skhoward

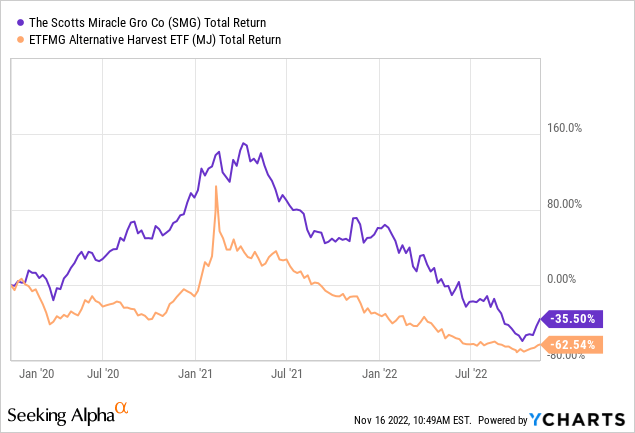

After an immense bull market, Scotts Miracle-Gro (NYSE:SMG) has lost a staggering 62% of its value this year and is trading around 75% below its all-time high set in early 2021. A few key factors have caused the stock to fall from grace. Chiefly, the general decline in “marijuana stocks” is primarily associated with a fall in retail investor speculation. Stocks related to marijuana rose dramatically in 2020, with the ETF (MJ) doubling, though subsequently losing all of those gains and then some. See below:

Scotts Miracle-Gro may now appear to be a cheap stock that is highly discounted based on its significant drawdown. Indeed, the stock is near its lowest price over the past five years and is well below its 2020 crash minimum. Many analysts see the stock as a “fire sale” opportunity. That said, I believe the company faces significant acute and long-term risk factors that may jeopardize its ability to survive. These include its high debt, immense losses in marijuana investments, falling demand for core products, and consumer preferences shifting away from pesticides, glyphosate, and other chemicals that research indicates are likely or potentially harmful to human health – some of which face multi-national bans. Together, I believe these long-term and immediate risk factors will continue to weigh on SMG’s value.

Sharp Declines In Sales Signal Trouble

The marijuana bubble took even those stocks like SMG, which generate little revenue from that segment, on a wild ride, but the worst of the declines now appear to be over as the sector gained renewed support. SMG is trading at a far lower price, though its forward “P/E” valuation is not too low at 16.7X. Indeed, while the “boom and bust” in pot stocks may be over, Scotts Miracle-Gro faces other fundamental risks.

Its marijuana-associated segment, Hawthorne, which sells a variety of marijuana-centric growing products, has seen revenue fall ~64% YoY in Q2, with nearly as significant declines in all sub-segments (lighting, nutrients, growing environments, media, etc.) (see 10-Q pg. 28). Scotts Miracle-Gro made huge investments into the marijuana segment that, seemingly, are becoming worthless as the segment fails to maintain its competitive edge in the developing and shifting market. In a sense, SMG’s Hawthorne unit acts as a venture capital investor in marijuana-growing products. As the marijuana market grows, new products and technologies are being developed that likely out-compete older peers. Thus, even with SMG’s massive number of Hawthorne brands, it is unclear whether those brands will remain profitable as new competitors emerge and eventually obtain a dominant market share.

The company is looking for ways to reduce overhead costs in its Hawthorne segment by integrating the best brands and closing its failing ones. This approach is likely wise, but it is not guaranteed to reduce costs since the sales of many of these brands appear to fluctuate rapidly as the marijuana market grows. One crucial factor is that professional marijuana growers generally avoid using the product MiracleGro due to complexities within the plant’s life cycle and preferences for natural fertilizers (1,2,3,4). Of course, the company is not necessarily looking at selling MiracleGro in its Hawthorne unit. Still, this factor indicates the firm may not have as strong of a synergistic relationship with the marijuana market as many may believe.

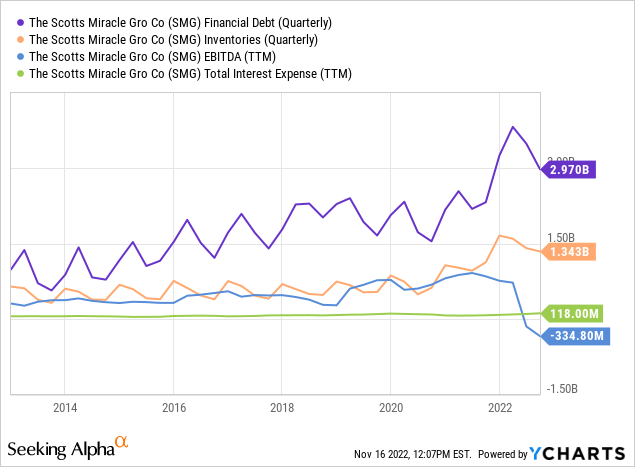

The company’s much larger consumer segment (~$900M in quarterly sales) has also faced apparent declines in demand, with sales falling by over 10% YoY. Certain features, such as its Roundup marketing agreement (sold by Miracle-Gro but produced by Monsanto), saw significant 35% YoY declines. The path of declines continued in Q3, with its US consumer segment seeing an 18% net sales decline, Hawthorne 49%, “other” 41%, and a total sales decline of 33%. Volume sales fell 40%, and prices rose 7%, indicating losses would be more significant if not for the rise in prices. This large miss resulted in a GAAP net loss of $3.97 ($2.04 adjusted to eliminate one-off costs). Most problematically, the company’s debt-to-EBITDA ratio rose to high levels of 6X, and its interest costs more than doubled YoY, indicating high insolvency risk if the firm cannot change the course of its business.

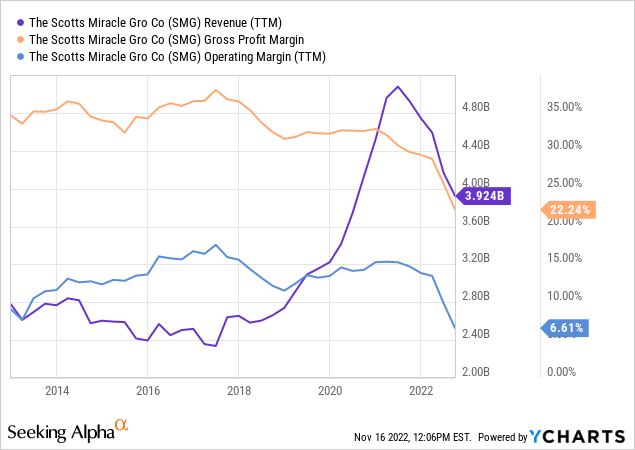

Though the trend of falling margins is accelerating, it is not new and began around 2017. The company saw robust sales growth in recent years due to acquisitions and price increases but is now in a clear state of falling sales. See below:

Scotts Miracle-Gro is losing ground on almost all fronts, with sales falling YoY in all categories during Q2 (10-Q pg. 28). Profit margins are declining mainly due to a relative cost increase. The global fertilizer shortage, higher transportation costs, and labor shortages are all key factors that, though slowing, may continue to harm margins in the future. To worsen the situation, the company’s debt and inventories are also highly elevated, and its interest costs are firmly above its EBITDA. See below:

If this trend lasts very long, the company may face restructuring as it fails to meet its financial obligations. The company has nearly $1 billion worth of current liabilities, primarily made up of accounts payable associated with its inventory level. If Scotts Miracle-Gro continues to see sales decline and is forced to reduce prices, then it could see its long-term debt grow or pursue equity dilutions.

Overall, it is apparent that Scotts Miracle-Gro is in a challenging financial situation that, though worsened by its significant Hawthorne investments, is by no means isolated to its Hawthorne segment. The company faces apparent demand difficulties in virtually all segments and categories combined with rising costs – production costs and non-operating interest expenses. Though the firm appears secure in the short run, I believe it has a considerable risk of financial restructuring if the tide does not change by next year.

What Is Driving Demand Difficulties?

The current consensus annual EPS estimate for SMG in 2023 is $3.78, giving it a forward “P/E” of ~16.3X. In my opinion, that is a high valuation given the company’s high balance sheet risks, the potential for negative operating margins, and falling sales. Analysts expect its earnings and sales to remain low until around 2025-2026, eventually rising back to a $7-$8 EPS by 2027. Of course, such a recovery may be doubtful, considering the firm’s core issues.

As mentioned in the company’s latest investor call, it is historically resilient to recessions and grew sales from 2008 to 2010. In the call, the company also blamed poor weather conditions for declining demand for many of its consumer products this year. That may be a factor and could continue to be if odd weather patterns and the drought continue. However, as with Miracle-Gro and marijuana, it is apparent that there is a broader trend against synthetic fertilizers due to perceived health risks. There is limited hard data on this point, but recent studies indicate that one-in-three people show signs of exposure to a pesticide called 2,4-D, commonly used in Miracle-Gro products. Other surveys indicate growing numbers desire lower exposure to pesticides, with glyphosate, the main ingredient in Roundup (marketed by SMG), being of particular concern once educated on the issue.

This risk factor is, at this point, difficult to quantify since few detailed surveys are done regarding consumer Gardner and lawn keeper preferences. However, with Europe soon banning the primary chemical Roundup, there is considerable risk that similar regulatory efforts spread to the US. Obviously, there is significant debate regarding the health effects of many chemicals used in Miracle-Gro’s products. However, the company ultimately depends on consumer demand and trust, and if preferences continue to shift toward organic, Miracle-Gro must change many of its products to conform. In my opinion, by defending its pesticide and glyphosate use, it risks permanently losing consumer trust – as is apparent within many online gardening communities. Of course, the company’s numerous environmental violation lawsuits also indicate this risk factor.

Risks related to regulation, brand trust, and demand for Miracle-Gro branded products are a point that I believe few analysts have covered adequately. At this point, Miracle-Gro still has immense market share dominance but can easily fall from grace if it fails to maintain trust. Indeed, it may be an existential risk given the firm’s extensive focus on a relatively small number of products. In my view, this factor may already be weighing on the firm’s sales, as indicated by the sharp declines in consumer volume sales in many of its products over the past year.

The Bottom Line

Overall, I do not believe SMG is a strong bet today, and I am generally bearish on the firm. The company is losing ground due to poor investments in its Hawthorne segment, a broader sales decline, and a cost rise. Given the sharp declines in its operating margin, negative EPS, and significant debt burden, the firm is at a relatively high risk of pursuing equity dilutions over the next year to improve its financial stability.

In the long term, I believe the firm will need to rebrand to better fit into a world that prefers organic or more natural products. Of course, Scotts Miracle-Gro is a large enough company with a substantial market share that it seems likely to rebrand as long as it does not delay unnecessarily. As such, I am not so bearish on the firm that I believe SMG is a short opportunity or is likely to go bankrupt. Still, given its high immediate financial risks and risk of further EPS losses, I would prefer the stock at a forward “P/E” below 9X (equating to a share price of $35).

The Best Legal Delta 9 Near You in Park Forest North

The Best Legal Delta 9 Near You in Park Forest North

Be the first to comment