hudiemm/iStock via Getty Images

Tax Loss Selling Strategy

This is the final article regarding my tax loss selling basket. I explained portions of the rationale for the strategy in the first three articles (here, here & here).

However, for those who haven’t read the earlier articles, here’s a quick synopsis:

- Investors who have net realized capital gains in the year can offset these by selling losers before December 30th (I previously had said tax treatment is by settlement date, but it’s actually by trade date for long positions).

- Stocks that are down on the year and preferably at multi year lows are good candidates for such selling.

- Because of the year-end deadline, investors who sell can become quite indiscriminate and this can create quick price plunges.

- Wash sale rules mean any investor who might want to get back into these names after realizing losses must wait 30 days. For this reason, I give the strategy through the middle of March to work, and no matter what the results, I sell the stock by that date. (If the stock bounces before then, I try to scale out of my position.)

Today I’m going discuss the last full position in the basket, viz. Organigram (NASDAQ:OGI)(TSX:OGI:CA) and then finish the article by tabulating the full list including entries that I haven’t written individual articles about.

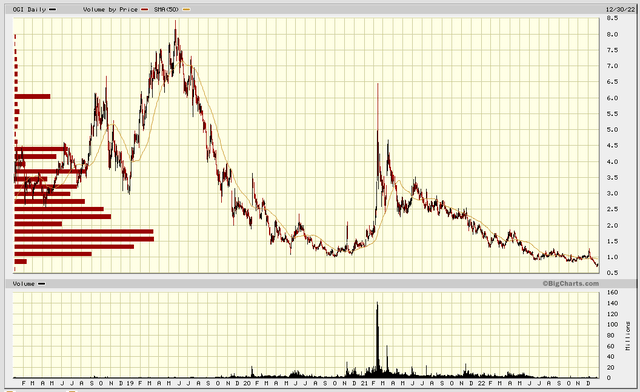

As can be seen by the 5 year chart, every OGI shareholder is sitting on a loss, and for some of them the loss may be in the neighborhood of 70% to 90%. Thus there are many potential tax loss sellers in this name.

bigcharts

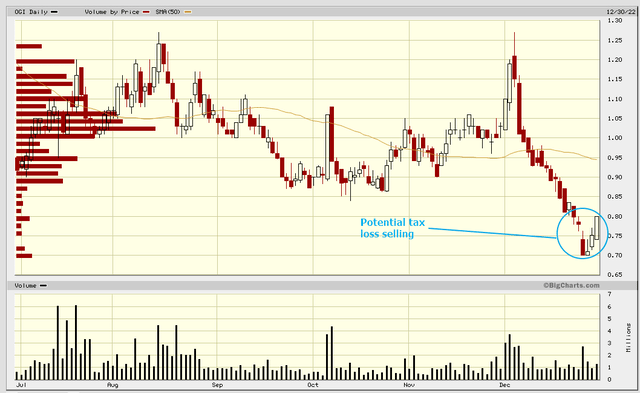

And as seen in the six month chart, there was a big dip at the end of December which could very well have been tax loss sellers throwing in the towel on this name. My buys for the basket were done during this latter period.

bigcharts

Organigram

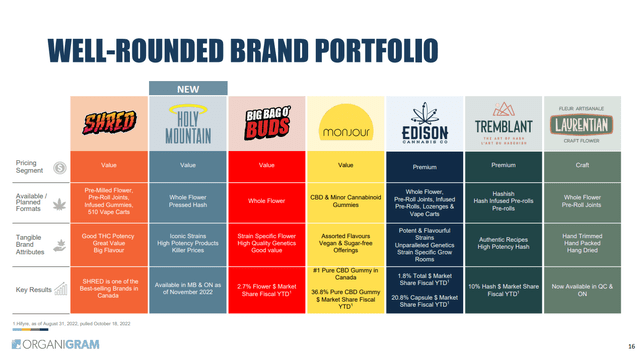

Organigram is a licensed Canadian marijuana producer & wholesaler with a number of well known brands in the recreational and medical marijuana spaces. It also has a small international presence in Israel and Australia.

Investor Presentation

Investor Presentation

It has grown revenues but at the cost of increasing cash flow losses.

