Irina Gutyryak/iStock via Getty Images

Canopy Growth (NASDAQ:CGC) is scheduled to announce Q2 earnings results on Wednesday, November 9th, before market opens.

The consensus EPS Estimate is -$0.19 (-533.3% Y/Y) and the consensus Revenue Estimate is $83.83M (-42.4% Y/Y).

Over the last 1 year, CGC has beaten EPS estimates 50% of the time and has beaten revenue estimates 75% of the time.

Over the last 3 months, EPS estimates have seen 3 upward revisions and 3 downward. Revenue estimates have seen 1 upward revision and 14 downward.

The Canadian cannabis company’s stock fell -6.57% on Aug. 5 after its FQ1 results, wherein net revenue declined ~19% Y/Y to C$110M.

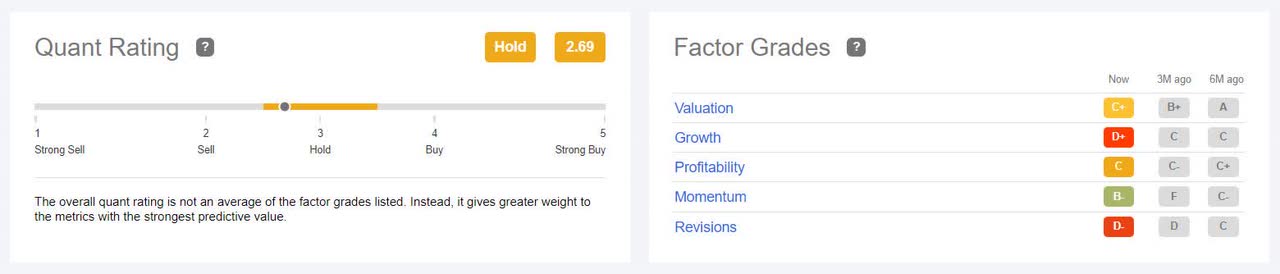

YTD, CGC has shed ~64%, however in the past one month has gained ~26%, see chart here. The SA Quant Rating and the average Wall Street Analysts’ Rating, both, on the stock is Hold.

During October end, it was reported that Senate Majority Leader Chuck Schumer said that the Senate was very close to agreeing on legislation that would allow cannabis businesses access to the U.S. banking system. A few days before this, President Joe Biden had asked the U.S. Department of Justice and HHS to “review expeditiously how marijuana is scheduled under federal law,” which sent cannabis stocks soaring.

In September, the Government of Canada began a legislative review of the 2018 Cannabis Act, a legislation that legalized the sale of marijuana in the country.

In October, Canopy Growth announced that it was acquiring Acreage to accelerate entry into the U.S. cannabis market. But a few days later the company warned that its planned creation of a U.S. holding company Canopy USA, could potentially lead to the delisting of its shares on Nasdaq.

The reason was that the U.S. stock exchanges do not permit the listing of cannabis companies that primarily operate in the U.S. The company said that Nasdaq had objected to its consolidating the financial results of Canopy USA if that entity closes on the acquisition of Wana, Jetty or Acreage.

Be the first to comment