koto_feja/E+ via Getty Images

War, they say, is the answer of those who have no arguments left.”― Andrew Ashling

Today, we take a look at a small biopharma concern with recent insider buying, one approved product on the market and another advancing in development. A full analysis follows below

Company Overview:

Radius Health, Inc. (NASDAQ:RDUS) is a Boston based commercial-stage biopharmaceutical concern focused on the development of therapies for bone health, orphan diseases, and oncology. The company currently has one commercial therapy, a recently acquired clinical asset, and is party to a potential stream of milestone and royalty payments from a recently divested oncology candidate. Radius was formed in 2003 and went public in 2014, raising net proceeds of $50.4 million at $8 per share. Its stock trades just below $7.00 a share, translating to a market cap of $330 million.

Commercial Asset: TYMLOS SC

TYMLOS SC (abaloparatide) is a subcutaneously injected synthetic peptide analog that engages the parathyroid hormone [PTH] receptor and is approved for the treatment of postmenopausal women with osteoporosis at high risk for fracture or patients who have failed or are intolerant to other available therapy. Eli Lilly’s blockbuster therapy Forteo and TYMLOS were the only two branded anabolic osteoporosis therapies – which build bone mass – before the former lost exclusivity with a generic version entering the market in 2019. Anti-resorptive agents such as Merck’s (NYSE:MRK) Fosamax and Amgen’s (NASDAQ:AMGN) monoclonal antibody Prolia comprised the balance of the market until Amgen’s dual action – increasing bone mass while decreasing bone resorption – sclerostin inhibitor and monoclonal antibody Evenity was approved in 2019.

The global market for osteoporosis therapies was $10.3 billion in 2020 and is expected to grow at a 2.2% CAGR to $12.4 billion in 2027. Despite the significant opportunity and demonstrating superiority to the competition, including Fosamax, Prolia, and Evenity, TYMLOS uptake has been tepid. This is partly due to the ongoing pandemic. After generating net sales of $173.3 million in 2019, that figure only grew 20% to $208.4 million in 2020 and 4% for the first nine months of 2021 to $153.9 million.

There are many reasons for the disappointing performance. First, coverage is limited to a maximum therapy period of two years. Second, TYMLOS came with a boxed warning for nearly five years due to a risk of osteosarcoma. Third, the company’s marketing application in the EU was rejected in 2019, closing off ~10% of the worldwide market. (Radius resubmitted in November 2021.) Fourth, Prolia controls the market with sales expected to soar north of $3 billion in FY21. Fifth, the remaining space is crowded, not only with the entrance of a cheaper Forteo generic – which to date has not had a big impact – but also with deep-pocketed Tier-1 competition with superior sales efforts. For example, Amgen’s other product Evenity surpassed $500 million in global sales during FY21, although it was approved two years after TYMLOS. Lastly and very importantly, TYMLOS requires a burdensome once-daily subcutaneous administration, whereas Prolia is a once-every-six-month injection and Evenity is a once-a-month injection. This dynamic has lowered patient compliance and thus sales.

Radius was attempting to address the administration issue with a sub-dermal patch. However, it failed to demonstrate non-inferiority in a Phase 3 trial that was readout on December 8, 2021, causing a 44% revaluation of the company’s stock down to $8.01 a share in the subsequent trading session.

On the positive side of the TMYLOS ledger, it recently achieved its primary endpoint in a pivotal trial evaluating it in the treatment of male osteoporosis. As such, Radius will submit an sNDA in early 2022 for this new indication. Also, the company was able to convince the FDA to approve the removal of the boxed warning on December 23, 2021. However, the market has clearly chosen to focus on the failure of TYMLOS patch.