The company expects to improve margins in 2023, but there’s no predictions of profitability.

Investor Presentation

Valuation

As the stock has been beaten down, it now sports relatively decent valuation numbers, in particular on EV/sales and Price to Book ratios.

Seeking Alpha

Cash on Hand

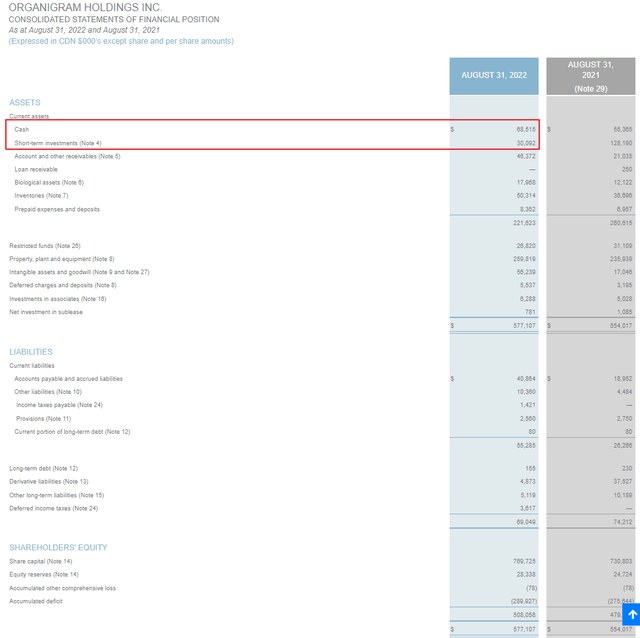

As of August 31, 2022, OGI had $68.5M (Canadian) in cash and $30M in short term investments. The company has about 314M shares outstanding, so that means it has cash and short term investments of $0.31 Canadian per share, or $0.23 US per share. That’s a little bit more than a quarter of the share price held in cash and short term investments.

sec.gov

OGI’s cash position also makes it less likely that the company will have to engage in a dilutive financing within my contemplated holding period (less than three months).

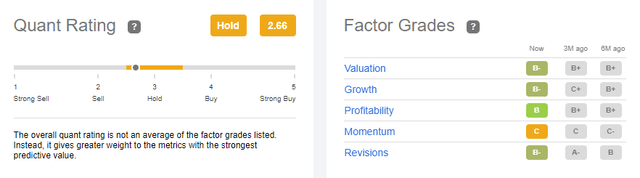

Quant Rating

Seeking Alpha has a hold rating on OGI, with all factor grades confirming it. For this reason I’m not considering holding the stock outside of my pre-planned window.

Seeking Alpha

Risks

OGI has been a chronically money losing operation though it is growing revenues. Unless it can drastically improve margins, it risks eventually going bankrupt.

However in the short term it has sufficient cash to avoid near term financing, which slightly reduces the risk here.

Trading Strategy

I have taken a full position in OGI with the hopes of scaling out if the stock price recovers from its presumed tax loss selling swoon. Either way I will be out of the stock by mid March.

Tax Loss Selling Basket

I haven’t been able to write up all of the entries in my tax loss selling basket, but here is a tabulated summary of the positions. Note that this year I decided to space out my buys in two halves, so in some cases I only have half a position; in others I have a full position.

| Company / Symbol | Position Size | Status |

| Achilles Therapeutics (ACHL) | Full | Open |

| AC Immune (ACIU) | Full | Open |

| ASLAN Pharmaceuticals (ASLN) | Half | Open |

| BlackSky Technology (BKSY) | Half | Open |

| Chimerix (CMRX) | Half | Open |

| DBV Technologies (DBVT) | Full | Sold ~25% of initial position |

| HCW Biologics (HCWB) | Half | Open |

| InflaRx (IFRX) | Half | Sold entire position |

| Isoray (ISR) | Full | Open |

| Kandi Technologies (KNDI) | Half | Open |

| 23andMe (ME) | Full | Open |

| Organigram (OGI) | Full | Open |

| Sesen Bio (SESN) | Half | Open |

| Trevi Therapeutics (TRVI) | Half | Open |

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment