PrathanChorruangsak/iStock via Getty Images

I’ve been doing a lot of work in the cannabis space recently and have come across some very interesting and very cheap opportunities. I’d like to share one here and potentially some more down the road. Typical microcap stuff applies – for small funds and PAs, trades around $25k/day, presentations/materials are not great (although IR isn’t bad) and there is one lone analyst who has written some reports on the business. However, this is one of the fastest growing (non-Tier 1 MSO), most profitable, highest margin and cheapest cannabis stocks in the entire cannabis universe. I also believe Cansortium Inc. (OTCQX:CNTMF) is at an inflection point where we could see a rapid increase in revenues/EBITDA from here (which we are already seeing as of Q1 and Q2) resulting in the stock trading above $0.75/share within the next year or so. There has been zero share price reaction after two record quarters thus far this year, and the stock currently trades at less than 3.0x my estimate of next year’s EBITDA, with a strong growth runway and very attractive takeout potential.

Cansortium Inc. (soon to be renamed ‘Fluent’) is a cannabis company that produces and sells medical cannabis throughout the US. The company’s core market is Florida where they are vertically integrated, engaging in the cultivation, processing, retail, and distribution of cannabis. Its medical cannabis products are offered in oral drops, capsules, suppositories, topicals, syringes, dried flower, pre-rolls, cartridges, and edibles. The company provides its products under the Fluent brand name. As of Q2 2022, Cansortium operated 27 dispensaries in Florida, 3 in Pennsylvania, one in Texas and formerly a grow operation in Michigan that they recently exited given the difficult pricing environment in the state. In the late 2010’s, Cansortium began selling medical marijuana under the business name Knox Medical with cultivation, processing and dispensing facilities in Florida, Texas, Pennsylvania and Puerto Rico. The company re-branded to Cansortium in 2019 and launched the Fluent Cannabis Care brand alongside an IPO on the Canadian Securities Exchange where they raised $56mm for expansion and commenced cultivation at their Tampa facility. At the time, Cansortium had 10 dispensaries in Florida with plans to expand to 30 (during 2019), while finishing the year having generated $29mm in revenues. Fast forward to today and Cansortium operates 31 total dispensaries with projected 2022 revenues of $90-95mm. Cansortium is very much a turnaround story that I believe is currently at an inflection point, having struggled under the weight of prior management, over-expansion plans and inability to deliver results. Today, on the back of new management efforts, operational improvements, a growing medical market in Florida and more controlled expansion plans, it’s possible we could see revenues and EBITDA significantly increase from here.

These increases are already underway as of Q1 and Q2 of this year, where Cansortium reported record quarterly revenues (and growth), record adjusted EBITDA and positive cash from operations. In addition, they are one of the only cannabis businesses worth mentioning that has NOT reduced guidance or lowered estimates for the year. In fact, FY22 guidance may prove to be conservative.

Cansortium has a few important characteristics that make it an attractive investment in the space: actual scale in one of the strongest markets in the US, vertical integration, and cash flow positivity. Cansortium has two large grow operations in Sweetwater and Tampa and has expanded their Florida cultivation operations from 26,000 square feet at the time of the IPO to 136,000 square feet today. Furthermore, the company is undertaking two projects to bring its cultivation footprint up 250,000 square feet which should be completed during the back half of this year. Cansortium’s combined production capacity of both their Sweetwater and Tampa facilities is 200,000 grams of production per week (22,000 lbs.). The facilities owned by Cansortium are incredibly efficient, utilizing vertical grow operations and capable of producing crop equal to a facility with 3x the square footage. Early on, Cansortium also entered into management services agreements for the funding and buildout of the facilities with payouts coming from cash generated by the facilities. I believe that strategy made a lot of sense given the upfront capital needs for cultivation as well as being able to tap the expertise of proven cultivators in the state. Now at scale, the company plans to end the year with 31-32 dispensaries in the state of Florida which are currently under construction and importantly are not factored into the FY22 guide. Although 85-90% of revenues are derived from Florida operations, CNTMF also has three dispensaries in Pennsylvania and a cultivation facility and retail dispensary in Texas, providing de minimis contribution to revenues. Although the PA dispensaries are somewhat recent builds, they are in favorable locations and provide a small chunk of revenues. Cansortium has also been growing their patient count in Texas, no small feat as the lone star state is one of the most restrictive in the entire US, neither legalizing medical or adult use at this stage. Cansortium is one of three license holders in Texas, has a 400k sq. ft cultivation facility attached to one retail dispensary, and will be ready to pounce on any change in state legalization. While management talked about making a legitimate run in Texas and helping to change the legislative environment, it’s possible that those assets could be disposed of to fund further expansion in Florida and pay down debt.

It’s estimated per OMMU data that Cansortium has around a 4% (and growing) share of the Florida medical market. OMMU and other sources will list Cansortium as the 6th or 7th largest player, however I believe market share stats are a bit misleading as players #3-5 have only 1-2 more dispensaries than Cansortium and only a few bps higher share of flower sales in the state. That is to say that the gap is not wide for Cansortium to move up the market share ranks, especially as they are growing faster than any of their peers at this stage. For example, the low end of the company’s FY22 guide implies 38% revenue growth year over year, significantly higher than all but a few of their peers. Moving forward, share gains can continue as Cansortium’s yields will increase from additional cultivation improvements, manufacturing capacity will increase, new dispensaries will be opened, and CNTMF is finally producing enough inventory to fully stock shelves.

From the Q4 2021 / Q1 2022 call:

Inventory shipped in Florida was up 75% in March compared to this past December, reflecting the highest levels of inventory we’ve ever had. We have enjoyed building inventory in the store vaults, while at the same time, experiencing record sales. So we’re selling more and producing more at the same time. For perspective, last year, we would run out of flower at our dispensaries almost every day. And sometimes we would not make it past the mid-day before running out of flower. We simply did not have enough production capacity to meet the demand in our stores and having flower is a key selling point to attract patients through the door to purchase any other products. Today, we have an adequate level of flower and overall supply for our 27 stores with Tampa and Sweetwater running at max production.

Additional benefits to actually having product include being able to measure the sales cadence, run tests, promote certain brands and generally manage inventory better. It’s hard to know what’s working when you don’t have enough product to sell. I believe the inventory situation has and will continue to improve moving forward and should help CNTMF continue to take share as Florida is an incredibly large untapped market with significant runway for growth. Management agrees.

From Q3 2021 call:

Okay. It’s tremendous. I think that we’ve said before and I’ve said before to you, which is if it were not for the race for footprint that’s going on in Florida, I would not open another store because we would — if we were in a vacuum, we would spend this year maximizing our existing store shelves to realize what those store ceilings are. We’ve not yet had — and even today, have not yet had the opportunity to take a store and have it at full robust inventory all day long every day.

…so the amount of market share is now starting to be traded around a little bit between us. But there are still more legislative events other than legalization. And I’ve spoken on this before, I think a reciprocity, which is a very simple administrative amount. If you think about the number of cardholders from other states that come to Orlando, Miami, Tampa and Jacksonville, just a reciprocity measure, which could be an easily regulatory move, which could happen any time now.

…it could be a 30% sales increase across the board without one new patient. So there are regulatory initiatives that could happen short of recreational that would dramatically increase Florida. Then there’s recreational. So I think what I’m seeing is the bigger MSOs are here, investors are here. Everyone’s here. Everyone is building more grow space. Florida still remains a very untapped market. We are nowhere near saturation on number of stores, number of square footage of canopy space. It is still a fast-growing market.

Importantly, the strategy of maximizing the existing footprint is a smart one given the limited capital requirements and additional capacity that the stores can absorb. There is without question a land grab taking place in Florida, but as a share taker, it would be more beneficial for Cansortium to have fully stocked shelves, be moving inventory and making sure they are catering to the customer base. I can’t overstate the benefits of this as common sense will reveal that having enough product to sell means…more sales. It also means being able to push higher margin / higher sale products, run sales tests, better utilize discounts and increase data collection. When asked about growth rates and SSS as of Q2, management had this to say:

What you’re seeing is just pure inventory. We were able to accomplish this growth. This company, like many others, was inventory constrained in 2020 and even in ’21, because inventory, because it’s vertical and we cannot obtain our products from any other source, we had to grow it to sell it. And so what you’re seeing in the Q4 of ‘21 and then Q1 and Q2 is just pure biomass coming online, these facilities that we had to invest and build are coming online. So we were able to put more product in the stores. The demand is still there. We could continue to grow in sales and would anticipate that we could in our existing stores. We haven’t yet reached the saturation point of demand on our existing stores. Now, projections on when we’ll reach that, I’m not able to tell you that, but the fact is that we could continue to absorb more inventory, even probably another 15%, 20% in our existing stores.

Of note, a quick look at IFRS earnings doesn’t exactly paint the picture of profitability. Unfortunately, one quirk of IFRS as it relates to cannabis is that companies are required to list ‘biological assets’ on the balance sheet which consist of cannabis plants in the grow process that will ultimately be transferred to inventory for sale. The assets are subject to quarterly estimates as there is no active secondary market for cannabis plants, and the assets are valued at fair value less costs to sell which estimates the expected harvest yield in grams for plants currently being cultivated and the expected selling price less costs to sell. This is a very difficult process to undergo, is subject to significant estimates, and can change frequently, resulting in recording gains or losses on biological assets. These adjustments result in what Cansortium reports as ‘adjusted gross margin’ which is gross profit plus or minus the changes in fair value of biological assets, and plus or minus the realized fair value of increments on inventory sold (basically the cost of production). I view adjusted gross margin as normalized.

For example, during Q1 2021, a large unrealized gain in fair value of biological assets was recorded which boosted gross margin, while in Q1 2022 the gain was much less, resulting in what looks like severe gross margin compression. It’s basically six one way, half dozen another as these charges are either added back or subtracted on the cash flow statement. As a result, it’s difficult to derive normalized gross margins other than to say during 2021, GMs were above 60%, and have come in the same through the first two quarters of 2022. I’d estimate those figures to decline slightly over time but management seems confident that a >60% GM is an achievable long-term figure. EBITDA margins are equally strong in the 30-35% range, although adjustments have to be made which I touch on below.

As Cansortium continues to take share, increase its Florida dispensary count, and receive additional revenue contributions from other states, it wouldn’t be hard to imagine revenues increasing at a 30% clip for the next few years. With a strong brand, cultivation buildouts complete and minimal capex for new dispensaries (basically lighting, millwork, flooring etc.), incremental margins should look very attractive and EBITDA flow through should be very strong. Should new dispensaries perform in line with the current footprint over time and SSS remain anywhere near today’s levels (mid-teens) then results could be even stronger.

Background

As mentioned, Cansortium is somewhat of a turnaround story with a shaky past consisting of over-aggressive expansion plans, management and board changes, and debt restructuring. Under the leadership of former co-founder and CEO José Hidalgo, the company had ambitious plans to nearly triple their dispensary footprint in 2019, but fell flat on their faces. Capital requirements, continuous construction delays and cultivation issues led to limited revenue generation along with massive operating losses and cash burn. The prior management team also entertained the idea of expanding into Puerto Rico and Canada which proved to be ill-fated as managing cultivation, processing, distribution and retail operations in multiple countries with limited geographical proximity is incredibly difficult. Convertible debt of $25mm was issued in 2019 and following another round of reduced fiscal year outlook, cost cutting measures were undertaken as well as a board and management shakeup. Three independent directors were installed (one of which included David Abrams of Harris/Blitzer/Apollo fame), while co-founder and Chairman José Hidalgo (moved to Chairman from the CEO role a few weeks earlier) resigned along with the COO and VP of Finance. Cost cuts were also enacted in the form of workforce reductions and elimination of senior management personnel and compensation, aiming to save Cansortium around $5mm per year.

A few weeks later, the company also announced that it reached an agreement with co-founders José Hidalgo and Henry Batievsky, along with two other former senior executives, for their immediate return of more than 26 million shares of stock, in aggregate, representing almost 15% of Cansortium’s outstanding shares on an as-converted basis. The co-founders agreed to transfer these shares for nominal consideration to the company for cancellation or to assist in the recapitalization of the company. Basically, the board decided that the founders share issuance was overly generous but let the former management team walk away with something. Following that, at the end of 2020, Cansortium also announced they entered into agreements to sell both the Canadian and Puerto Rican operations for undisclosed amounts in order to focus on Florida and continued US operations.

Cansortium continued by restructuring their debt in early 2020 with $13mm of Promissory Notes being restructured to remove amortization and extend the maturity, while an additional $13mm in near-term liabilities were paid off using the returned Founder’s shares discussed above. A capital raise was conducted a few months later via private placement whereby Cansortium offered 10.2mm equity units at $0.45 per unit, or approximately $4.6 million. Each unit consisted of one common share and one common share purchase warrant which entitles holders to acquire one share at an exercise price of $0.45 per warrant share.

The turnaround efforts started to bear fruit in Q1 2020 where Cansortium grew revenues over 80% YoY and generated positive EBITDA for the first time in the company’s history. Current CEO Robert Beasley was appointed to the role in September 2020 following a ten-month stint as a Senior Advisor to the Board. I am a fan of Beasley thus far and touch more his background below.

