just since the start of 2020, the company’s FFO per share has already doubled again.

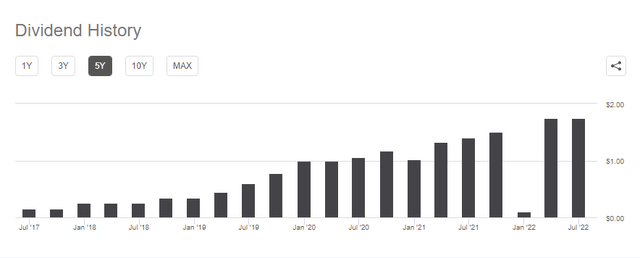

The company has richly rewarded its shareholders as this growth has occurred. Here is the company’s dividends per share over the years:

IIPR Dividend History (Seeking Alpha)

As you can see, the company’s dividend has grown from just a small amount in 2017 to almost $2 per share per quarter now. This has been one of the most notable growth stories out of the REIT industry in many years.

However, the good times may be coming to an end. A change in federal cannabis policy would likely end Innovative Industrial’s ability to earn outsized returns. And, even if that doesn’t happen, the company is facing significant problems at the moment.

Cannabis Legalization Would Crash The Party

A report from Financial Regulation News pointed out that community bankers are pushing hard for cannabis to be normalized on a federal level so that they can start lending to the industry:

The Independent Community Bankers of America (ICBA), along with a coalition of 44 state community banking associations, is urging Congress to include legislation in the America COMPETES Act that allows legal cannabis businesses to access financial services and banking.

The legislation they are urging passage of is the Secure and Fair Enforcement “SAFE” Banking Act, which would establish a safe harbor for financial institutions that serve cannabis-related businesses in states that have legalized cannabis for medicinal or recreational use.

“The conflict between state and federal law has created legal uncertainty for community banks, inhibited access to the banking system for cannabis-related businesses, and created serious public safety concerns,” ICBA President and CEO Rebeca Romero Rainey said.

Anecdotally, I can tell you that I spoke to the management team of one regional bank that is heavily involved in banking the cryptocurrency and online gaming industries. The bank is on the cutting edge of developments in crypto and other frontier areas of banking. Yet, when I asked about marijuana, they said that while it was on their radar, it’s just too complicated for the time being with the federal policy as it is.

That’s the market opportunity for Innovative Industrial right now. Even banks that are delighted to bank cryptocurrency brokerages are scared to lend against marijuana right now. IIPR cleverly found a way to get around the existing regulatory framework and legally provide capital to these otherwise untouchable cannabis producers. They filled a major market opportunity and have gotten richly rewarded for it.

However, the moment that banks can lend to marijuana producers, the sky-high yields on new marijuana facilities leasing will end. Banks can get money from depositors at 1% or 2% per year. Meanwhile, Innovative Industrial issued a preferred stock (IIPR.PA) with a yield of 9%. On a level playing field, it will be exceptionally difficult for a company that pays 9% for access to capital to compete with banks that have dirt cheap deposits.

Bulls could counter by saying that this doesn’t matter in the near-term. After all, Innovative Industrial has an average remaining lease on its existing properties of more than 16 years. Given that Innovative Industrial has locked-in huge returns on capital out to nearly 2040, what’s the problem here?

Tenants Are Showing Strain

High rents are great, but if the tenants can’t pay, then you have problems. Historically, Innovative Industrial has been able to collect 100% of rent owed to it from tenants. But we don’t drive by looking at the rearview mirror. How do the future prospects of Innovative’s tenants look?

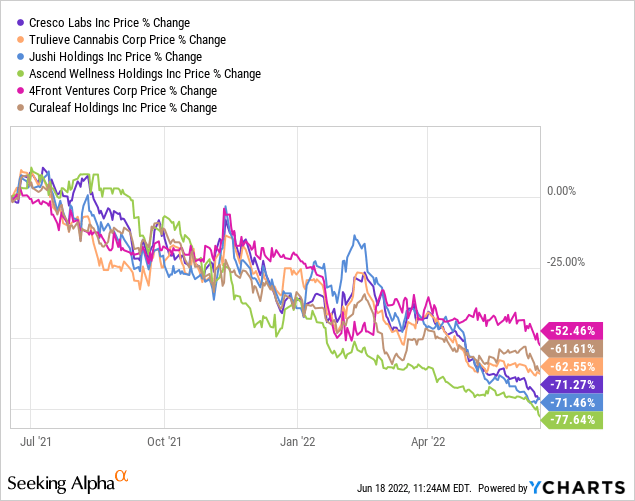

Judging by the stock market, quite poor. Here are stock performances for various publicly-traded IIPR tenants over the past year:

The ability of these companies to raise fresh funding to continue operating their businesses — and pay IIPR its rents — is under increasing stress. A logical place for a marijuana company to cut costs might be in demanding a break in rent from its landlords.

And that’s just the publicly-listed companies, which at least have access to things such as at-the-money “ATM” stock offerings to bring in some fresh cash. Innovative Industrial also does a good deal of business with companies that aren’t publicly-traded and presumably have even less access to capital as the marijuana industry’s downturn intensifies.

