3 Tech Stocks For Your Watchlist Today

While the broader stock market faces volatility following the Federal Reserve’s first pandemic-era rate hike, tech stocks continue to shine. Sure, this sector would be more prone to feel the impacts of interest rate hikes in the near term. However, some would also argue that this is part and parcel of the return to normalcy. This seems to be the case as the Fed aims to reel in hot inflation figures this year. Despite all of this, tech companies continue to innovate and grow their offerings across the board.

Take Alphabet (NASDAQ: GOOGL) subsidiary Google for example. As of yesterday, the tech goliath is reportedly acquiring Raxium, a developer of components in augmented reality (AR) devices. In particular, Raxium makes micro LEDs that act as the display on AR hardware. According to a report from The Information, the current deal could be worth up to $1 billion. By doing so, Google could, in theory, be bolstering its division that works on metaverse-linked tech. In other words, AR headsets. The likes of which companies such as Meta Platforms (NASDAQ: FB), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT) are already pursuing. This would show that exciting new spaces in the tech world continue to attract big players and plenty of funding.

At the same time, chip giants like Intel (NASDAQ: INTC) continue to ramp up their operations as well. Namely, the company is planning to invest approximately $88 billion towards expanding its manufacturing capacity in Europe. It aims to do so over the next decade. This includes the construction of an $18.6 billion mega fabrication facility in Germany. By and large, it seems that the tech industry continues to power forward despite stock market losses. With all that said, could these tech stocks be top buys in the stock market today?

Tech Stocks For Your March 2022 Watchlist

Accenture Plc.

Accenture is a multinational professional services company whose main businesses include information technology services and consulting. In fact, it is a leader in professional services with leading capabilities in digital, cloud, and security. Combining unmatched experience and specialized skills across more than 40 industries, it is powered by the world’s largest network of Advanced Technology and Intelligent Operations centers.

Today, the company reported a very strong second-quarter for its fiscal 2022. Diving in, total revenues for the quarter were $15 billion, an increase of 28% year-over-year. It also saw strong double-digit increases in its revenue in the North America and Europe segments at 26% and 31% year-over-year respectively. Accenture also posted an earnings per share of $2.54 for its latest quarter, compared with the consensus estimate of $2.37. On top of that, it also declared a quarterly cash dividend of $0.97, up by 10% from a year ago.

New bookings for the quarter came at a record of $19.6 billion, with record bookings in both consulting and outsourcing of $10.9 billion and $8.7 billion respectively. Julie Sweet, Accenture’s Chair & CEO, said, “Our outstanding second-quarter financial performance demonstrates continued strong, broad-based demand across all our markets, services, and industries. We continue to take significant market share as clients increasingly turn to Accenture as the partner uniquely positioned to help them navigate today’s accelerating pace of change. Our core strength is the diversity of our business that enables us to digitally transform across the enterprise through the depth and breadth of our services.” Given the impressive quarter, should you consider adding ACN stock to your portfolio today?

[Read More] Stock Market Today: Dow Jones, S&P 500 Opens Flat On Ukraine Developments & Fed Decisions

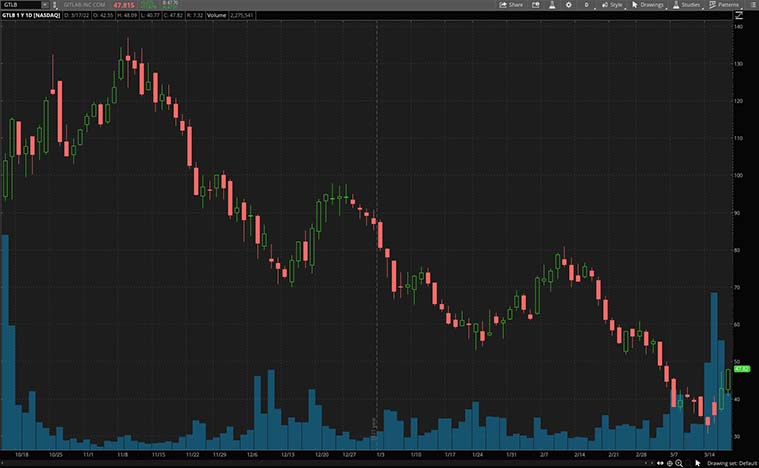

GitLab Inc.

Next up, we have GitLab, a tech company that is the provider of The DevOps Platform, a single open-source application that enables organizations to deliver better and safer software. It also empowers organizations to maximize the overall return on software development by delivering software faster and more efficiently. Its single application is easier to use, leads to faster cycle time, and allows visibility throughout and control over all stages of the DevOps lifecycle.

On March 14, 2022, the company reported its fourth-quarter and full-year fiscal 2022 financials. Firstly, it posted a total revenue of $77.8 million. It says that it continues to see strong momentum for customers adopting its DevOps platform, with revenue increasing 69% year-over-year. This growth is also broad-based, driven by strong customer additions across all company sizes. Secondly, it reported that its Dollar-Based Net Retention increased above 152% year-over-year.

GitLab also noted that it saw huge increases in almost all its customer metrics. Notably, customers with more than $1 million of Annual Recurring Revenue (ARR) almost doubled with a 95% increase year-over-year. It also issued a better-than-expected outlook for its first quarter and fiscal 2023 financial year. For revenue, it expects a topline revenue of $78 million for the quarter. All things considered, will you invest in GTLB stock right now?

[Read More] Top Stock Market News For Today March 17, 2022

Zoom Video Communications Inc.

Last but not least is Zoom Video Communications. For the most part, consumers and organizations alike would be familiar with what Zoom has to offer. After all, its cloud communication services have and continue to connect people from across the globe. Even as pandemic conditions are somewhat improving, Zoom remains a prominent part of many people’s lives.

Overall, ZM stock has not had the best performance in the stock market this year. Despite concerns over long-term growth, analysts over at investment firm Benchmark, appear to be bullish on it. To highlight, analyst Matthew Harrigan recently raised ZM stock to a Buy rating from a Hold rating. Moreover, Harrigan also hit the company’s shares with a “conservative” price target of $124.

Among the key reasons for this positive upgrade would be the ongoing shift toward hybrid work arrangements. The firm notes such a fundamental change in workflow even after the pandemic presents Zoom with long-term growth opportunities. Also, Harrigan acknowledges that the company’s short-to-mid-term growth would seem slow compared to its blowout results during the pandemic. With all this in mind, some investors could see the current weakness in ZM stock as an opportunity. Would you say the same?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel.

CLICK HERE RIGHT NOW!!

Be the first to comment