Capital Structure

As of this writeup, Cansortium has 252.2 million common shares carrying one vote per share, and 2.7mm Proportionate voting shares carrying ten votes per share. The option incentive plan has an additional 16mm options outstanding along with 38mm warrants at a one for one conversion, for a total of 308mm fully diluted shares. The weighted average exercise price of the options is $0.52/share, and the warrants have various strikes, all higher than today’s share price.

Cansortium also entered into a credit agreement with a syndicate of lenders during 2021 providing for a loan up to $71mm. The loan matures in 2025 and bears interest at 13%, callable in 18 months. The Term Loan consisted of a $50 million tranche priced with an original issue discount of 3% plus 12.5 million warrants to acquire 12.5 million common shares with an exercise price of $1.20 per share for a term of four years after the closing date; as well as a $21 million tranche priced with an original issue discount of 7% with no equity component. Subject to certain conditions, the loan can be increased by up to $20 million. If nothing else, this financing speaks to the lack of attractive financing options in the industry, which aren’t improving. I asked about potential refinancing and I think Cansortium would be interested in exploring all options. However, with rates rising and cannabis still federally illegal, there aren’t any great options at the moment. Of note, two former board members (including David Abrams) participated in the financing. Based on the low end of CNTMF’s 2022 EBITDA guide, leverage comes in at 2.8x.

Lastly, in April of this year Cansortium completed non‐brokered private placement that includes a 10.0% unsecured convertible debenture in the principal amount of $3mm, as well as 3,076,923 pre‐funded common share purchase warrants at a price of $0.39 per Pre‐Funded Warrant, for aggregate gross proceeds of $4.7mm. The Debenture will come due in 2032 and is convertible into common shares at a conversion price of $0.79 per common share. Each Pre‐Funded Warrant shall entitle the holder to purchase one common share at an additional exercise price of $0.40 per common share (for a total common share issue price equal to $0.79) for a period of 12 months from the date of issuance.

Notes on the Florida Market and Regulation

There are a number of states that haven’t yet legalized medical or adult cannabis use and have placed heavy restrictions on the amount of THC in various products as well as the conditions required for patients to obtain medical marijuana (seizures, epilepsy, cancer, terminal illnesses). Florida’s foray into medical sales began when these bans were lifted fully in 2019 by Governor Ron DeSantis who signed a bill lifting the ban on the sale of medical marijuana. Texas, as you can imagine, is perhaps the most restrictive state in the US when it comes to cannabis and has barely budged on some of the regulations I just mentioned. Today, there are 22 Medical Marijuana Treatment Center (MMTC) license holders in Florida, responsible for hundreds of dispensaries across the state.

Florida is a phenomenal medical use market with over 740,000 registered medical patients. The state generated over $1.0 billion in medical sales during 2020, $1.3 billion in medical sales in 2021, and is on pace for over $1.5 billion during 2022. Currently, Florida adds around 150-170k new medical card holders per year, and with a population of 22 million contains within it a significant TAM for both medical and adult use. The estimated patient count represents something like 3-4% of Florida’s adult population. Industry estimates forecast the Florida market to double in size by 2026 and reach nearly $3.0B in revenues during that time. Trulieve (OTCQX:TCNNF) is an MSO and the leading scaled player in Florida with over 50% market share throughout their 100 dispensaries and nearly $1.2B in revenues. Curaleaf (OTCPK:CURLF) is a close second. While barriers to entry are relatively low for the actual construction of the retail stores (leading to the significant expansion you’ve seen among nearly all MSOs), barriers for licensing, approvals, permits, and regulatory affairs are quite high from both a time and resources standpoint.

There is also a land grab taking place in Florida from both an expansion standpoint and retail/market share standpoint in the form of product discounting. While I wouldn’t normally be too excited about a retail race to the bottom, I believe its transitory as ultimately the highest quality flower, brands and concepts will survive (and need to make a margin to exist). In addition, I don’t believe a single state like Florida has a TAM big enough to justify continuous loss making such as a software company with a $100B TAM. The state will rationalize over time, but the land grab status will also result in consolidation, which I view as a positive for Cansortium. Industry experts have also claimed that Florida licenses are the most valuable in the entire industry. This is because each MMTC licensee can open an unlimited number of dispensaries, cultivation and processing facilities throughout the state, a characteristic unique to the Florida program.