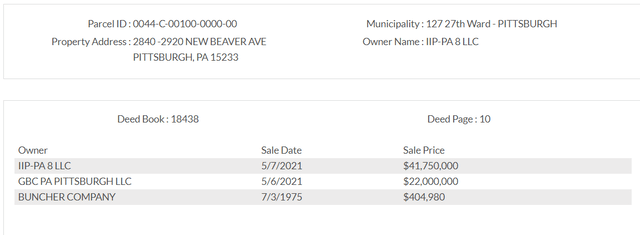

There is another problem here. Innovative Industrial often helps fund its counterparties by buying properties at a significantly higher price than its tenants paid for them previously. Here’s one example Orca noted where IIPR’s largest tenant, Parallel, paid $22 million for a property and then flipped it to $41.75 million to IIPR literally the next day:

IIPR property sales history (Allegheny County records)

Investors should be aware of this because it has significant ramifications if Parallel ends up not paying its rents later. Book value on IIPR’s balance sheet reflects the price it paid for a property (in this case $42 million) whereas its open market value was just $22 million at the time of the acquisition.

This is not a problem if Parallel pays its rents for the entirety of its contractual lease period. However, given that Parallel’s planned SPAC deal already failed, Parallel is facing a lawsuit, and that lawsuit alleges weakening financial performance as per the Orca report, one should be rather cautious in assuming that Parallel will be able to pay its rents over the entirety of the contract.

According to the Orca report, it’s not just Parallel either. Here’s Orca on Kings Garden:

IIPR’s second largest tenant is a private company which was recently embroiled in a lawsuit accusing its founder of falsifying its financials and selling illegal black-market cannabis. The case is ongoing, but we think the severity of the allegations should concern investors given Kings Garden’s outsized contribution to Company revenues and returns in recent years.

The Orca report goes on to note that it projects that IIPR has been earning a roughly 30% effective yield on its financial dealings with Kings Garden. Needless to say, a company on more solid footing would be unlikely to accept such expensive capital. Also, it’s reasonable to ask if a company can possibly earn a 30% return on capital in the marijuana industry, given how limited profitability has been for even the strongest players in the sector to date.

It’s easy to say, “Who cares if Kings Garden goes bust, someone else will rent the building.” But will they rent it at the same rate that the old tenant did? Almost certainly not. Particularly as more financing options become available to marijuana companies, there will be little reason to accept such expensive capital from IIPR.

To wrap this section up, I’d note that Innovative Industrial’s response to the Blue Orca short sell report did not address these concerns about tenant quality/solvency at Kings Garden or Parallel whatsoever. If there had been any good news to report on that front, that would have been a good time and place to do so.

IIPR Remains Expensive Compared To AFC

There’s one other big factor that leads to my skeptical view of IIPR stock’s prospects.

That is that we now have a reasonably decent publicly-traded comparable in the form of AFC Gamma (AFCG). AFC describes its business as follows:

“[We are] a leading provider of institutional loans to high-quality cannabis operators nationwide in all aspects of production: cultivation, processing, and distribution. We offer loans and related facilities, generally secured by substantial assets such as real estate, licenses and cashflow.”

There is some difference between lending money to a marijuana grower and renting it a cultivation facility at above-market rates with a built-in effective interest rate spread. However, in practice, these businesses should have fairly similar models and resulting valuations.

And yet, they don’t. AFCG stock is trading at just seven times forward earnings, and is offering an eye-popping 14% dividend yield. A dividend yield, which, I’d point out, they literally hiked just last week.

Am I saying AFC Gamma is a good investment? Not necessarily. I haven’t done enough work to say either way. However, it’s a clear warning sign to Innovative Industrial stockholders that a clear comp to your business is selling at 7x earnings and pays a 14% dividend yield despite growing its income and dividend. The market is treating cannabis lending like a subprime business. Yet, IIPR stock is still yielding a rather pedestrian sum by comparison.

IIPR Stock’s Bottom Line

Would I be outright short IIPR stock? No, I would not. However, if I owned shares, I’d be rather nervous given the balance of the information we’ve reviewed here.

Given the market plunge we’ve seen lately, including in REITs specifically, there are a large number of REITs which yield at least 6%. So it’s far from impossible to swap out of IIPR stock into something with higher dividend safety without taking an immediate income cut.

If Innovative Industrial were able to keep growing as it did in the past, that’d be one thing. However, it seems highly unlikely that Innovative’s growth streak will continue as it did in the past. Given the problems that some of Innovative’s top tenants have run into already, merely holding the line at the current dividend payout would seem like a success at this point.

Admittedly, there’s a decent chance that they’ll be able to pull it off for at least a time. I’m skeptical that federal marijuana legalization will go through during the current congressional term. And if it doesn’t happen now, it likely won’t happen for years, as polls show a strong possibility of the Republicans regaining control of both the House and Senate in November. This would likely delay federal marijuana legalization until at least 2025.

So perhaps Innovative Industrial can keep its current business model humming along for the next few years despite the growing strains on its tenants’ finances. However, the long-term outlook for this business is exceptionally cloudy. If you hold for the dividend, keep an exceptionally close eye on the company’s quarterly results going forward.

Be the first to comment