Are These The Best Tech Stocks To Invest In September 2022?

Many investors are keeping a close eye on technology stocks as we kick off September 2022. For the uninitiated, tech stocks have been on a roller coaster ride over the past year. Meanwhile, many analysts are predicting that they will continue to be volatile in the months ahead. While there is no sure way to predict the future of the stock market, there are a few factors that could impact tech stocks in the coming months. First, interest rates are expected to rise in the second half of the year, which could put pressure on stock prices.

Additionally, the ongoing trade war between the United States and China could also lead to volatility in tech stocks, as tensions between the two countries continue to escalate. This is evident with tech firms like NVIDIA Corporation (NASDAQ: NVDA) and Micron Technology Inc. (NASDAQ: MU). Shares of both companies have fallen recently in light of new export rules from the U.S. in regards to exporting chips to China.

Finally, earnings reports from major tech companies will also being digested by investors. With so much uncertainty on the horizon, it’s important to stay disciplined with your investment strategy and keep a diversified portfolio. Technology stocks may be volatile, but they can still offer opportunities for long-term growth. With that, here are three top tech stocks to watch in the stock market today.

Tech Stocks To Invest In [Or Avoid] Right Now

Shopify (SHOP Stock)

Next, Shopify Inc. (SHOP) is a Canadian e-commerce company headquartered in Ottawa, Ontario. In brief, the company offers online retailers a platform to buy and sell products. As well as a suite of tools to manage inventory, orders, and customers. Shopify is an e-commerce platform that enables businesses of all sizes to sell online. In July, the company reported a miss for its second quarter 2022 financial results.

In detail, Shopify reported a 2nd quarter 2022 loss of $0.01 per share, with revenue of $1.3 billion. Versus, Wall Street’s consensus earnings estimate of $0.03 per share, with revenue of $1.8 billion. Additionally, the company notched in a revenue increase of 16% during the same period, in 2021. Moreover, the company reported that its subscription solutions revenue was up 10% year-over-year at $366.4 million for the quarter.

“While commerce through offline channels grew faster in Q2, where our exposure is lower but growing, we continued to see increased adoption of our solutions, enabling our merchants to remain agile against a challenging macro environment and highlighting the breadth and resilience of our business model,” stated Amy Shapero, Shopify’s CFO. With that, shares of SHOP have been beaten down by over 77%. This comes after closing Friday’s trading session at $30.11 per share. Considering all of this, do you think SHOP is a good buy at these price levels?

[Read More] 5 Top Dividend Stocks To Watch In A Bear Market

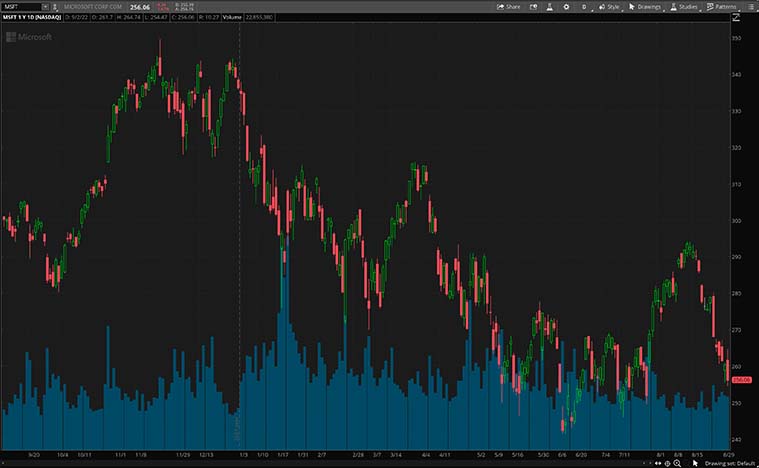

Microsoft (MSFT Stock)

Next, Microsoft Corporation (MSFT) is an American multinational technology company with headquarters in Redmond, Washington. It develops, manufactures, licenses supports, and sells computer software, consumer electronics, personal computers, and related services. Most notably, some of its best-known software products are; Microsoft Windows, Microsoft Office suite, Internet Explorer and Edge web browsers. For a sense of scale, Microsoft is one of the largest information technology companies in the world.

In July, Microsoft reported its most recent Q4 2022 financial results. In detail, the company posted earnings of $2.23 per share. As well as revenue of $51.9 billion. This is in comparison to, analysts’ consensus estimates of earnings of $2.28 per share, on revenue of $52.9 billion.

“In a dynamic environment we saw strong demand, took share, and increased customer commitment to our cloud platform. Commercial bookings grew 25% and Microsoft Cloud revenue was $25 billion, up 28% year over year,” commented Amy Hood, executive vice president, and CFO of Microsoft. “As we begin a new fiscal year, we remain committed to balancing operational discipline with continued investments in key strategic areas to drive future growth.” With that, shares of MSFT stock are still down over 23% since the start of 2022. As of Friday’s closing bell, shares of MSFT stock are trading at $256.06 per share.

[Read More] Cheap Stocks To Buy Now? 3 Marijuana Stocks To Watch

Roblox (RBLX Stock)

Lastly, Roblox Corporation (RBLX) is an American technology company that develops and operates the Roblox platform, which is a social networking service for people to play games, create experiences and interact with other people. Just last month, the company announced its second quarter 2022 financial results.

Diving in, Roblox reported a loss of $0.30 per share on revenue of $591.2 million for the second quarter. This is in comparison with the consensus estimates of a loss of $0.23 per share and revenue of $658.5 million. Though, Roblox was able to notch in a revenue increase of 30.2% during the same period, last year. Meanwhile, the company announced its Average Daily Active Users grew 21% year-over-year to 52.2 million.

David Baszucki, CEO of Roblox commented in his letter to shareholders, “We are driving record levels of users and engagement globally as we execute on our innovation roadmap and broaden the appeal of Roblox across geographies and age groups. We continue to make progress on key operational and product initiatives to enhance the long-term value of the Roblox platform.” Moving along, shares of RBLX stock are down over 60%. Meanwhile, RBLX stock is looking to start off this shortened trading week at $37.94 per share. With this in mind, will you be watching RBLX stock in the stock market this week?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel.

CLICK HERE RIGHT NOW!!

Be the first to comment