While that may be the case, barriers remain high. Importantly, in 2017, the Florida medical marijuana law established a cap on the number of medical marijuana dispensaries able to operate within the state, while also requiring that each dispensary be vertically integrated, meaning they must also manage cultivation, processing and distribution for the dispensaries. This is most likely one of those stupid political rules (that has been challenged many times but never overturned) that will most likely fall by the wayside once cannabis is de-scheduled and legal at the Federal level, opening the doors for capitalism to come in and do its thing by chopping up each part of the supply chain over time. For now, however, these regulations provide barriers to entry in terms of capital requirements, in addition to the legal, technical and operational skills needed to file the paperwork to obtain a license, access capital to fund a grow operation, or start to build a retail footprint. Although Florida has yet to legalize the use of cannabis on an adult use or recreational basis, I believe it is only a matter of time until all states follow down that path.

Lastly, most companies do not disclose their retail unit economics, but I understand them to be solid with four-wall stores estimated to cost between a few hundred thousand dollars up to a million or so (depending on sq. footage) to build with the potential to generate $3.5-6mm in annual revenues at 20-30% EBITDA margins. The unit economics improve further if you are vertically integrated, have your own cultivation and efficient methods of distribution. Federal legalization and interstate commerce will undoubtedly change a lot of things, but for now, geographic advantages within states are real.

Management

Cansortium is led by Robert Beasley who is an attorney by trade and has done significant work in the cannabis space including helping early-stage licensees obtain their licenses and navigate the regulatory landscape. If you’ve done work across the cannabis industry, you’ll have noticed that most of the management teams don’t have direct backgrounds in cannabis (how can you?) but rather have very different although occasionally complementary backgrounds and skillsets. I’ve seen strong backgrounds in legal, investment banking or finance, and a large number of retail operators. There are also your share of bad actors and some management teams that are just full of it as there are in any new growth industry. Beasley has an interesting background as he basically helped create the legislative and rulemaking process in Florida as it relates to cannabis and has also designed and constructed a number of dispensaries giving him a unique angle as an operator. Beasley started a law firm in 2001, focusing on commercial litigation and administrative law, and in 2015 he became involved in legislative efforts to bring medical cannabis to Florida. When the first five licenses were awarded in the state, he acted as a legal consultant to those license holders and helped connect them with capital sources. He eventually became chair of the board of one of those companies, which launched him into an even more active role in the cannabis business. As a result, he’s both experienced and knowledgeable about the industry, and if you listen to the calls he provides way more color around operations and strategy than many executives in cannabis. I like the way he’s thinking about the retail business, growth in Florida and slowly expanding into other states.

Prior to Robert Beasley, the company was run by co-founder José Hidalgo, who struggled to scale the business, couldn’t raise non-dilutive capital, and failed to manage through the buildout of the company’s aggressive expansion plans. Although things like construction delays are difficult to plan for, aggressive guidance, over-promising and under-delivering led the board to make a change in 2020. A smart move, especially given the significant opportunity in the state of Florida.

I view management compensation as very fair and see nothing egregious surrounding base comp or incentive pay. The board is a different story. The lowest director compensation in 2021 was above $200k, with many other board members receiving over $500k in total compensation. Although the board compensation has changed since the most recent management information circular, I’d view those level of compensation as egregious, especially for a microcap company on the verge of a turnaround. Put simply, the board needs work, with basically no retail, operational or cannabis experience (there is a pharmacist and nuclear scientist on the board), however it is somewhat telling that they’ve managed to turn this business around (albeit as the Florida rising tide lifts all boats) without a deeply experienced board.

One of the board members, William Smith of The Smith Group, owns 1.4mm proportionate voting shares (52% of the class, 6% of the voting rights) as well as 35.6mm common shares (15.8% of the class, 14.1% of the voting rights). His ownership/board agreement with the company dates back to the company’s inception, where Smith has served as a source of capital and provided some sort of strategic oversight. In trying to figure out who he is, I asked for an audience with him which IR balked at. From what I’ve gathered, he founded a few TV stations (WPAN) in Florida and is a private investor outside of that. Years ago, following the sale of his TV assets he was living in Florida and was introduced to the former management team via a friend who gauged his interest in investing in a cannabis related business. Since then, as mentioned, he’s been behind a lot of the financings you’ll read about in the filings while the company was attempting to scale. Prior to his share ownership and prior to his joining the board he served as an over-paid consultant to Cansortium. If you read the ‘Consulting Fees’ section of the management information circular (via the 6/30/22 Management Information Circular), you’ll see that Bill Smith has been paid over $3 million dollars to date as part of various agreements with the company. However, he also had a hand in bringing Robert Beasley on as CEO, with whom he had a prior relationship while Beasley served as a consultant to Cansortium. At a high level, I believe he’s harmless, not involved in day-to-day operations and more so determining what happens strategically in the event of a potential acquisition, for example. I do not know what percentage of his net worth is tied to his investment in Cansortium. Although future equity raises are possible, I’d imagine as the company’s largest shareholder who has been involved with this business for years, he’s not incredibly interested in diluting his ownership stake in a meaningful way especially as the company has now reached a point of real scale and cash flow positivity. In addition, I wouldn’t view it as the worst thing in the world to have a somewhat permanent capital, very incentivized large shareholder here, especially whose money is most likely not going anywhere in the short term.