Divested Asset: Elacestrant

The other Radius Phase 3 trial that was readout in 4Q21 was for elacestrant, a selective estrogen receptor degrader (a.k.a. SERD) that was evaluated in the treatment of breast cancer. Specifically, it was being investigated as a 2nd or 3rd line treatment of estrogen receptor-positive and human epidermal growth factor 2 negative advanced or metastatic breast cancer [MBC] in patients who have received prior treatment with one or two endocrine therapies, including cyclin-dependent kinase 4/6 inhibitor.

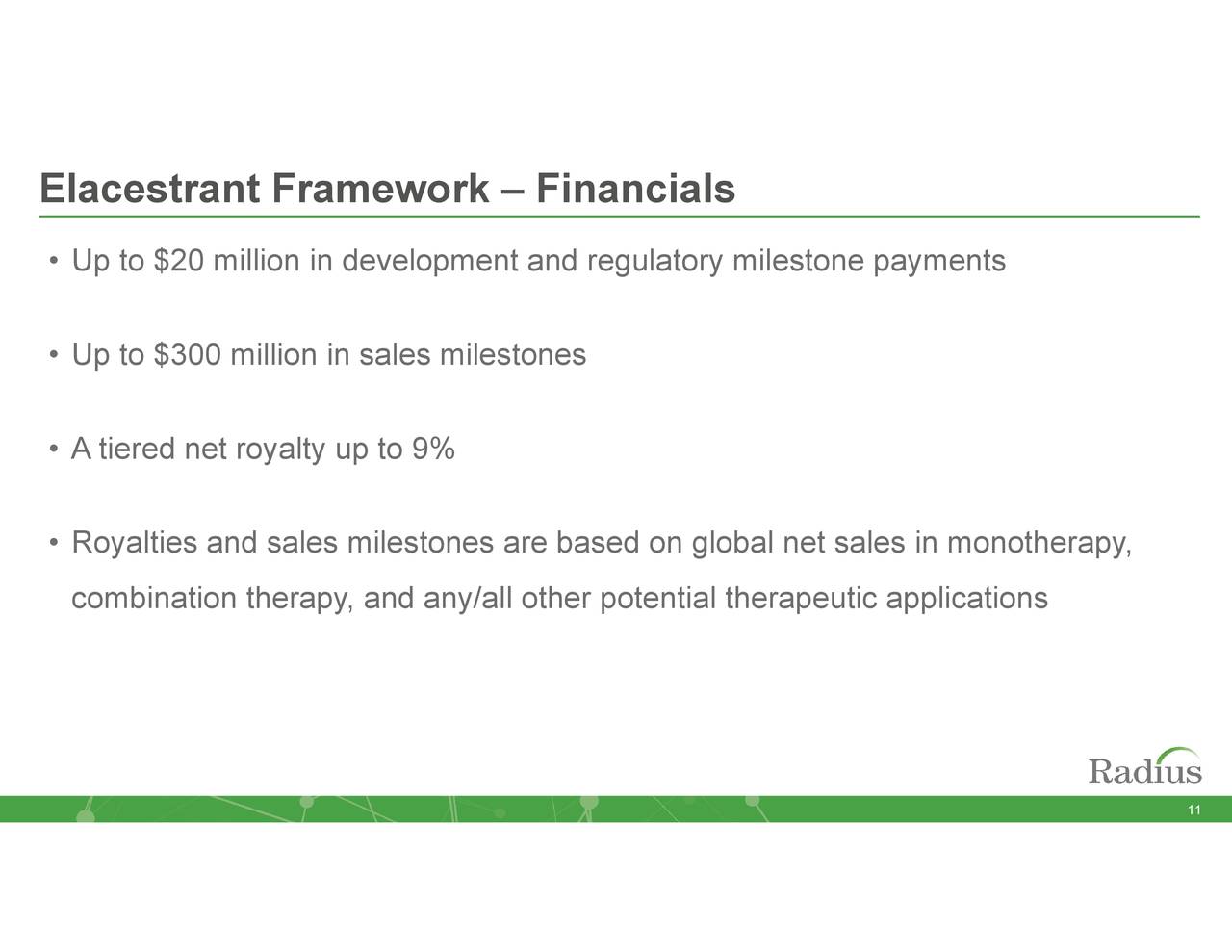

Elacestrant Deal Details (November Company Presentation)

