Editor’s note: Seeking Alpha is proud to welcome Alexander Carchidi as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Flowering Cannabis Plants on a Farm in Greenhouse kmatija

As the world’s biggest marijuana business (when excluding the industry in the U.S.), Tilray Brands (NASDAQ:TLRY)(TSX:TLRY:CA) isn’t a stock for the faint of heart. At the moment, Tilray is a risky investment as a result of fierce competition in its home cannabis market in Canada, not to mention the significant uncertainty of its success in its preferred cannabis markets of the near future – specifically in the EU. Nonetheless, its footprint of alcohol brands in the U.S. continues to grow and, with it, the company’s distribution network, which could ease its entry into the recreational marijuana market there in the event of legalization.

Furthermore, though its profitability isn’t improving, it can likely take out enough new debt to keep the lights on for quite some time. Therefore, while it’s probable that the stock will continue to fall in the near term, it’s still suitable for a long-term hold, and now is a favorable time to buy. Here’s why.

Strong positioning in the EU won’t solve market share erosion in Canada

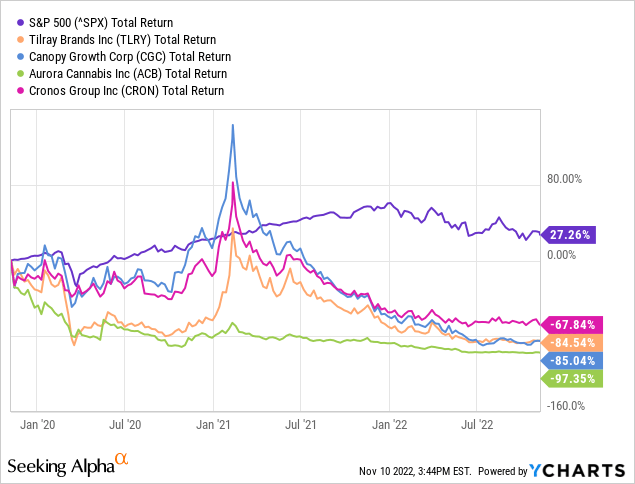

Tilray’s shares have performed abysmally over the last three years, with the total return falling by more than 84.5%. But it’s in good company, with the same period seeing similarly large drops in the total return of many of its competitors – including Canopy Growth (CGC), Aurora Cannabis (ACB), and Cronos Group (CRON) – as shown below.

In its 2022 fiscal year, the company brought in $628.37 million in total revenue against operating expenses of $366.60 million and net losses of $476.80 million – and things could get worse before they start to get better. One of the biggest risks to Tilray today is that its share of the recreational cannabis market in Canada is collapsing. Whereas it claimed to hold an 8.5% slice as of its latest earnings release, a year prior it held around 16%. That’s a problem, as Canada is where it derives 99% of its total revenue from marijuana sales before taking excise taxes into account. While there aren’t any competitors in the country that are any larger by revenue, it’s clear that they gained ground over the last 12 months, and management doesn’t seem to have any specific plan to reverse the trend. So it might continue.

At the same time, Tilray might not need to be so dependent on the Canadian market much longer. In the EU, where the company has a significant footprint in places like Germany and Portugal, marijuana legalization is advancing. It’s even helping German regulators to determine the appropriate quality standards for recreational cannabis products sold there. Whenever legalization goes into effect, it’ll be able to leverage the distribution infrastructure it has from its medicinal market leadership to scale up its adult use operations quite quickly.

Furthermore, Tilray’s cultivation facilities in Portugal mean that it won’t face tariffs when exporting to other EU countries, thereby reducing the risk of American competitors cheaply eating its lunch. There aren’t any European players that are anywhere close to rivaling Tilray’s scale, so it could be dominant in the space – at least in the period following the market’s opening.

But revenue growth from international markets will take quite some time before the segment can approach the size of its sales in Canada after any advancement of legalization policies. That’s why the top line could continue to fall further than the 8.8% drop in its quarterly revenue between Q1 of FY 2023 and a year prior. Plus, in its 2022 fiscal year, Tilray spent around $211.3 million in cash, though its TTM cash burn was just over $151 million.

Given that it has roughly $490.6 million in cash and equivalents on hand, it won’t be running out of money in the next two years or so – even if its spending ramps up again to penetrate newly legalized markets. Still, it will likely take longer than that to become cash flow positive, which would imply issuing new shares or taking out fresh debt. And its segments outside cannabis are unlikely to come to the rescue anytime soon.

Alcohol sales won’t save the day, but they might help

Tilray’s foray into selling alcohol via its brewing and distilling subsidiaries in the U.S. is going fairly well, though much like with international cannabis sales, it might not be enough to prevent total revenue from falling this year. On a constant currency basis, its quarterly beverage revenue grew from $15.46 million in the first quarter of FY 2022 to reach $20.65 million in its Q1 of FY 2023, making it the fastest-growing segment and also the only segment other than distribution to expand at all. Management is keen to keep acquiring alcohol companies to continue penetrating the market, including most recently on Nov. 7 when it bought Montauk Brewing Company. That purchase will shore up Tilray’s distribution network in the northeast U.S., which is a core element of its strategy to prepare for cannabis legalization in the country.

Upon federal legalization of cannabis or progress in state-level legalization initiatives, the company will already have a distribution system ready to supply any new stores it opens. It’s true that competitors might already be established in the markets it’s aiming to enter. It’s also true that some of those competitors, especially the smaller ones, might be interested in buying Tilray’s products to sell at their retail locations. So the risk of failing to gain traction in the U.S. market upon legalization is somewhat lower than it would be for another international operator planning to enter the market.

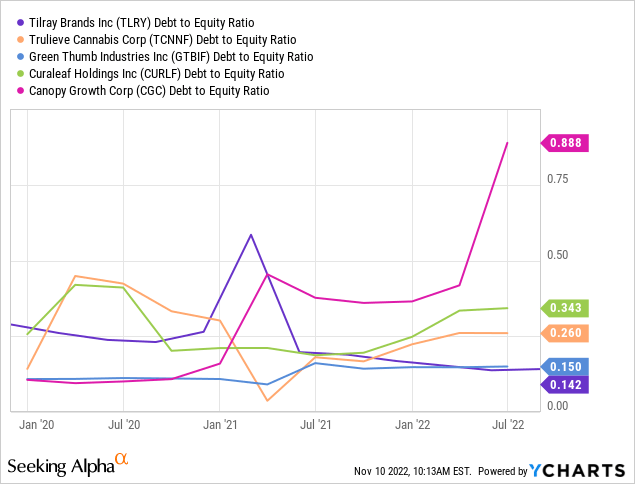

The other factor supporting Tilray’s chances of success in the potential post-legalization scramble for the U.S. market is that it can raise plenty of capital by borrowing. Its total debt to equity ratio is 0.14, which means that it’s significantly less leveraged than many of its competitors in North America, as shown below.

As a result, when other companies will be faced with high borrowing costs to finance their expansion after legalization, Tilray’s will be somewhat lower, which will lead to lower interest payments in the years that follow. Notably, the company’s total operational expenses are only 53.4% of its quarterly revenue, whereas competitors like Canopy Growth spend upward of 95% and into triple-digit percentages.

The risks explain the valuation

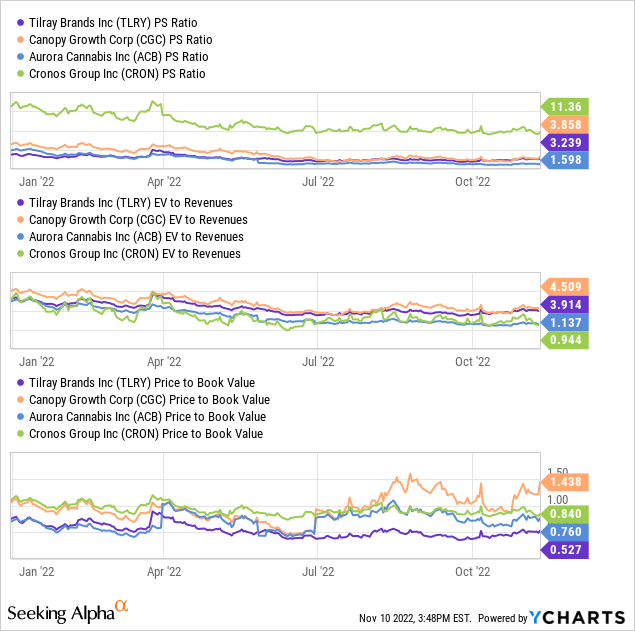

In terms of its valuation, Tilray compares favorably to its peers shown below on the basis of its price-to-sales (P/S) ratio, price-to-book (P/B) ratio, and also the ratio of its enterprise value (EV) to its revenue.

So, it isn’t a bargain buy, as its share price may still be inflated from the run-up it had in 2021, but it’s also no longer inflated like before. Expect its post-legalization valuation to balloon once again and revenue growth to follow afterward. In other words, within a year or two it probably won’t be trading much more cheaply than it is right now, barring major delays with new legislation.

Of course, a major risk associated with a Tilray investment right now is that legalization will take longer to occur than management expects, thereby leaving it exposed to running out of cash, not to mention competitors making inroads in the U.S. market and becoming entrenched. Another risk is that as interest rates continue to rise as a result of the fight against inflation, the market will continue to punish unprofitable growth stocks whether or not they have major catalysts on the horizon. Finally, there is the risk of overexpanding its output of cannabis compared to demand, a common bugbear of the industry.

Success is far from guaranteed

Buying Tilray today is a gamble because the near term has little to offer in the way of relief from pressures on its top and bottom lines. Tilray still hasn’t proven that its marijuana cultivation and sales operations can be profitable in any of its markets. Buying up profitable or near-profitable alcohol companies won’t change that, and due to the existing competitors in the alcohol market, it’s improbable that it can ever scale its beverage revenues to the level where they’ll make up for losing so much money elsewhere. Plus, its margins are compressing across the board, with the exception of its cannabis segment. And all of the above makes the stock unsuitable for investors with a short time horizon.

Despite the bearish year that’s likely on the way, the business is making good use of its diversification into alcohol and its early positioning in the EU markets to dramatically change course in the years that follow. And thanks to its low level of debt, it has plenty of flexibility to keep growing. Therefore, for investors seeking a long-term global cannabis play, there aren’t many other options that have the possibility of making such a turnaround. So it’s worth investing in its shares today, presuming the risks are tolerable.

Be the first to comment