Notably, an important part of Bill Smith’s share ownership involves something called an ‘equity price guarantee’ or ‘floor price obligation’. Without getting into the weeds, Smith’s company, Can Endeavour, provided a loan to Cansortium during 2018 in the form of a promissory note. The note was restructured in 2020, pushing the maturity to the end of 2022 and providing for the issuance of additional common shares to Smith. These common shares, in addition to the original common shares issued during 2018 in connection with the original promissory note are subject to a price floor of $0.65/share. I am working on getting the exact details of the guarantee (IR was very vague, management pushed our call back to next week), but I believe in the event the company is sold for let’s say $0.30/share, Bill Smith would be entitled to receive $0.65/share for his stake. The price guarantee expires in May 2023. I understand the ridiculousness of issuing such a guarantee, but it’s at least interesting to me given the current share price of $0.17, which sits materially below the equity price floor as well as every single financing transaction entered into by Smith.

Valuation

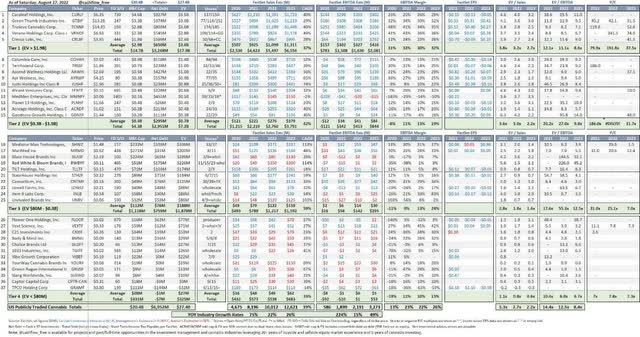

There is currently a persistent bias against smaller cannabis companies in terms of their valuations compared to the largest companies in the space. Part of the discount revolves around lack of awareness (as with most microcaps) but I believe the discounts in some cases are unwarranted as smaller companies often times have higher revenue growth, opportunities for margin expansion, equal access to capital and better competitive positionings within their geographies. Take a look at this very informative chart (as of 8/27) I found on Twitter from someone with the handle @cashflow_free. I apologize if it’s hard to see, but you can go to his Twitter and find it. Cansortium sits in the Tier 3 bucket, and things get interesting when you look at their revenue growth rates, EBITDA margins and valuation compared to the rest of the universe.

@cashflow_free

*Of note, it looks like the chart (as well as the company as of Q2) is including leases as debt for Cansortium, which elevates the enterprise value. Excluding the leases, I get an EV of $99.4mm.

Using the low end of this year’s guide for $90-95mm in revenues and $25-28mm in adjusted EBITDA, Cansortium trades for a fully diluted EV/EBITDA of less than 4.0x. I estimate they can do at least $35mm in EBITDA next year, pushing the valuation down further to 2.8x. My estimates for next year include a dip in revenue growth as well as some margin compression. I view this as overly conservative given new dispensaries coming online, increased cultivation capacity and continued contributions from PA dispensaries. I know these are not great businesses, the regulatory environment is uncertain, and the balance sheet isn’t stellar, but I believe Cansortium is mispriced. Average peer multiples for companies in Tiers 1-4 are no lower than 6.7x. The entire cannabis universe trades at 8.5x. Even excluding the most egregiously valued businesses within Tier 3 reflects a 10.5x average multiple. Were Cansortium to trade even a few turns higher to the lowest comp set multiple of 6.5x EBITDA, (using the low end of Cansortium’s current year estimates) upside would be significant.