Radius had sold elacestrant’s worldwide rights to privately held Italian concern Menarini Group in exchange for $30 million upfront, reimbursement of Phase 3 trial expenses, $320 million of potential milestones, and tiered net royalties up to 9% back in July 2020. In October 2021, the two concerns announced that elacestrant had met its two primary endpoints, demonstrating statistically significant progression-free survival in the overall population versus standard of care (22.3% vs 9.4%) and in patients harboring estrogen receptor 1 mutations (26.8% vs 8.2%).

These results put the companies in a position to have the first approved oral SERD for breast cancer, beating Roche’s (OTCQX:RHHBY) giredestrant, Sanofi’s (NASDAQ:SNY) amcenestrant, and AstraZeneca’s (NASDAQ:AZN) camizestrant to market. Oral SERDs could eventually grow to address a $2 billion to $3 billion opportunity. Applications are expected to be submitted to both the FDA and EMA during 2022.

Acquired Asset: RAD011

After making the deal with Menarini, Radius invested some of those upfront proceeds into RAD011 – a pharmaceutical-grade synthetic cannabidiol [CBD] oral solution – in January 2021. In exchange for an upfront consideration of $12.5 million to Fresh Cut Development and Benuvia Therapeutics, the company expects to enter its relatively new compound into a pivotal Phase 2/3 trial (SCOUT) for the treatment of hyperphagia-related behavior in patients with Prader-Willi Syndrome [PWS] sometime in 1Q22. The rare genetic disease is characterized by physical, mental, and behavioral issues, including hyperphagia (never feeling full). RAD011 has received fast track and orphan drug designations from the FDA for the treatment of hyperphagia and weight loss in patients with PWS – the first of several indications Radius anticipates pursuing with its CBD asset.

Balance Sheet & Analyst Commentary:

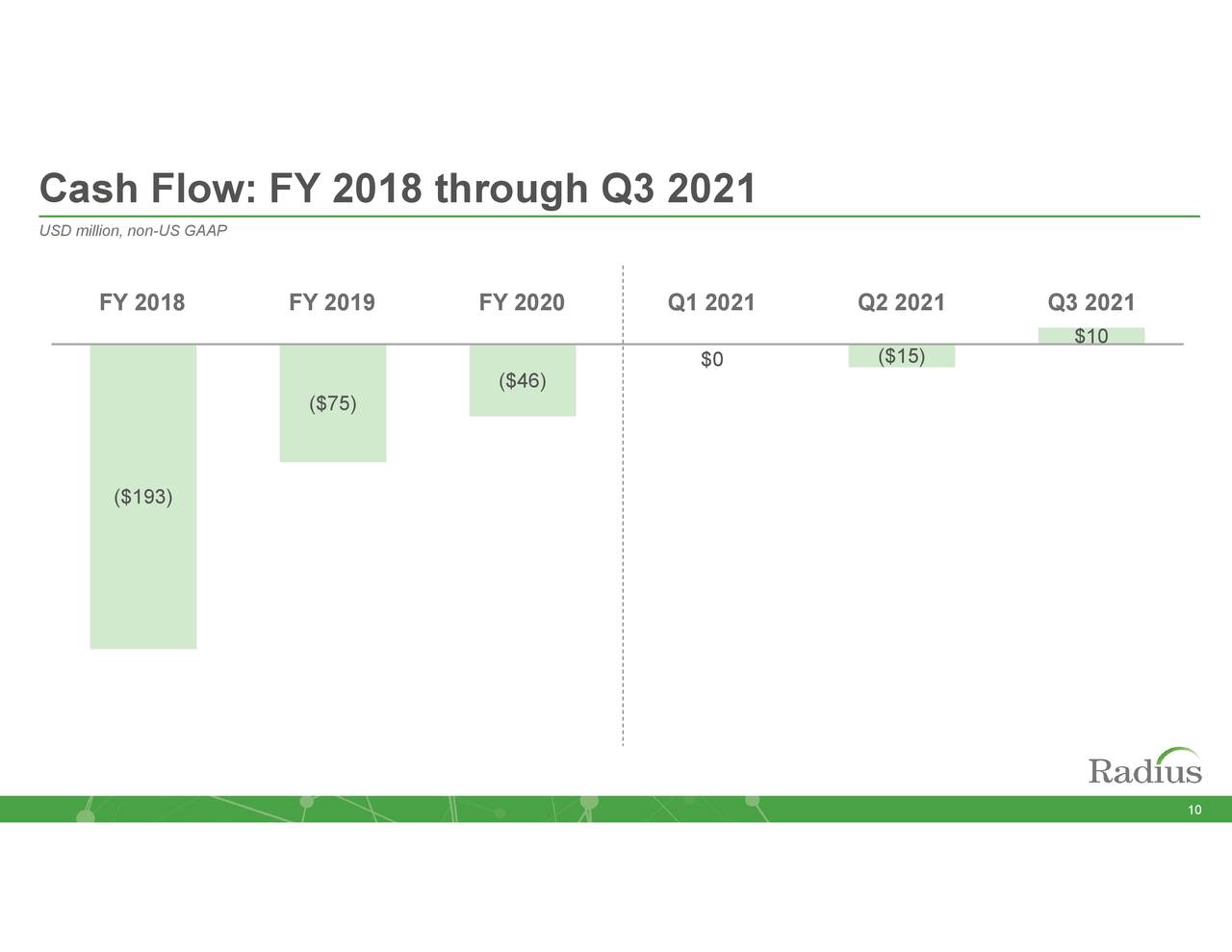

With TYMLOS trials wrapped up and elacestrant off the books, the only trial expenses the company anticipates over the next year is from RAD011. The trimmed down R&D line should allow Radius to achieve profitability in FY22, which should ease the looming obligations of a term loan, credit facility, and convertible note, which collectively have ~$67 million (principal plus interest) due in 2023 and ~$301 million due in 2024. As of September 30, 2021, the company held unrestricted cash of $109.6 million after using cash from operating activities of $24.2 million during the first nine months of 2021.

RDUS – Cash Flow (November Company Presentation)

Not surprisingly, almost all Street analysts jumped ship after the news of the transdermal patch failure hit the tape. Over the past few months, eight analyst firms including JPMorgan and Goldman Sachs have either reissued or downgraded the shares to Hold, Sell or Neutral ratings. Price targets proffered range from $7 to $18 a share.

Beneficial owner Rubric Capital Management has a different take, purchasing over 2.2 million shares in early and mid-December, raising its ownership interest to 6.96 million shares, or 15% of the company.

Verdict:

From a catalyst perspective, there isn’t any huge near-term bull case for Radius. Investors pinned their hopes on the transdermal patch and it did not pan out. The news on elacestrant is solid, but even if it eventually achieves $500 million in sales, annual net royalties will be less than $50 million. With that said, it is eligible for $300 million of commercial milestones (and $20 million regulatory) and Menarini may have first mover status, but the realization of these sales milestones is likely many years away. And RAD011 is a speculative play at this juncture. Radius’ net debt of ~$228 million will act as a drag on its upside.

However, TYMLOS generates revenue over $200 million with 90%+ gross margins and that should act as a hard floor on its downside, especially with the boxed warning removal and likely indication-expanding results from its male osteoporosis trial. As such, its stock should have a nice floor and possibly remain rangebound in the high-single digits, making it a solid covered call candidate, which is how I have a position in RDUS within my own accounts. Fourth quarter results should be out very shortly, providing a new and updated set of data points for consideration.

In war, the first casualty is truth.”― Terry Hayes

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment