24K-Production/iStock via Getty Images

Tilray Brands Inc (NASDAQ:TLRY) is recognized as one of the world’s largest cannabis producers with a diverse portfolio of medical and recreational brands covering various product categories. Despite continued growth, this is a market segment that has been crushed over the past two years, largely failing to live up to what was exuberant expectations at the high. Indeed, TLRY is down a disastrous 80% compared to levels in early 2021 and more than 40% lower this year.

That being said, we’re highlighting what has evolved into a more positive outlook in recent weeks with the stock rallying since the company’s last earnings report. Reports that Germany is moving forward with the legalization of recreational marijuana represent a new growth driver with Tilray already established in the country. The technical setup in the stock is also compelling which we can tie into underlying fundamentals that may have finally turned a corner. We are bullish on TLRY and see shares climbing higher through 2023.

TLRY Key Metrics

Tilray last reported its fiscal 2023 Q1 results on October 7th with the headline net revenue at $153.2 million, down 9% year over year. The company noted sales were flat on a constant currency basis. Cannabis sales declined by 17% y/y to $58.6 million in the context of a particularly strong comparison period in 2021, while the distribution side of the business has also been pressured by weaker pricing over the period.

A strong point has been in the beverage segment, with revenues climbing 34% to $20.7 million and now representing approximately 14% of the business. Notably, Tilray recently announced the acquisition of New York-based Montauk Brewery which joins its holdings of “Sweetwater Brewing Company”, “Breckenridge Distillery”, and the “Alpine Beer Company”. The idea here is to both diversify the business and capture some synergies with new high-growth product categories like cannabis-infused beverages.

source: company IR

A theme for the company has been an effort at cost savings and operational efficiency. The success is evident by the gross margin climbing to 51% from 43% in the period last year. Management explains the company has captured $108 million in annualized cash savings year to date with more gains expected going forward. The adjusted net EPS loss of -$0.08 narrowed from -$0.13 in the quarter last year. Favorably, the adjusted EBITDA at $13.5 million climbed by 6% year over year and was also the 14th consecutive quarter with a positive result.

In terms of guidance, the company is targeting adjusted EBITDA between $70 and $80 million for the year ahead with an expectation of reaching positive free cash flow. This compares to the adjusted EBITDA of $48 million in fiscal 2022. Finally, the company ended the quarter with $491 million in cash against $658 million in total debt. The implied net debt to forward adjusted EBITDA leverage ratio under 2.5x highlights overall stable liquidity.

What’s Next For TLRY?

The Q1 report was important to confirm the business remains vibrant despite the headline-making challenges between inflationary cost pressures and concerns regarding consumer demand. While profitability has been elusive, the cost savings efforts and trends in adjusted EBITDA as a first step are encouraging with a path for more improvement going forward.

We mentioned the reports of the potential legalization of recreational marijuana in Germany. In October, the government laid out plans to make the country the first in Europe to have a fully regulated market allowing for personal possession of between 20 to 30 grams for personal consumption, while a timetable for the implementation has not been declared.

This is a major development because Tilray is already established in the country on the medical side with an approximate 20% market share, and the move could open the door for the rest of Europe. As explained during the earnings conference call, Tilray’s experience in Canada makes it well-positioned to capture this opportunity and leverage its global infrastructure.

One angle supporting the view that the legislation will move forward is the urgency for the region to collect higher tax revenues. It’s estimated, the legal market would create 27,000 jobs and raise 4.7 billion Euros in tax revenue. Any headlines regarding progress towards these efforts could work as a positive catalyst for the stock. All this is in addition to the ongoing organic trends and the company’s momentum in beverages.

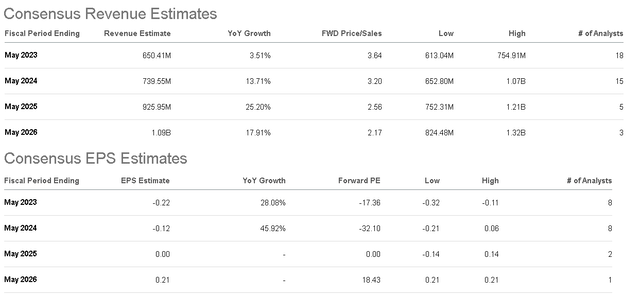

The outlook is for the company’s growth to re-accelerate over the next few years. According to consensus estimates, the forecast is for revenue to climb 3.5% this year with the momentum in beverages balancing the softer distribution segment trends. Going forward, top-line growth can rebound towards 14% next year and jump towards 25% by fiscal 2025 with expanded access in several countries.

The bullish case for the stock is simply that there is an upside to these estimates, particularly out of Europe. We believe the company can outperform on the earnings side through stronger-than-expected margins. In terms of valuation, based on management’s EBITDA guidance for fiscal 2023, the stock is trading at an approximate EV-to-forward EBITDA ratio of 35x. We believe this level is attractive considering the early stage of the profitability potential. Looking out towards 2024, that multiple would narrow to under 20x making shares appear cheap at the current level

Seeking Alpha

TLRY Stock Price Forecast

There’s a lot to like about Tilray as a global leader in cannabis. We rate TLRY as a buy and see several reasons for the stock to maintain the recent bullish momentum. From a high-level perspective, the backdrop of declining inflation and stabilizing interest rates have led to a pullback in the U.S. Dollar which is positive for risk sentiment overall.

The stock is currently above the $4.00 price level which has acted as a key area of resistance since Q1 has put the bulls back in control. We’re watching a forming “golden crossover” with the 50-day moving average converging with the 200-day moving average as a technical buy signal. To the upside, $5.00 is back on the table as our price target over the next few months.

In terms of risks, keep in mind that the company’s lack of earnings and negative cash flows will likely keep shares volatile. Weaker-than-expected sales trends could open the door for a leg lower in the stock. The gross margin and adjusted EBITDA will be key monitoring points over the next few quarters.

Seeking Alpha

Be the first to comment