Before I get roasted on the cash flow statement, I would ask readers to try and normalize for a less restrictive cost of capital as well as a normalized tax rate. I know that’s not entirely fair. But if you’re not familiar, at a high level, flower-touching cannabis companies are taxed on gross profit, unable to deduct normal business expenses in line with non-cannabis companies. As a result, tax rates range between 65-75% for most publicly traded cannabis companies, severely impacting cash flow and, as a side note, also creating large deferred tax liabilities for some as companies can elect to defer payments. While I don’t believe this investment depends on favorable regulation to work, I think it’s somewhat unfair to assume Cansortium (or any cannabis company) will have to pay 75% tax rate into the foreseeable future. However it’s also probably unfair to give them credit for future normalized free cash flow. But I think it’s important to note what will happen to the profitability profile of these companies if federal legalization takes place. Lastly, capex needs are less than larger operators as a percentage of revenue, and maintenance capex for retail facilities is low (basically lighting and millwork inside), which should boost unlevered free cash flow moving forward.

As mentioned, unit economics for the dispensaries are not disclosed yet, I’m working on getting them. Some of these businesses, even the largest MSOs don’t even keep things like individual store level P&Ls which is kind of crazy to think about. Conversations with industry operators did reveal the substantial profitability of some dispensaries around the US, although individual results depend on things like vertical integration, geography, market growth, location and brands. The rough math or average (depending on square footage) is something like 50-60% gross margins, 10% labor, 30% additional opex (rent, supplies, overhead). Four wall margins seem to be strong and with limited buildout costs for a smaller dispensary $250-500k, quick ramp up periods and average revenue per store of $2.5-$4mm, payback times and cash on cash returns can be attractive.

Of note, in December 2020, AYR Wellness, a large MSO, acquired Liberty Health Services, a Florida based operator, for $290mm. At the time of the acquisition, Liberty had just opened their 28th dispensary with plans for another 14 by the end of 2021. Today, Liberty operates 49 dispensaries in the state of Florida. The price paid represented (albeit when sentiment was much better) a 94% premium to Liberty’s stock price at the time of the deal announcement. Breaking down the math a bit further, AYR paid over $10mm per dispensary (at the time) or $7.0mm for the full 42 planned dispensaries in the state of Florida. At the time of the acquisition, Liberty was doing less than $60mm in revenues, reflecting a valuation of around 5.0x revenues. AYR also had this to say about Liberty’s dispensaries on the M&A call:

“We expect to significantly improve the dispensaries productivity in Florida, which currently stands at a run rate revenue of about $2 million a year, well below the top performance in this state at $4 million to $10 million.”

Using the same math for Cansortium, with 27 dispensaries projected 2022 revenues of $90-95mm, and Florida representing 85% of revenues, each dispensary should be doing on average around $3.0-3.3mm in revenues. At the same 5.0x sales multiple, Cansortium stock would be valued around $1.30 on Florida operations alone. While Cansortium has remedied their inventory/product availability issues, interestingly, Liberty’s stores were also viewed as underperforming at the time of the deal due to product unavailability and grow inefficiencies. Although it’s not exactly apples to apples, and New Jersey is now an adult-use state, some of AYR’s stores in New Jersey (prior to adult-use) were doing $10mm per store. Just wild numbers. I now place even more weight on management’s comments about maximizing the existing store footprint with additional inventory absorption available. That would represent a potential additional 23% revenue growth just by increasing inventory absorption, without taking on one new customer or building one new store. I believe Cansortium should be placed in the same/similar bucket as AYR’s Florida operations, and believe that adult-use sales could drive the same type of opportunity. Furthermore, conversations with industry operators also revealed that dispensaries can typically be valued at around 1.5x revenues. This is an estimate, refers to a lot of mom and pops, and has very little transaction precedents. In other words, I’d view 1.5x revenues the price to pay for a struggling operator. Using that math, in an extremely conservative scenario and once again not accounting for additional Florida growth or any of the optionality described below, Cansortium shares would be valued around $0.40/share for the Florida operations alone.

Using the license value approach to valuation is also somewhat illustrative of the potential value. I’d estimate that Cansortium’s Florida licenses alone should be worth nearly the entirety of Cansortium’s market cap. I’d estimate a good baseline to be $75-100 million for the licenses alone. A number of precedent transactions, some dating years ago, point to Florida vertical integration licenses being worth between $50-60mm. Planet 13’s purchase of Harvest Health Florida medical license for $55mm is one example. Planet 13 has yet to begin cultivation pointing to the value of Florida operations being worth more than $55mm over time. Nature’s Way also sold a license in 2019 for $67 million. In late August, Green Sentry, a private cannabis operator, acquired all of MedMen’s Florida operations for $63 million. Included in the purchase price was an MMTC license, 14 dispensaries and a small cultivation facility. As mentioned, the Texas license could also fetch between $60-80mm as Cansortium is one of only three licensees in a state that has yet to legalize even medical use.

Putting it all together:

Texas license per share @ $60mm: $0.20/share (taken with a grain of salt)

Michigan and Pennsylvania operations / licenses per share @ $28mm: $0.09/share

Florida operations per share @ 6.5x 2023 EBITDA: $0.60/share

(-) Debt: $56mm (excl. op. leases): $0.18/share

(+) Cash: $9.0mm: $0.03/share

Equity Value (excluding Florida license value): $0.74/share or 335% upside

Lastly, it is worth mentioning that toward the end of the 2021 Annual Meeting, during the Q&A session, the only question asked was about the board’s receipt of an offer by a venture capital firm, Iconoclast Ventures, to acquire all the outstanding shares of the company. Iconoclast was founded by Jake Bergmann (who asked the question), one of the co-founders of Surterra Wellness, the third largest cannabis operator in the state of Florida. Given the share price of Cansortium has declined 80% this year, just as the company has righted the ship and set to experience significant growth and profitability from here, I viewed the potential bid at the time as very opportunistic. In addition, industry conversations revealed that there was no formal offer letter, no financing in place, and somewhat unprofessional in presentation. In fact, there was such little substance to the ‘offer’ that it was not material enough to disclose. I only highlight it here as confirmation of the attractiveness of Cansortium’s assets and competitive position. I doubt Surterra will be the last takeout offer they receive.

Final Caveat

The entire cannabis sector is being driven by flows and sentiment. It’s kind of wild. On one hand, I like the non-correlated part of things as these stocks don’t generally trade in line with the broader economy/market (although a recession would obviously hurt the consumer), but on the other hand, valuations could remain depressed or even dip further from here. I think many investors thoughts SAFE banking and federal legalization would have passed at this stage, and the fact that it hasn’t has led to a lot of capital leaving the space, and some large cannabis funds shutting down. Capital markets have all but dried up as well, with capital raises down 66% from 2021 (equity capital raises down 97%) and M&A volume down 80% YoY. This has obviously put significant pressure on cannabis stocks – as if there wasn’t already from 2021 – and this year has been particularly brutal. It could remain that way if people give up hope completely that SAFE banking will ever pass. One knowledgeable investor in the space said we could experience a ‘nuclear winter’. If that were to happen, combined with an actual prolonged recession, we could see a wave of bankruptcies as there are already plenty of operators who are struggling under the weight of pricing, expansion and debt loads (as well as large deferred tax payments). As a result, the biggest risk to the thesis involves not seeing any near term share price increase, no multiple expansion, and no M&A activity where Cansortium could be explored as a takeout target. In a multi-year bearish scenario where SAFE banking doesn’t pass, no capital enters the space, institutions are frozen out and capital markets dry up, I would likely reconsider my bullish tone. It’s also possible that some companies trading at 3x – 4x – 5x EBITDA could see their valuations drop further, but like any crisis some of these business will have opportunities to get stronger and continue to take share. Along with Cansortium, I’ve made it a priority to focus on the operators with decent balance sheets, cash flow generation, lower tax payments, strong brands and located in great markets or protected states. Against that backdrop, my biased opinion is that Cansortium would still serve as a very strong acquisition candidate which makes it even more interesting right now.

Optionality

- Cultivation capacity increases / yield improvements

- Florida opening up adult use legalization

- Additional dispensary openings in Florida

- Acquisition offer / takeout

- Texas license being sold

- Additional dispensaries in Pennsylvania

- Sentiment improvement!

Risks

- Trouble scaling – mitigated with recent efforts

- Federal legalization introduces significant competition – tough to avoid but CNTMF has scale in Florida, and legalization would be the tide that lifts all boats

- Balance sheet inflexibility – there will be solutions here including increased term loan and refinancing eventually

- Potential dilution – I believe dilution is behind them at this stage

- Single state operators don’t receive higher multiples – don’t need a higher multiple for this to work out well

- Large individual share ownership – I don’t believe this will be a problem as the individual has been involved for a long time, is on the board and should want to see a positive outcome

- Competition – CNTMF is in a protected state and would make for a strong acquisition target

- Can’t do anything in Texas or anything with the license – remains to be seen but management thinks otherwise

The Best Legal Delta 9 Near You in Park Forest North

The Best Legal Delta 9 Near You in Park Forest North

Be the first to comment